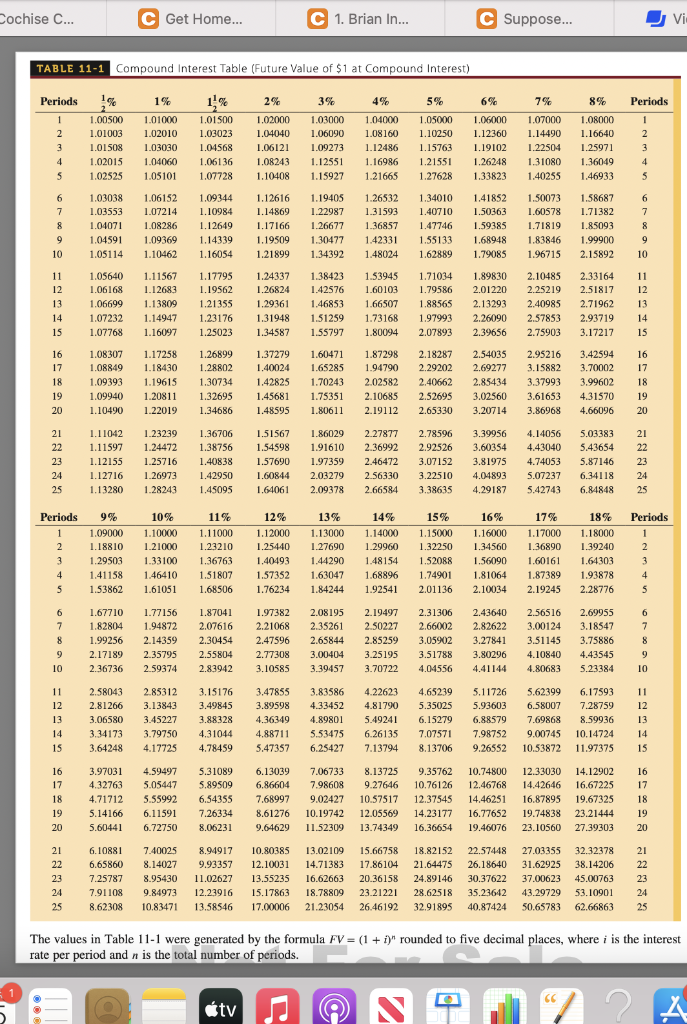

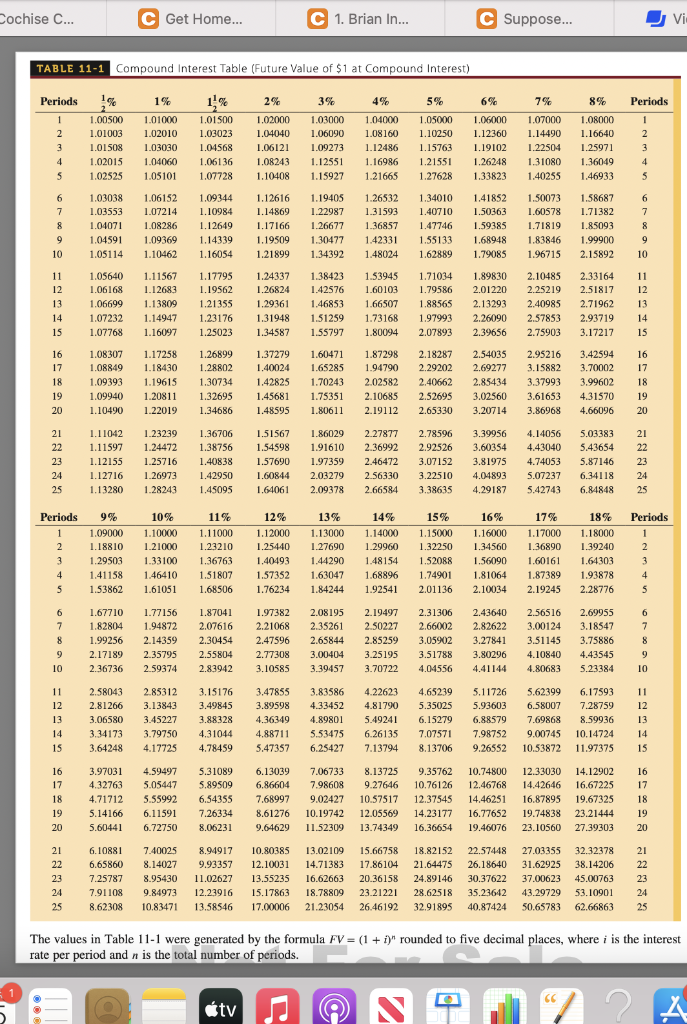

Suppose that you invest $7,000 at 6% interest, compound quarterly, for 5 years. use Table 11-1 to calculate the compound interest (in $) on your investment.

Suppose that you invest $7,000 at 6% interest, compound quarterly, for 5 years. use Table 11-1 to calculate the compound interest (in $) on your investment.

