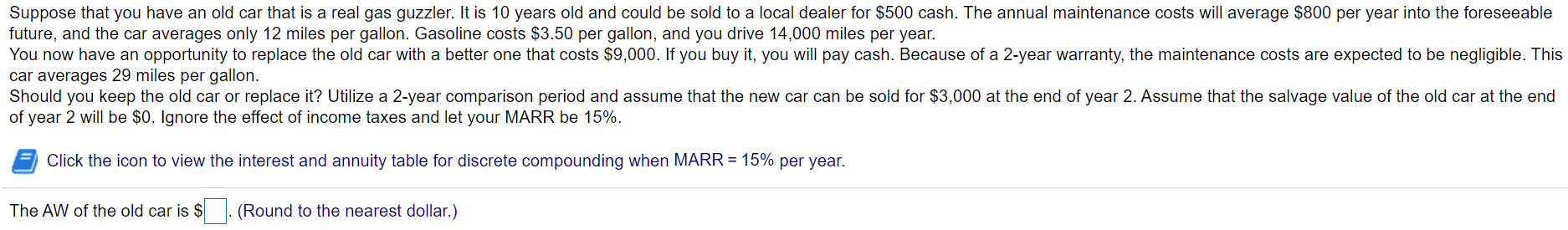

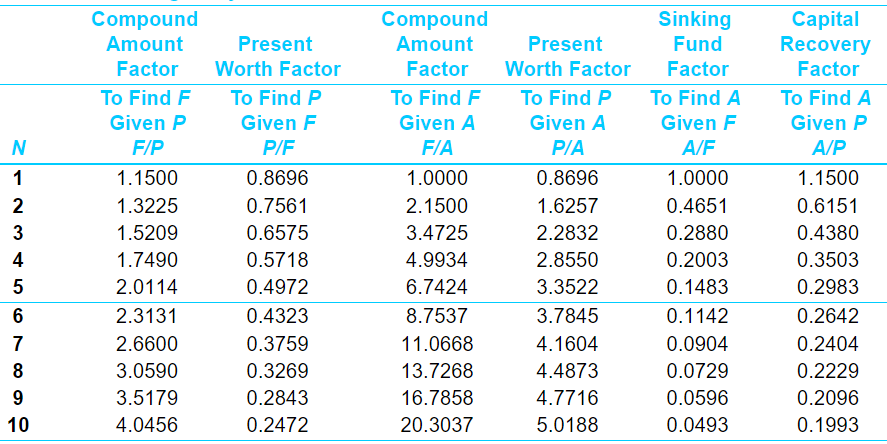

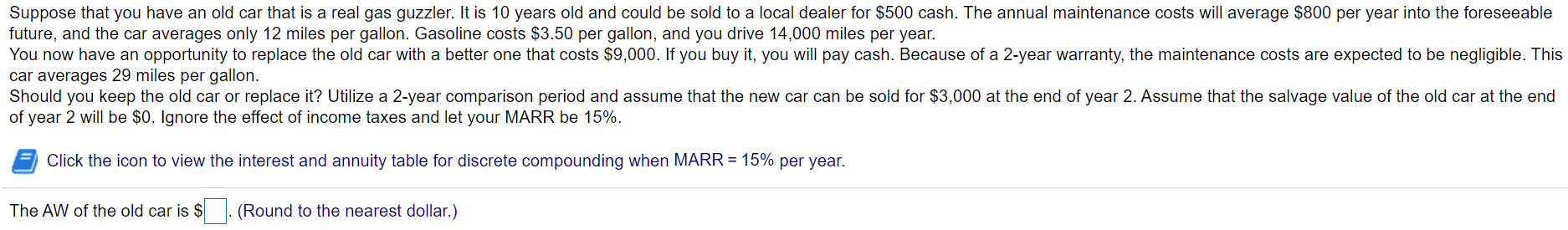

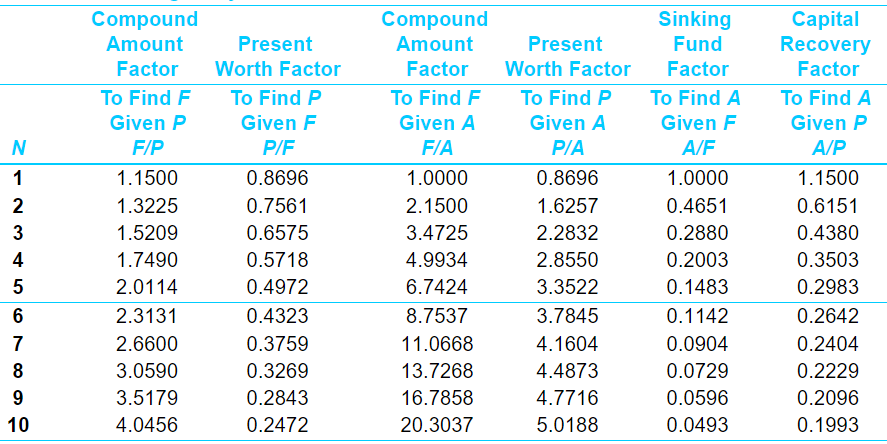

Suppose that you have an old car that is a real gas guzzler. It is 10 years old and could be sold to a local dealer for $500 cash. The annual maintenance costs will average $800 per year into the foreseeable future, and the car averages only 12 miles per gallon. Gasoline costs $3.50 per gallon, and you drive 14,000 miles per year. You now have an opportunity to replace the old car with a better one that costs $9,000. If you buy it, you will pay cash. Because of a 2-year warranty, the maintenance costs are expected to be negligible. This car averages 29 miles per gallon. Should you keep the old car or replace it? Utilize a 2-year comparison period and assume that the new car can be sold for $3,000 at the end of year 2. Assume that the salvage value of the old car at the end of year 2 will be $0. Ignore the effect of income taxes and let your MARR be 15%. Click the icon to view the interest and annuity table for discrete compounding when MARR = 15% per year. The AW of the old car is $. (Round to the nearest dollar.) N 2 3 4 5 Compound Amount Factor To Find F Given P F/P 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 Present Worth Factor To Find P Given F P/F 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 Compound Amount Factor To Find F Given A FIA 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 Present Worth Factor To Find P Given A PIA 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4651 0.2880 0.2003 0.1483 0.1142 0.0904 0.0729 0.0596 0.0493 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 6 