Answered step by step

Verified Expert Solution

Question

1 Approved Answer

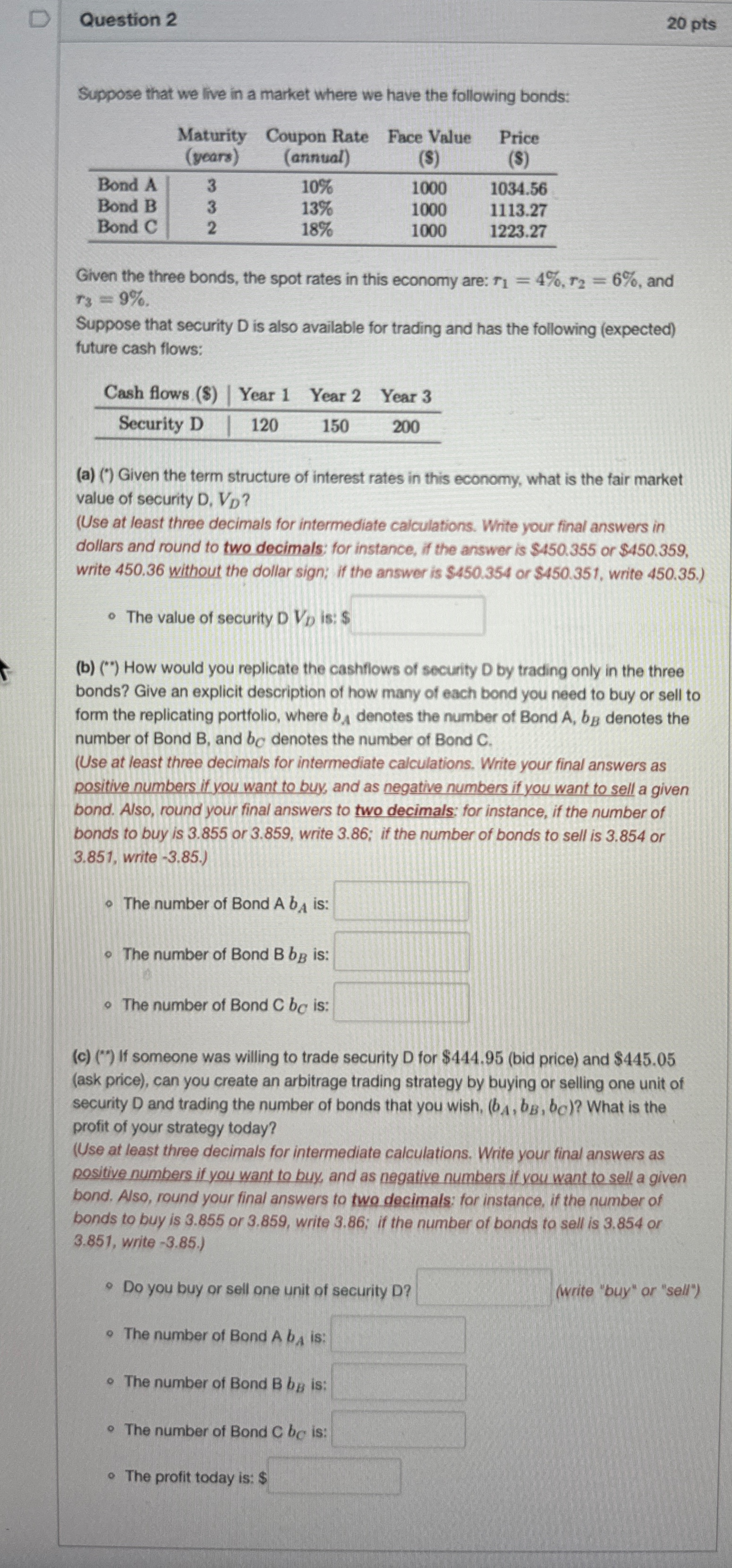

Suppose that we live in a market where we have the following bonds: Given the three bonds, the spot rates in this economy are: r

Suppose that we live in a market where we have the following bonds:

Given the three bonds, the spot rates in this economy are: and

Suppose that security D is also available for trading and has the following expected

future cash flows:

a Given the term structure of interest rates in this economy, what is the fair market

value of security

Use at least three decimals for intermediate calculations. Write your final answers in

dollars and round to two decimals: for instance, if the answer is $ or $

write without the dollar sign; if the answer is $ or $ write

The value of security is:

b How would you replicate the cashflows of security D by trading only in the three

bonds? Give an explicit description of how many of each bond you need to buy or sell to

form the replicating portfolio, where denotes the number of Bond denotes the

number of Bond and denotes the number of ond

Use at least three decimals for intermediate calculations. Write your final answers as

positive numbers if you want to buy, and as negative numbers if you want to sell a given

bond. Also, round your final answers to two decimals: for instance, if the number of

bonds to buy is or write ; if the number of bonds to sell is or

write

The number of Bond is:

The number of Bond is:

The number of Bond is:

c If someone was willing to trade security D for $bid price and $

ask price can you create an arbitrage trading strategy by buying or selling one unit of

security and trading the number of bonds that you wish, What is the

profit of your strategy today?

Use at least three decimals for intermediate calculations. Write your final answers as

positive numbers if you want to buy, and as negative numbers if you want to sell a given

bond. Also, round your final answers to two decimals: for instance, if the number of

bonds to buy is or write ; if the number of bonds to sell is or

write

Do you buy or sell one unit of security D

write "buy" or "sell"

The number of Bond is

The number of Bond is:

The number of Bond is:

The profit today is: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started