Question

Suppose that today, March 25th, 2021, you own a portfolio consisting of investments in four stock indices: the Dow Jones Industrial Average (200,000$), the FTSE-100

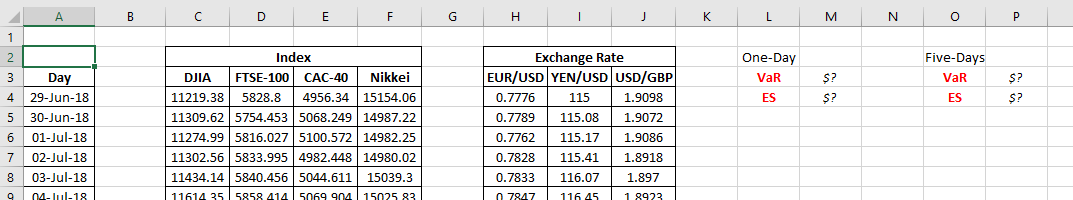

Suppose that today, March 25th, 2021, you own a portfolio consisting of investments in four stock indices: the Dow Jones Industrial Average (200,000$), the FTSE-100 (100,000$), the CAC-40 (300,000$) and the Nikkei-225 (400,000$). The total value of the investments is then one million US dollars.

The Excel spreadsheet attached contains the last 1001 days of historical data on the closing prices of the four indices, together with exchange rates. You would like to assess the total risk of your portfolio using the historical simulation approach.

*I cant enter the excel file because there is 1000 entries. i just need to know how do I solve this? I have to find VaR and ES.

(a) Estimate the one-day 99% Value-at-Risk of the portfolio.

(b) Estimate the one-day 99% Expected Shortfall of the portfolio.

(c) Estimate the five-days 99% Value-at-Risk of the portfolio.

(d) Estimate the five-days 99% Expected Shortfall of the portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started