Answered step by step

Verified Expert Solution

Question

1 Approved Answer

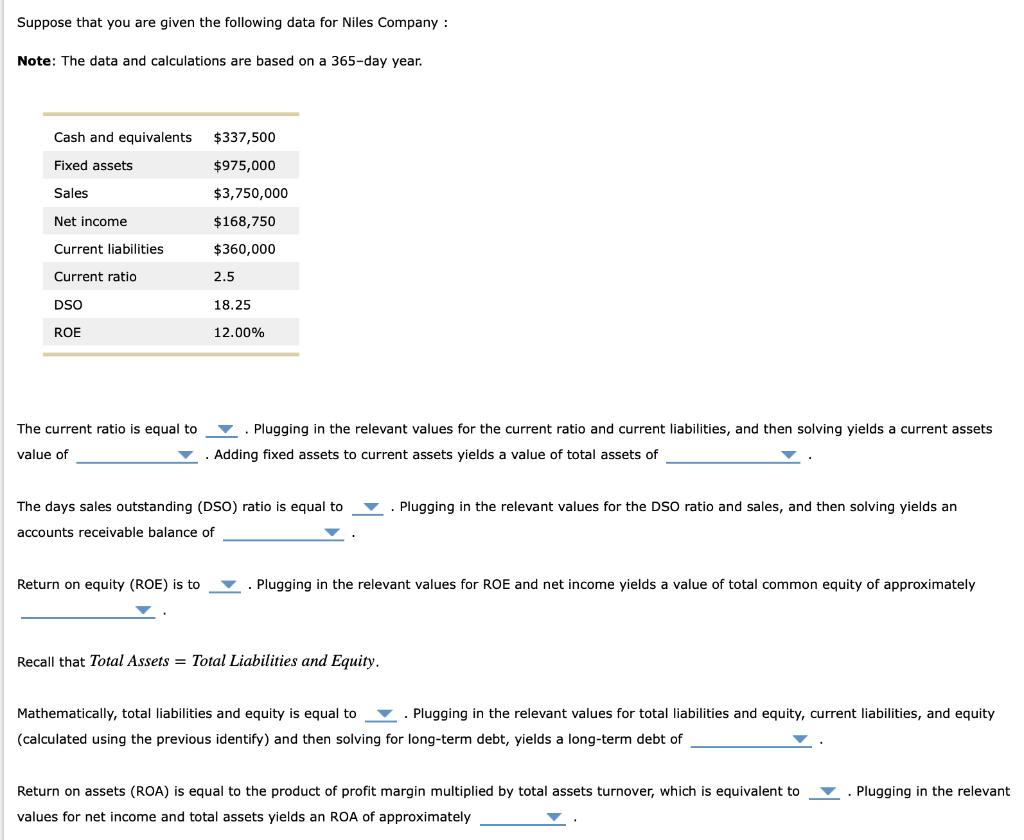

Suppose that you are given the following data for Niles Company : Note: The data and calculations are based on a 365-day year. Cash

Suppose that you are given the following data for Niles Company : Note: The data and calculations are based on a 365-day year. Cash and equivalents $337,500 Fixed assets $975,000 Sales $3,750,000 Net income Current liabilities Current ratio DSO ROE $168,750 $360,000 2.5 18.25 12.00% The current ratio is equal to value of Plugging in the relevant values for the current ratio and current liabilities, and then solving yields a current assets Adding fixed assets to current assets yields a value of total assets of The days sales outstanding (DSO) ratio is equal to accounts receivable balance of . Plugging in the relevant values for the DSO ratio and sales, and then solving yields an Return on equity (ROE) is to Plugging in the relevant values for ROE and net income yields a value of total common equity of approximately Recall that Total Assets = Total Liabilities and Equity. Mathematically, total liabilities and equity is equal to . Plugging in the relevant values for total liabilities and equity, current liabilities, and equity (calculated using the previous identify) and then solving for long-term debt, yields a long-term debt of Return on assets (ROA) is equal to the product of profit margin multiplied by total assets turnover, which is equivalent to values for net income and total assets yields an ROA of approximately Plugging in the relevant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started