Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose that you hold a piece of land in the City of London that you may want to sell in one year. As a U.S.

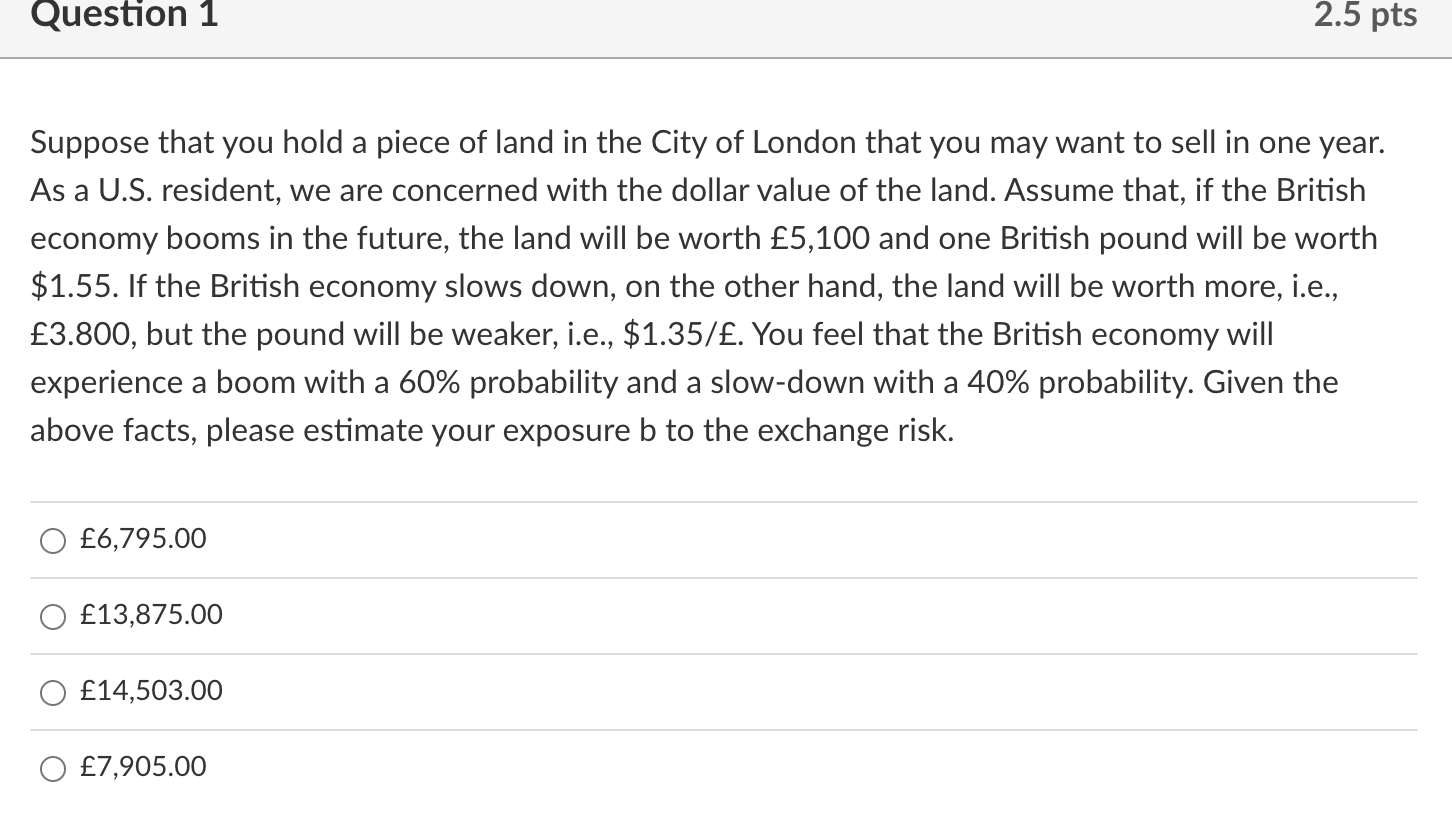

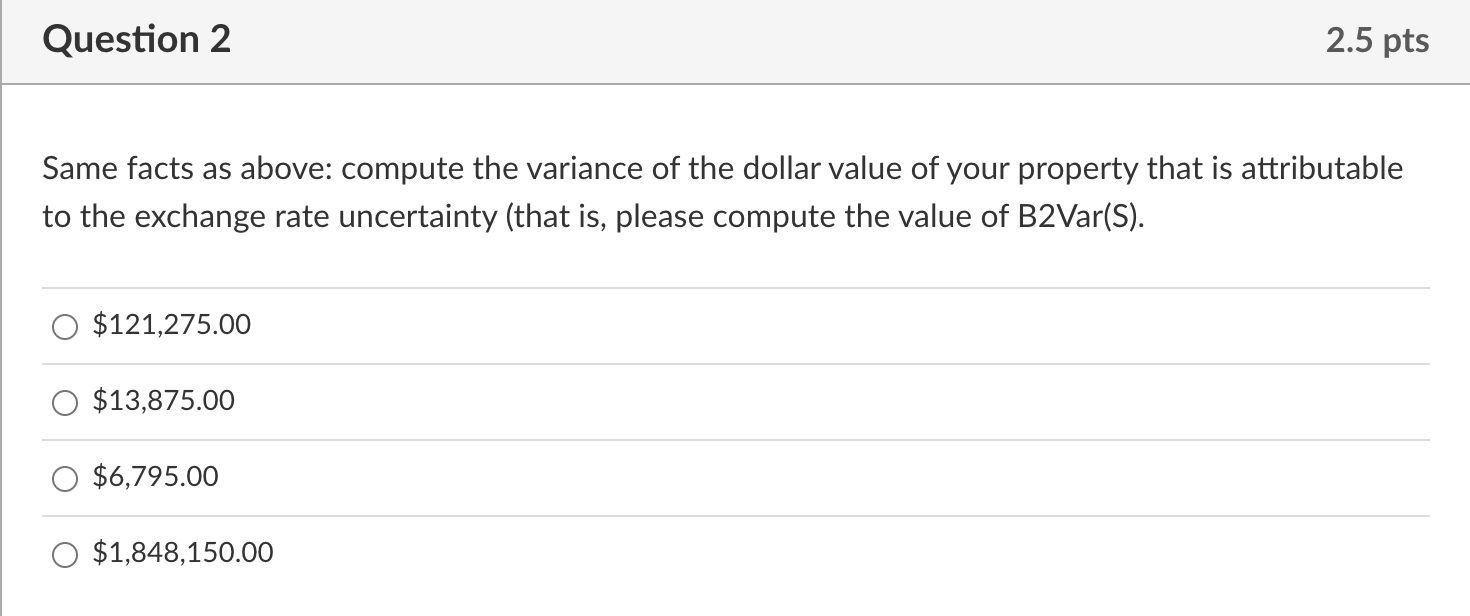

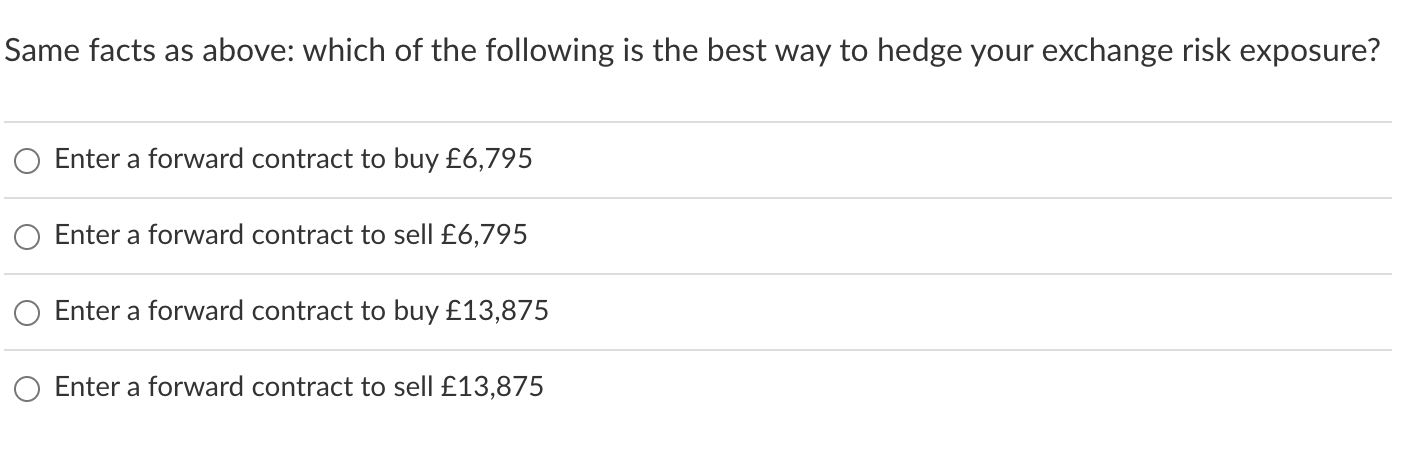

Suppose that you hold a piece of land in the City of London that you may want to sell in one year. As a U.S. resident, we are concerned with the dollar value of the land. Assume that, if the British economy booms in the future, the land will be worth 5,100 and one British pound will be worth $1.55. If the British economy slows down, on the other hand, the land will be worth more, i.e., 3.800, but the pound will be weaker, i.e., $1.35/. You feel that the British economy will experience a boom with a 60% probability and a slow-down with a 40% probability. Given the above facts, please estimate your exposure b to the exchange risk. \begin{tabular}{c} 6,795.00 \\ \hline13,875.00 \\ 14,503.00 \\ 7,905.00 \end{tabular} Same facts as above: compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty (that is, please compute the value of B2Var(S). $121,275.00 $13,875.00 $6,795.00 $1,848,150.00 Same facts as above: which of the following is the best way to hedge your exchange risk exposure? Enter a forward contract to buy 6,795 Enter a forward contract to sell 6,795 Enter a forward contract to buy 13,875 Enter a forward contract to sell 13,875

Suppose that you hold a piece of land in the City of London that you may want to sell in one year. As a U.S. resident, we are concerned with the dollar value of the land. Assume that, if the British economy booms in the future, the land will be worth 5,100 and one British pound will be worth $1.55. If the British economy slows down, on the other hand, the land will be worth more, i.e., 3.800, but the pound will be weaker, i.e., $1.35/. You feel that the British economy will experience a boom with a 60% probability and a slow-down with a 40% probability. Given the above facts, please estimate your exposure b to the exchange risk. \begin{tabular}{c} 6,795.00 \\ \hline13,875.00 \\ 14,503.00 \\ 7,905.00 \end{tabular} Same facts as above: compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty (that is, please compute the value of B2Var(S). $121,275.00 $13,875.00 $6,795.00 $1,848,150.00 Same facts as above: which of the following is the best way to hedge your exchange risk exposure? Enter a forward contract to buy 6,795 Enter a forward contract to sell 6,795 Enter a forward contract to buy 13,875 Enter a forward contract to sell 13,875 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started