Question

Suppose that the U.S. Boeing Corporation has just exported a Boeing 747 to British Airways and billed 10 million, payable in one year. At the

Suppose that the U.S. Boeing Corporation has just exported a Boeing 747 to British Airways and billed 10 million, payable in one year. At the same time, the corporation has also imported several key components for manufacturing the airplanes from Germany and has been billed 10 million, payable in one year. The pounds and euros are very volatile against U.S. dollars, and you need to consider forward, money market, and options hedge.

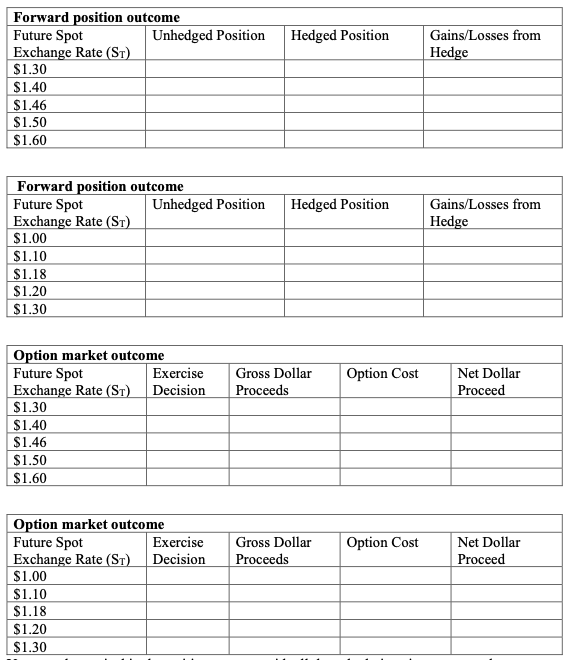

Consider five possible exchange rate scenarios for dollar-pound and dollar-euro in one year. And show the calculations used. These exchanges rates are: $1.30/, $1.40/, $1.46/, $1.50/, $1.60/ for dollar-pound and $1.00/, $1.10/, $1.18/, $1.20/, $1.30/ for dollar- euro.

What hedging strategy is best: forward hedge? Money market hedge? Option hedge?

- Find the outcomes of the forward and money market hedging, then use the same forward rates as the strike exchange rates for options market hedging.

- Find the future spot rates that would make him indifferent between option and forward outcomes.

Please provide the calculations to complete the below tables:

\begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|l|}{ Forward position outcome } \\ \hline FutureSpotExchangeRate(ST) & Unhedged Position & Hedged Position & Gains/LossesfromHedge \\ \hline$1.30 & & & \\ \hline$1.40 & & & \\ \hline$1.46 & & & \\ \hline$1.50 & & & \\ \hline$1.60 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|l|}{ Forward position outcome } \\ \hline FutureSpotExchangeRate(ST) & Unhedged Position & Hedged Position & Gains/LossesfromHedge \\ \hline$1.00 & & & \\ \hline$1.10 & & & \\ \hline$1.18 & & & \\ \hline$1.20 & & & \\ \hline$1.30 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|l|}{ Option market outcome } \\ \hline FutureSpotExchangeRate(ST) & ExerciseDecision & GrossDollarProceeds & Option Cost & NetDollarProceed \\ \hline$1.30 & & & & \\ \hline$1.40 & & & & \\ \hline$1.46 & & & & \\ \hline$1.50 & & & & \\ \hline$1.60 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|l|}{ Option market outcome } \\ \hline FutureSpotExchangeRate(ST) & ExerciseDecision & GrossDollarProceeds & Option Cost & NetDollarProceed \\ \hline$1.00 & & & & \\ \hline$1.10 & & & & \\ \hline$1.18 & & & & \\ \hline$1.20 & & & & \\ \hline$1.30 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|l|}{ Forward position outcome } \\ \hline FutureSpotExchangeRate(ST) & Unhedged Position & Hedged Position & Gains/LossesfromHedge \\ \hline$1.30 & & & \\ \hline$1.40 & & & \\ \hline$1.46 & & & \\ \hline$1.50 & & & \\ \hline$1.60 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{4}{|l|}{ Forward position outcome } \\ \hline FutureSpotExchangeRate(ST) & Unhedged Position & Hedged Position & Gains/LossesfromHedge \\ \hline$1.00 & & & \\ \hline$1.10 & & & \\ \hline$1.18 & & & \\ \hline$1.20 & & & \\ \hline$1.30 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|l|}{ Option market outcome } \\ \hline FutureSpotExchangeRate(ST) & ExerciseDecision & GrossDollarProceeds & Option Cost & NetDollarProceed \\ \hline$1.30 & & & & \\ \hline$1.40 & & & & \\ \hline$1.46 & & & & \\ \hline$1.50 & & & & \\ \hline$1.60 & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{5}{|l|}{ Option market outcome } \\ \hline FutureSpotExchangeRate(ST) & ExerciseDecision & GrossDollarProceeds & Option Cost & NetDollarProceed \\ \hline$1.00 & & & & \\ \hline$1.10 & & & & \\ \hline$1.18 & & & & \\ \hline$1.20 & & & & \\ \hline$1.30 & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started