Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you have decided to perform a Multiples Based Valuation of General Mills (Ticker: GIS), and have decided to use Kellogg (Ticker: K)

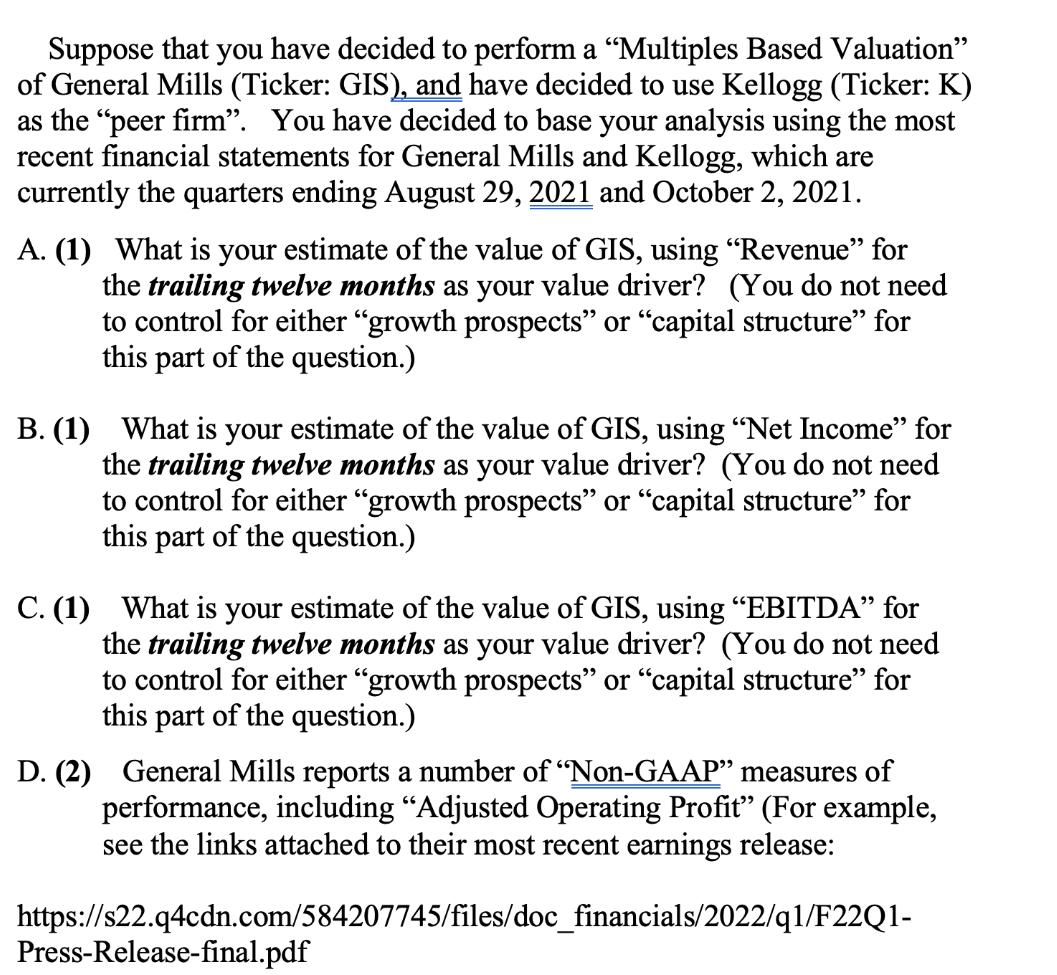

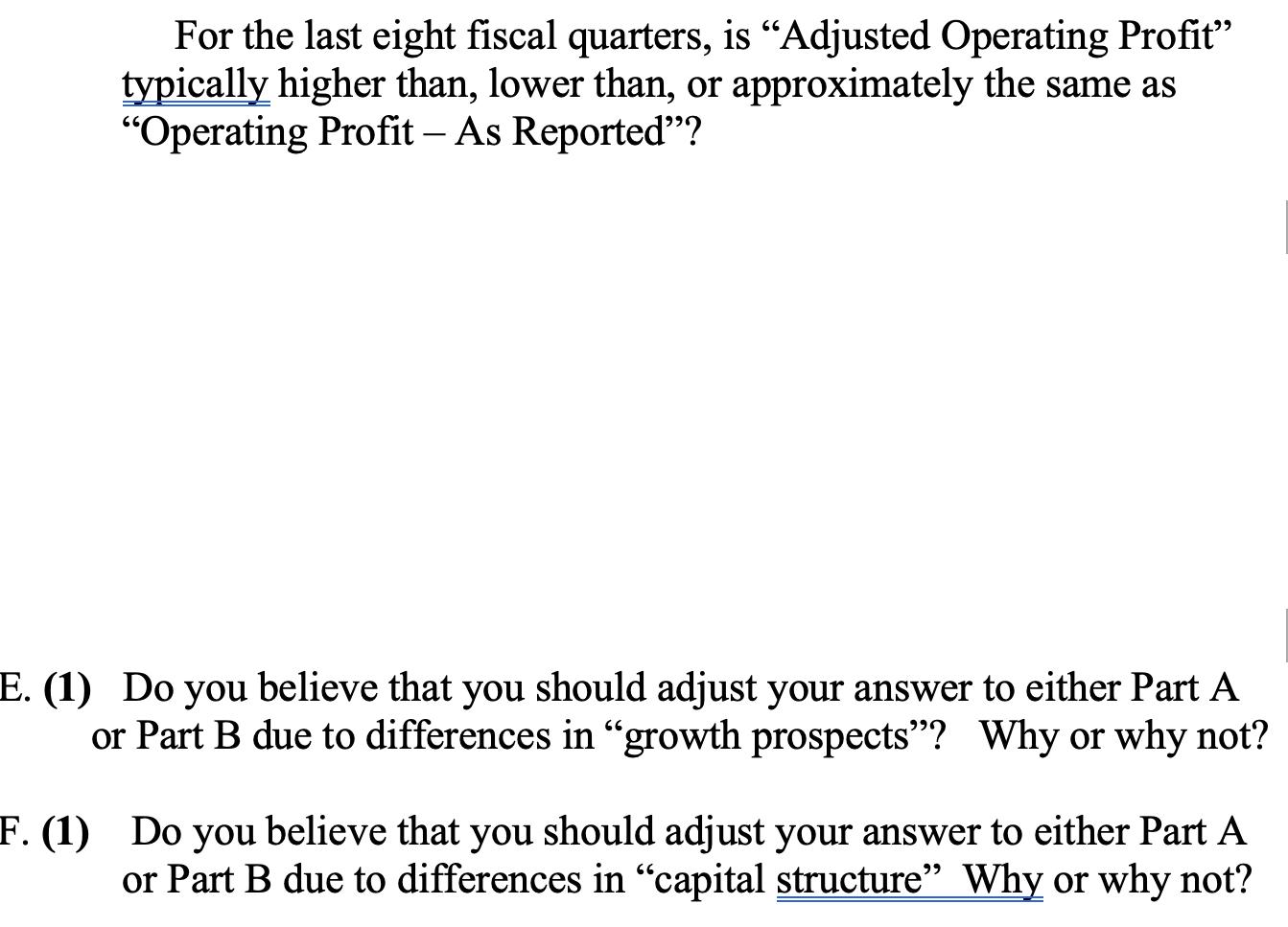

Suppose that you have decided to perform a "Multiples Based Valuation" of General Mills (Ticker: GIS), and have decided to use Kellogg (Ticker: K) as the "peer firm". You have decided to base your analysis using the most recent financial statements for General Mills and Kellogg, which are currently the quarters ending August 29, 2021 and October 2, 2021. A. (1) What is your estimate of the value of GIS, using "Revenue" for the trailing twelve months as your value driver? (You do not need to control for either "growth prospects" or "capital structure" for this part of the question.) B. (1) What is your estimate of the value of GIS, using "Net Income" for the trailing twelve months as your value driver? (You do not need to control for either "growth prospects" or "capital structure" for this part of the question.) C. (1) What is your estimate of the value of GIS, using "EBITDA" for the trailing twelve months as your value driver? (You do not need to control for either "growth prospects" or "capital structure" for this part of the question.) D. (2) General Mills reports a number of "Non-GAAP" measures of performance, including "Adjusted Operating Profit" (For example, see the links attached to their most recent earnings release: https://s22.q4cdn.com/584207745/files/doc_financials/2022/q1/F22Q1- Press-Release-final.pdf For the last eight fiscal quarters, is "Adjusted Operating Profit" typically higher than, lower than, or approximately the same as "Operating Profit - As Reported"? E. (1) Do you believe that you should adjust your answer to either Part A or Part B due to differences in "growth prospects"? Why or why not? F. (1) Do you believe that you should adjust your answer to either Part A or Part B due to differences in "capital structure" Why or why not?

Step by Step Solution

★★★★★

3.67 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

A1 G IS Revenue TT M 37 217 K Revenue TT M 13 089 G IS Revenue K Revenue 2 84 Value of G IS 2 84 K Value K Value 52 2 billion G IS Value 149 7 billion B1 G IS frac K G IS frac NI K NI G IS G IS G IS f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started