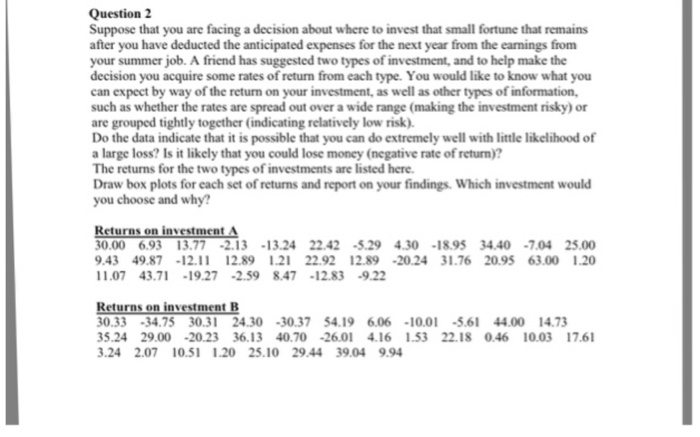

Suppose that you are facing a decision about where to invest that small fortune that remains after you have deducted the anticipating cd expenses for the next year from the earnings from your summer job. A friend has suggested no types of investment, and to help make the decision you acquire some rates of return from each type. You would like to know what you can expect by way of the return on your investment, as well as other types of information, such as whether the rates are spread out over a wide range (making the investment risky) or are grouped lightly together (indicating relatively low risk). Do the data indicate that it is possible that you can do extremely well with little likelihood of a large loss? Is it likely that you could lose money (negative rate of return)? The returns for the two types of investments are listed here. Draw box plots for each set of returns and report on your findings. Which investment would you choose and why? 30.00 6.93 13.77 -2.13 -13.24 22.42 -5.29 4 30 -1895 34.40 -7.04 25.00 9.43 49.87 -12.11 12.89 1.21 22.92 12.89 -20.24 31.76 20.95 63.00 1.20 11.07 43.71 -19.27 -2.59 8.47 -12.83 -9.22 30.33 -34.75 30 31 24.30 -30.37 54.19 6.06 -10.01 -5.61 44.00 14.73 35.24 29.00 -20.23 36.13 40.70 -26.01 4.16 1.53 22.18 0.46 10.03 17.61 3.24 2.07 10.51 1.20 25.10 29.44 39.01 9.94 Suppose that you are facing a decision about where to invest that small fortune that remains after you have deducted the anticipating cd expenses for the next year from the earnings from your summer job. A friend has suggested no types of investment, and to help make the decision you acquire some rates of return from each type. You would like to know what you can expect by way of the return on your investment, as well as other types of information, such as whether the rates are spread out over a wide range (making the investment risky) or are grouped lightly together (indicating relatively low risk). Do the data indicate that it is possible that you can do extremely well with little likelihood of a large loss? Is it likely that you could lose money (negative rate of return)? The returns for the two types of investments are listed here. Draw box plots for each set of returns and report on your findings. Which investment would you choose and why? 30.00 6.93 13.77 -2.13 -13.24 22.42 -5.29 4 30 -1895 34.40 -7.04 25.00 9.43 49.87 -12.11 12.89 1.21 22.92 12.89 -20.24 31.76 20.95 63.00 1.20 11.07 43.71 -19.27 -2.59 8.47 -12.83 -9.22 30.33 -34.75 30 31 24.30 -30.37 54.19 6.06 -10.01 -5.61 44.00 14.73 35.24 29.00 -20.23 36.13 40.70 -26.01 4.16 1.53 22.18 0.46 10.03 17.61 3.24 2.07 10.51 1.20 25.10 29.44 39.01 9.94