Answered step by step

Verified Expert Solution

Question

1 Approved Answer

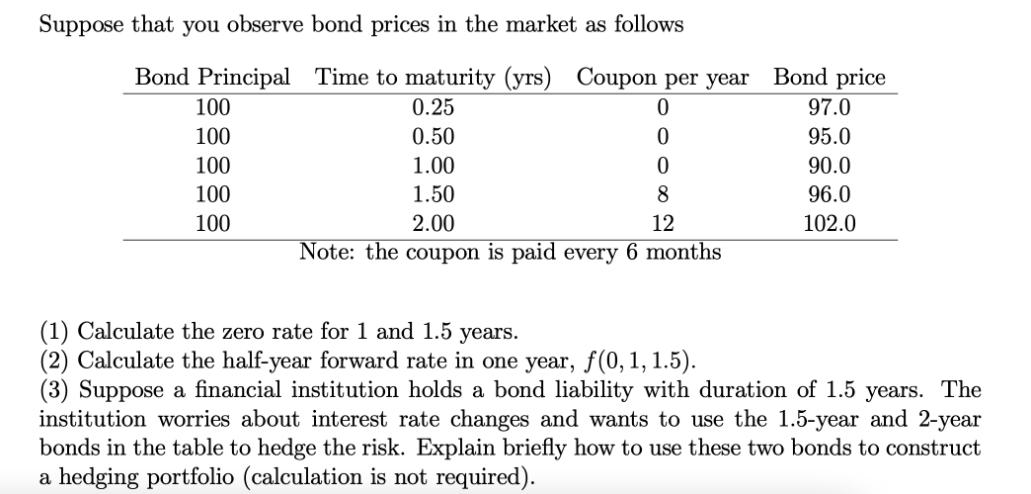

Suppose that you observe bond prices in the market as follows Bond Principal Time to maturity (yrs) Coupon per year Bond price 0.25 0.50

Suppose that you observe bond prices in the market as follows Bond Principal Time to maturity (yrs) Coupon per year Bond price 0.25 0.50 97.0 95.0 TIIT 100 100 100 100 100 1.00 1.50 2.00 90.0 0 0 0 8 12 96.0 102.0 Note: the coupon is paid every 6 months (1) Calculate the zero rate for 1 and 1.5 years. (2) Calculate the half-year forward rate in one year, f(0, 1, 1.5). (3) Suppose a financial institution holds a bond liability with duration of 1.5 years. The institution worries about interest rate changes and wants to use the 1.5-year and 2-year bonds in the table to hedge the risk. Explain briefly how to use these two bonds to construct a hedging portfolio (calculation is not required).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the zero rate for 1 and 15 years we can use the formula for calculating the present v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started