Cochise C... C Get Home... C 1. Brian In... C Suppose... Vi TABLE 11-1 Compound Interest Table (Future Value of $1 at Compound Interest) 1% 3% 49% 5% 6% 7% 8% Periods Periods 1 2 3 4 5 1.00500 1.01003 1.01508 1.02015 1.02525 1.01000 1.02010 1.03030 1.04060 1.05101 1.01500 1.03023 1.04568 1.06136 1.07728 2% 1.02000 1.04040 1.06121 1.08243 1.10408 1.03000 1.06090 1.09273 1.12551 1.15927 1.04000 1.08160 1.12486 1.16986 1.21665 1.05000 1.10250 1.15763 1.21551 1.27628 1.06000 1.12360 1.19102 1.26248 1.33823 1.07000 1.14490 1.22504 1.31080 1.40255 1.08000 1.16640 1.25971 1.36049 1.46933 1 2 3 4 5 5 6 7 6 7 8 9 10 1.03038 1.03553 1.04071 1.04591 1.05114 1.06152 1.07214 1.08286 1.09369 1.10462 1.09344 1.10984 1.12649 1.14339 1.16054 1.12616 1.14869 1.17166 1.19509 1.21899 1.19405 1.22987 1.26677 1.30477 1.34392 1.26532 1.31593 1.36857 1.42331 1.48024 1.34010 1.40710 1.47746 1.55133 1.62889 1.41852 1.50363 1.59385 1.68948 1.79085 1.50073 1.60578 1.71819 1.83846 1.96715 1.58687 1.71382 1.85093 1.99900 2.15892 8 9 10 1.11567 1.17795 1.12683 2.33164 2.51817 1.19562 11 12 13 14 15 1.05640 1.06168 1.06699 1.07232 1.07768 1.13809 1.14947 1.16097 1.24337 1.26824 1.29361 1.31948 1.34587 1.21355 1.23176 1.25023 1.38423 1.42576 1.46853 1.51259 1.55797 1.53945 1.60103 1.66507 1.73168 1.80094 1.71034 1.79586 1.88565 1.97993 2.07893 1.89830 2.01220 2.13293 2.26090 2.39656 2.71962 2.10485 2.25219 2.40985 2.57853 2.75903 11 12 13 14 1S 2.93719 3.17217 16 17 18 19 20 1.08307 1.08849 1.09393 1.09940 1.10490 1.17258 1.18430 1.19615 1.20811 1.22019 1.26899 1.28802 1.30734 1.32695 1.34686 1.37279 1.40024 1.42825 1.45681 1.48595 1.60471 1.65285 1.70243 1.75351 1.80611 1.87298 1.94790 2.02582 2.10685 2.19112 2.18287 2.29202 2.40662 2.52695 2.65330 2.54035 2.69277 2.85434 3.02560 3.20714 2.95216 3.15882 3.37993 3.61653 3.86968 3.42594 3.70002 3.99602 4.31570 4.66096 16 17 18 19 20 21 22 23 24 25 1.11042 1.11597 1.12155 1.12716 1.13280 1.23239 1.24472 1.25716 1.26973 1.28243 1.36706 1.38756 1.40838 1.42950 1.45095 1.51567 1.54598 1.57690 1.60844 1.64061 1.86029 1.91610 1.97359 2.03279 2.09378 2.27877 2.36992 2.46472 2.56330 2.66584 2.78596 2.92526 3.07152 3.22510 3.38635 3.39956 3.60354 3.81975 4.04893 4.29187 4.14056 4.43040 4.74053 5.07237 5.42743 5.03383 5.43654 5.87146 6.34118 6.84848 21 22 23 24 25 Periods 1 2 3 4 5 9% 1.09000 1.18810 1.29503 1.41158 1.53862 10% 1.10000 1.21000 1.33100 1.46410 1.61051 11% 1.11000 1.23210 1.36763 1.51807 1.68506 12% 1.12000 1.25440 1.40493 1.57352 1.76234 13% 1.13000 1.27690 1.44290 