Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the amount of debt is 60% as the amount of equity for a project. If the IRR on debt is 8% and the

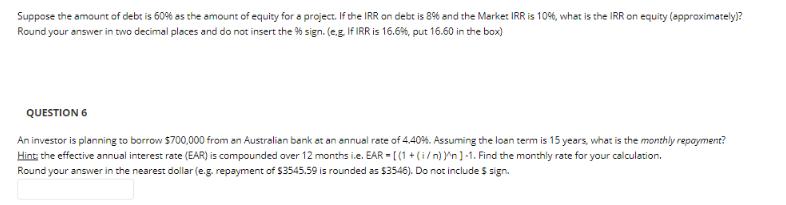

Suppose the amount of debt is 60% as the amount of equity for a project. If the IRR on debt is 8% and the Market IRR is 10%, what is the IRR on equity (approximately)? Round your answer in two decimal places and do not insert the 9% sign. (e.g. If IRR is 16.6%, put 16.60 in the box) QUESTION 6 An investor is planning to borrow $700,000 from an Australian bank at an annual rate of 4.40%. Assuming the loan term is 15 years, what is the monthly repayment? Hint: the effective annual interest rate (EAR) is compounded over 12 months i.e. EAR-[(1 + (i/n))'n ]-1. Find the monthly rate for your calculation. Round your answer in the nearest dollar (e.g. repayment of $3545.59 is rounded as $3546). Do not include $ sign.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To find the IRR on equity we can use the Weighted Average Cost of Capital WACC formula which takes i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started