Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S.

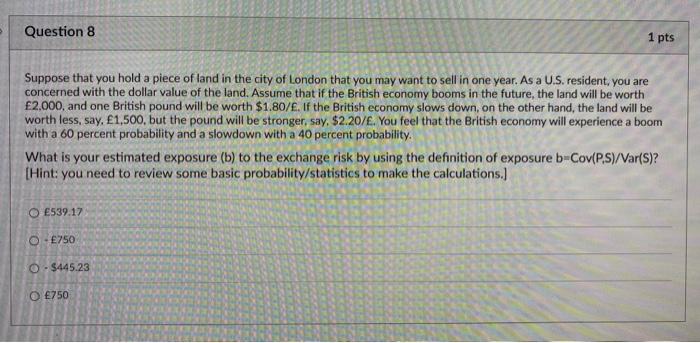

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth E2,000, and one British pound will be worth $1.80/E. If the British economy slows down, on the other hand, the land will be worth less, say, E1,500, but the pound will be stronger, say, $2.20/E.Youfeelthat the British economy will experience a boom with a 60 percent probability and a slowdown with a 40 percent probability. What is your estimated exposure (b) to the exchange risk by using the definition of exposure b=Cov(P.S)/Var(S)? [Hint: you need to review some basic probability/statistics to make the calculations.] 2539.17 $445.23 5750

Suppose that you hold a piece of land in the city of London that you may want to sell in one year. As a U.S. resident, you are concerned with the dollar value of the land. Assume that if the British economy booms in the future, the land will be worth E2,000, and one British pound will be worth $1.80/E. If the British economy slows down, on the other hand, the land will be worth less, say, E1,500, but the pound will be stronger, say, $2.20/E.Youfeelthat the British economy will experience a boom with a 60 percent probability and a slowdown with a 40 percent probability. What is your estimated exposure (b) to the exchange risk by using the definition of exposure b=Cov(P.S)/Var(S)? [Hint: you need to review some basic probability/statistics to make the calculations.] 2539.17 $445.23 5750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started