Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the ABX-AAA has a coupon of 40 basis points. The initial index value of 100 b) An investor wants to buy insurance on the

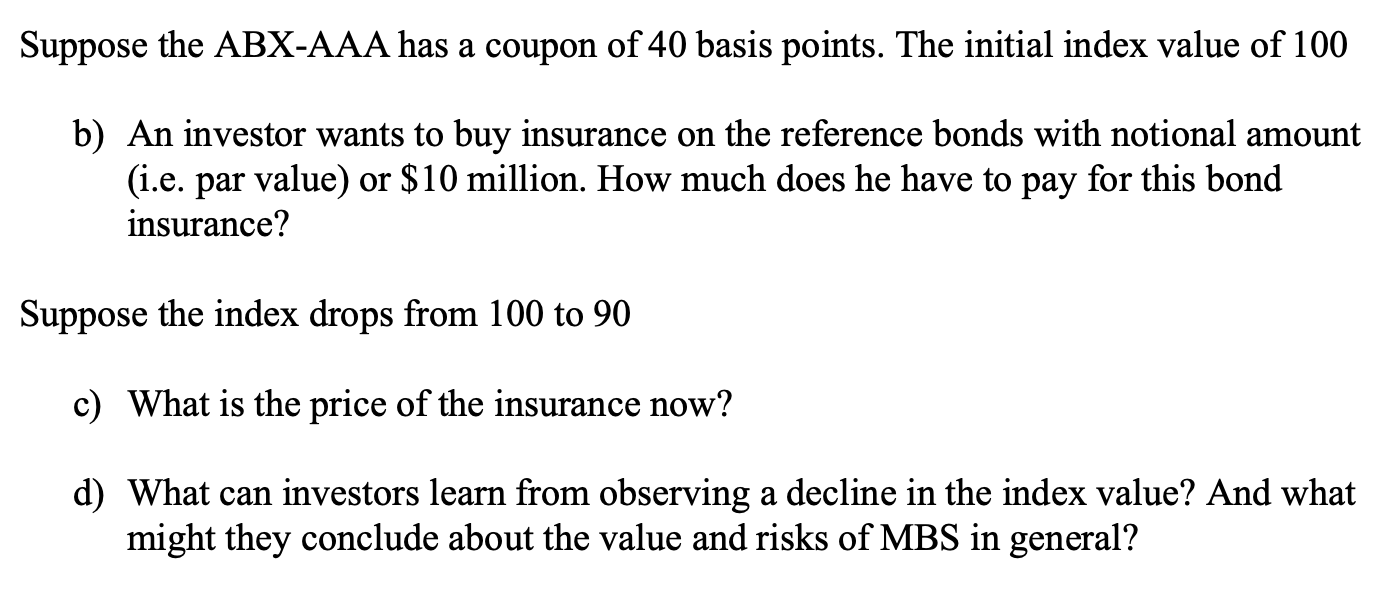

Suppose the ABX-AAA has a coupon of 40 basis points. The initial index value of 100 b) An investor wants to buy insurance on the reference bonds with notional amount (i.e. par value) or $10 million. How much does he have to pay for this bond insurance? Suppose the index drops from 100 to 90 c) What is the price of the insurance now? d) What can investors learn from observing a decline in the index value? And what might they conclude about the value and risks of MBS in general

Suppose the ABX-AAA has a coupon of 40 basis points. The initial index value of 100 b) An investor wants to buy insurance on the reference bonds with notional amount (i.e. par value) or $10 million. How much does he have to pay for this bond insurance? Suppose the index drops from 100 to 90 c) What is the price of the insurance now? d) What can investors learn from observing a decline in the index value? And what might they conclude about the value and risks of MBS in general Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started