1.63047 1.84244 14% 1.14000 1.29960 1.48154 1.68896 1.92541 15% 1.15000 1.32250 1.52088 1.74901 2.01136 16% 1.16000 1.34560 1.56090 1.81064 2.10034 17% 1.17000 1.36890 1.60161 1.87389 2.19245 18% 1.18000 1.39240 1.64303 1.93878 2.28776 Periods 1 2 3 4 5 6 7 8 1.67710 1.82804 1.99256 2.17189 2.36736 1.77156 1.94872 2.14359 2.35795 2.59374 1.87041 2.07616 2.30454 2.55804 2.83942 1.97382 2.21068 2.47596 2.77308 3.10585 2.08195 2.35261 2.65844 3.00404 3.39457 2.19497 2.50227 2.85259 3.25195 3.70722 2.31306 2.66002 3.05902 3.51788 4.04556 2.43640 2.82622 3.27841 3.80296 4.41144 2.56516 3.00124 3.51145 4.10840 4.80683 2.69955 3.18547 3.75886 4.43545 5.23384 8 9 10 9 10 11 12 2.85312 13 2.58043 2.81266 3.06580 3.34173 3.64248 3.13843 3.45227 3.79750 4.17725 3.15176 3.49845 3.88328 4.31044 4.78459 3.47855 3.89598 4.36349 4.88711 5.47357 3.83586 4.33452 4.89801 5.53475 6.25427 4.22623 4.81790 5.49241 6.26135 7.13794 4.65239 5.35025 6.15279 7.07571 8.13706 5.11726 5.93603 6.88579 7.98752 9.26552 5.62399 6.58007 7.69868 9.00745 10.53872 6.17593 7.28759 8.59936 10.14724 11.97375 11 12 13 14 15 14 15 16 17 18 19 20 3.97031 4.32763 4.71712 5.14166 5.60441 4.59497 5.05447 5.55992 6.11591 6.72750 5.31089 5.89509 6.54355 7.26334 8.06231 6.13039 6,86604 7.68997 8.61276 9.64629 7.06733 7.98608 9.02427 10.19742 11.52309 8.13725 9.27646 10.57517 12.05569 13.74349 9.35762 10.76126 12.37545 14.23177 16.36654 10.74800 12.46768 14.46251 16.77652 19.46076 12.33030 14.42646 16.87895 19.74838 23.10560 14.12902 16.67225 19.67325 23.21444 27.39303 16 17 18 19 20 21 22 23 24 25 6.10881 6.65860 7.25787 7.91108 8.62308 7.40025 8.14027 8.95430 9.84973 10.83471 8.94917 9.93357 11.02627 12.23916 13.58546 10.80385 12.10031 13.55235 15.17863 17.00006 13.02109 14.71383 16.62663 18.78809 21.23054 15.66758 17.86104 20.36158 23.21221 26.46192 18.82152 21.64475 24.89146 28.62518 32.91895 22.57448 26.18640 30.37622 35.23642 40.87424 27.03355 31.62925 37.00623 43.29729 50.65783 32.32378 38.14206 45.00763 53.10901 62.66863 21 22 23 24 25 The values in Table 11-1 were generated by the formula FV = (1 + i)" rounded to five decimal places, where i is the interest rate per period and n is the total number of periods. ty S. A

Suppose that you invest $7,000 at 6% interest, compound quarterly, for 5 years. use Table 11-1 to calculate the compound interest (in $) on your investment.

Suppose that you invest $7,000 at 6% interest, compound quarterly, for 5 years. use Table 11-1 to calculate the compound interest (in $) on your investment.