Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you are a money maker for short-term Government bonds. You receive the following information on bids and asks for a given bond: Deduce

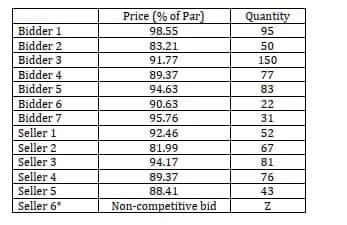

Suppose that you are a money maker for short-term Government bonds. You receive the following information on bids and asks for a given bond:

Deduce the market price of the bond under a single price auction. Show your reasoning graphically and explain in detail your answer. Assume that this security bears no coupon and matures 60 days from now. Calculate this bonds discount yield and bond equivalent yield.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started