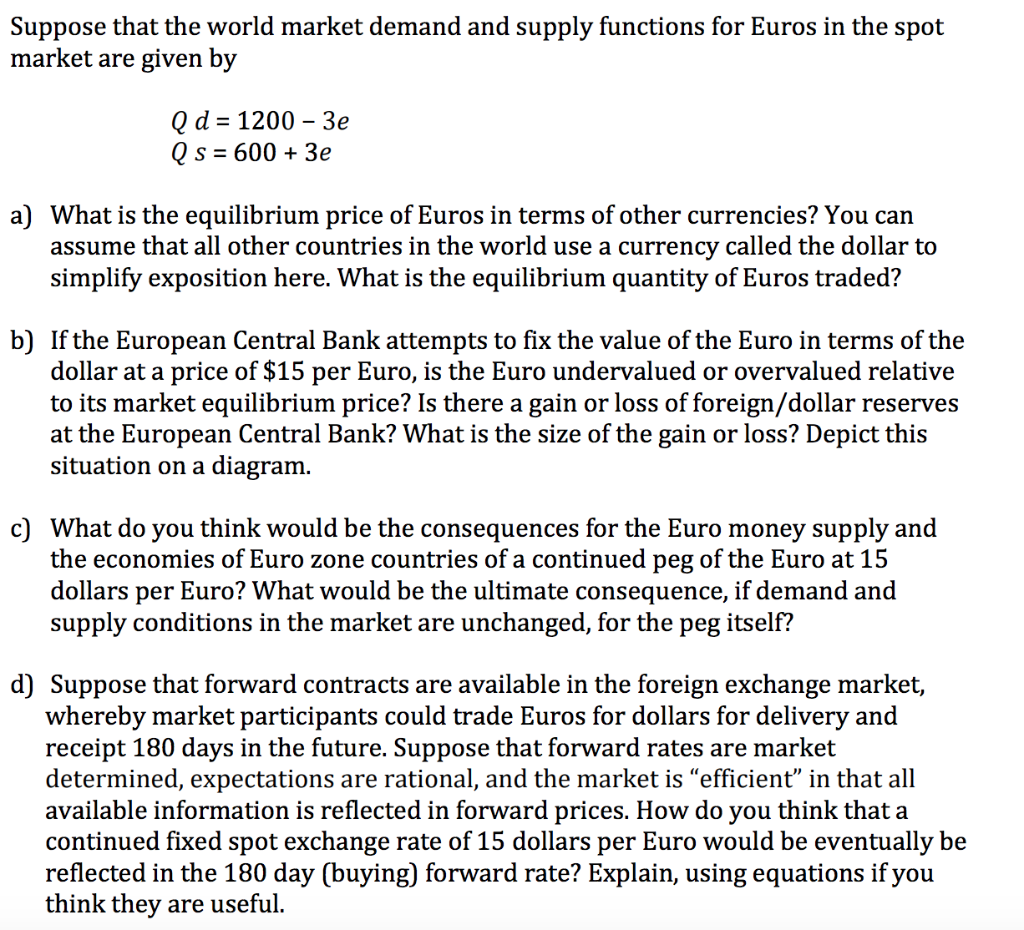

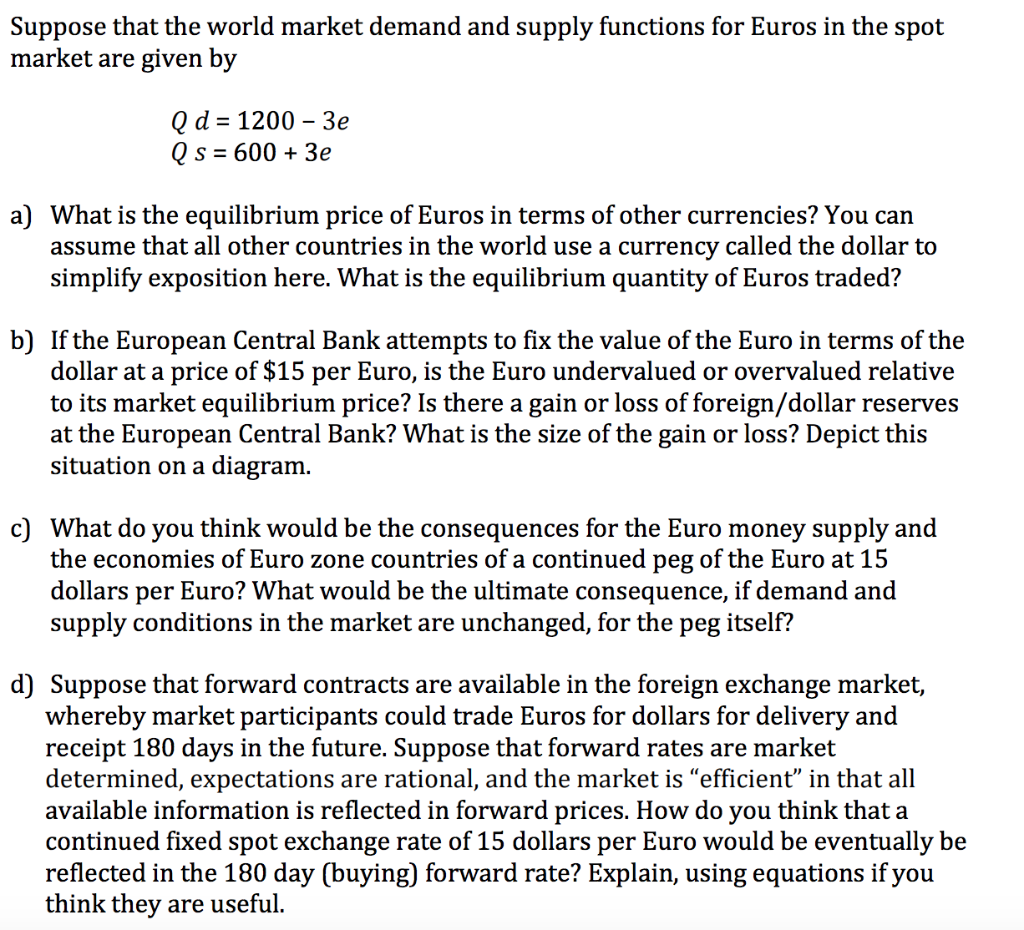

Suppose that the world market demand and supply functions for Euros in the spot market are given bjy Qd- 1200 3e Qs600+3e a) What is the equilibrium price of Euros in terms of other currencies? You can assume that all other countries in the world use a currency called the dollar to simplify exposition here. What is the equilibrium quantity of Euros traded? b) If the European Central Bank attempts to fix the value of the Euro in terms of the dollar at a price of $15 per Euro, is the Euro undervalued or overvalued relative to its market equilibrium price? Is there a gain or loss of foreign/dollar reserves at the European Central Bank? What is the size of the gain or loss? Depict this situation on a diagram c) What do you think would be the consequences for the Euro money supply and the economies of Euro zone countries of a continued peg of the Euro at 15 dollars per Euro? What would be the ultimate consequence, if demand and supply conditions in the market are unchanged, for the peg itself? d) Suppose that forward contracts are available in the foreign exchange market, whereby market participants could trade Euros for dollars for delivery and receipt 180 days in the future. Suppose that forward rates are market determined, expectations are rational, and the market is "efficient" in that all available information is reflected in forward prices. How do vou think that a continued fixed spot exchange rate of 15 dollars per Euro would be eventually be reflected in the 180 day (buying) forward rate? Explain, using equations if you think thev are useful Suppose that the world market demand and supply functions for Euros in the spot market are given bjy Qd- 1200 3e Qs600+3e a) What is the equilibrium price of Euros in terms of other currencies? You can assume that all other countries in the world use a currency called the dollar to simplify exposition here. What is the equilibrium quantity of Euros traded? b) If the European Central Bank attempts to fix the value of the Euro in terms of the dollar at a price of $15 per Euro, is the Euro undervalued or overvalued relative to its market equilibrium price? Is there a gain or loss of foreign/dollar reserves at the European Central Bank? What is the size of the gain or loss? Depict this situation on a diagram c) What do you think would be the consequences for the Euro money supply and the economies of Euro zone countries of a continued peg of the Euro at 15 dollars per Euro? What would be the ultimate consequence, if demand and supply conditions in the market are unchanged, for the peg itself? d) Suppose that forward contracts are available in the foreign exchange market, whereby market participants could trade Euros for dollars for delivery and receipt 180 days in the future. Suppose that forward rates are market determined, expectations are rational, and the market is "efficient" in that all available information is reflected in forward prices. How do vou think that a continued fixed spot exchange rate of 15 dollars per Euro would be eventually be reflected in the 180 day (buying) forward rate? Explain, using equations if you think thev are useful