Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that there is a small open economy named B in this world, and households in this country trade financial assets in the international

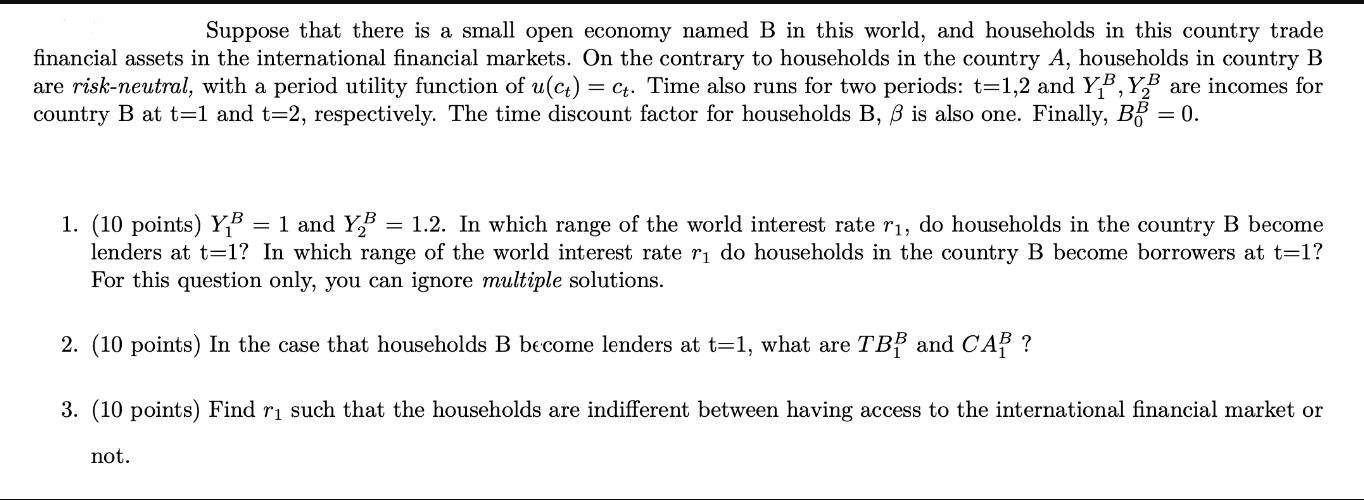

Suppose that there is a small open economy named B in this world, and households in this country trade financial assets in the international financial markets. On the contrary to households in the country A, households in country B are risk-neutral, with a period utility function of u(ct) = ct. Time also runs for two periods: t=1,2 and YB, YB are incomes for country B at t=1 and t=2, respectively. The time discount factor for households B, B is also one. Finally, BB = 0. = 1. (10 points) YB 1 and YB = 1.2. In which range of the world interest rate r, do households in the country B become lenders at t=1? In which range of the world interest rate ri do households in the country B become borrowers at t=1? For this question only, you can ignore multiple solutions. 2. (10 points) In the case that households B become lenders at t=1, what are TBB and CAB? 3. (10 points) Find r such that the households are indifferent between having access to the international financial market or not.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 If the world interest rate r1 is less than 02 households in country ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started