Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you have $10,000 to invest in bonds. A broker calls you with some information yc requested on certain junk bonds. If the company

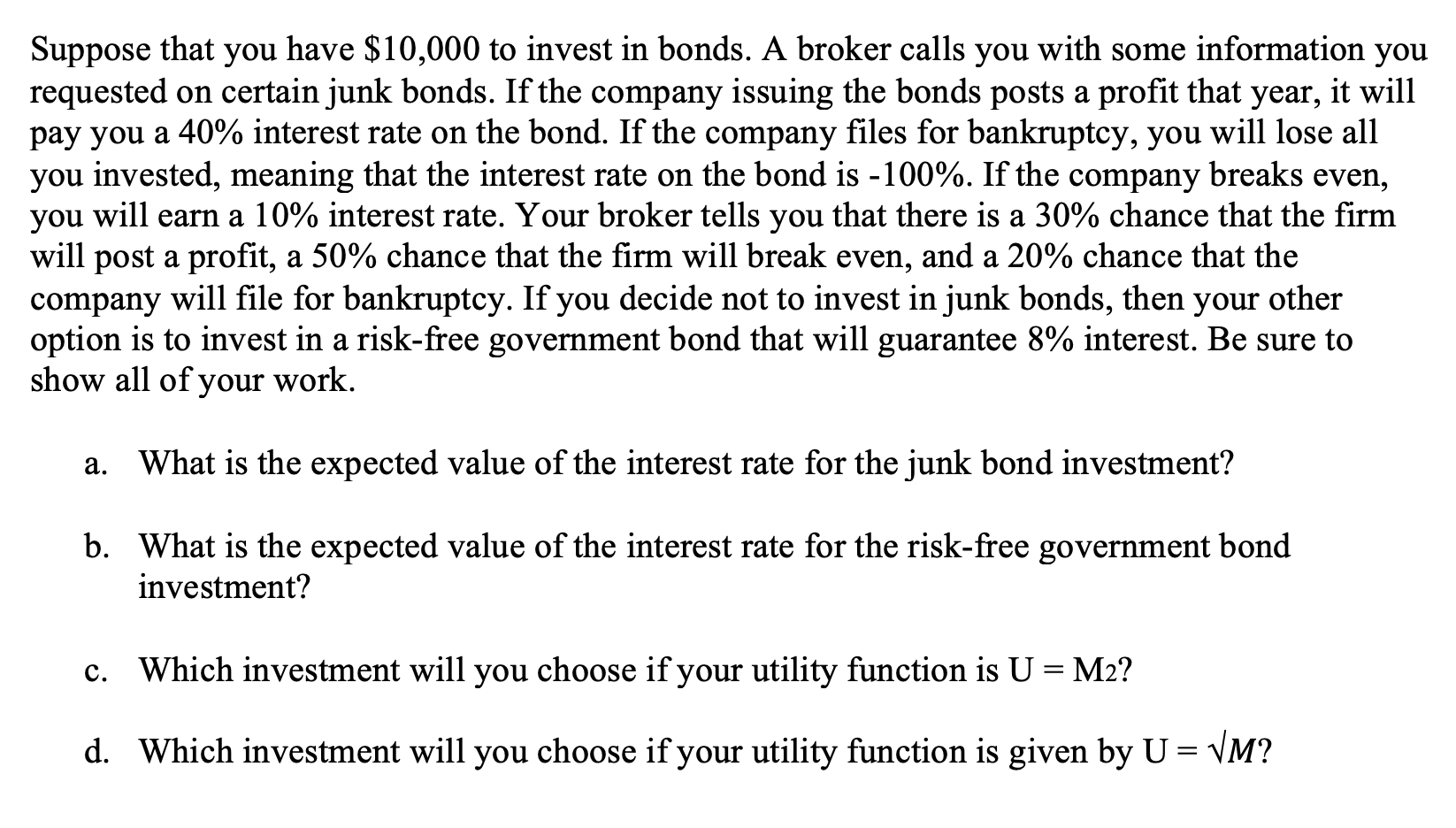

Suppose that you have $10,000 to invest in bonds. A broker calls you with some information yc requested on certain junk bonds. If the company issuing the bonds posts a profit that year, it wil pay you a 40% interest rate on the bond. If the company files for bankruptcy, you will lose all you invested, meaning that the interest rate on the bond is 100%. If the company breaks even, you will earn a 10% interest rate. Your broker tells you that there is a 30% chance that the firm will post a profit, a 50% chance that the firm will break even, and a 20% chance that the company will file for bankruptcy. If you decide not to invest in junk bonds, then your other option is to invest in a risk-free government bond that will guarantee 8% interest. Be sure to show all of your work. a. What is the expected value of the interest rate for the junk bond investment? b. What is the expected value of the interest rate for the risk-free government bond investment? c. Which investment will you choose if your utility function is U=M2 ? d. Which investment will you choose if your utility function is given by U=M

Suppose that you have $10,000 to invest in bonds. A broker calls you with some information yc requested on certain junk bonds. If the company issuing the bonds posts a profit that year, it wil pay you a 40% interest rate on the bond. If the company files for bankruptcy, you will lose all you invested, meaning that the interest rate on the bond is 100%. If the company breaks even, you will earn a 10% interest rate. Your broker tells you that there is a 30% chance that the firm will post a profit, a 50% chance that the firm will break even, and a 20% chance that the company will file for bankruptcy. If you decide not to invest in junk bonds, then your other option is to invest in a risk-free government bond that will guarantee 8% interest. Be sure to show all of your work. a. What is the expected value of the interest rate for the junk bond investment? b. What is the expected value of the interest rate for the risk-free government bond investment? c. Which investment will you choose if your utility function is U=M2 ? d. Which investment will you choose if your utility function is given by U=M Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started