7 8 9 10 Suppose that you have an old car that is a real gas guzzler. It is 10 years old and could be sold to a local dealer for $500 cash. The annual maintenance costs will average $800 per year into the foreseeable future, and the car averages only 12 miles per gallon. Gasoline costs $3.50 per gallon, and you drive 14,000 miles per year. You now have an opportunity to replace the old car with a better one that costs $9,000. If you buy it, you will pay cash. Because of a 2-year warranty, the maintenance costs are expected to be negligible. This car averages 29 miles per gallon. Should you keep the old car or replace it? Utilize a 2-year comparison period and assume that the new car can be sold for $3,000 at the end of year 2. Assume that the salvage value of the old car at the end of year 2 will be $0. Ignore the effect of income taxes and let your MARR be 15%. Click the icon to view the interest and annuity table for discrete compounding when MARR = 15% per year. The AW of the old car is $. (Round to the nearest dollar.) N 2 3 4 5 Compound Amount Factor To Find F Given P F/P 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 Present Worth Factor To Find P Given F P/F 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 Compound Amount Factor To Find F Given A FIA 1.0000 2.1500 3.4725 4.9934 6.7424 8.7537 11.0668 13.7268 16.7858 20.3037 Present Worth Factor To Find P Given A PIA 0.8696 1.6257 2.2832 2.8550 3.3522 3.7845 4.1604 4.4873 4.7716 5.0188 Sinking Fund Factor To Find A Given F A/F 1.0000 0.4651 0.2880 0.2003 0.1483 0.1142 0.0904 0.0729 0.0596 0.0493 Capital Recovery Factor To Find A Given P A/P 1.1500 0.6151 0.4380 0.3503 0.2983 0.2642 0.2404 0.2229 0.2096 0.1993 6 7 8 9 10