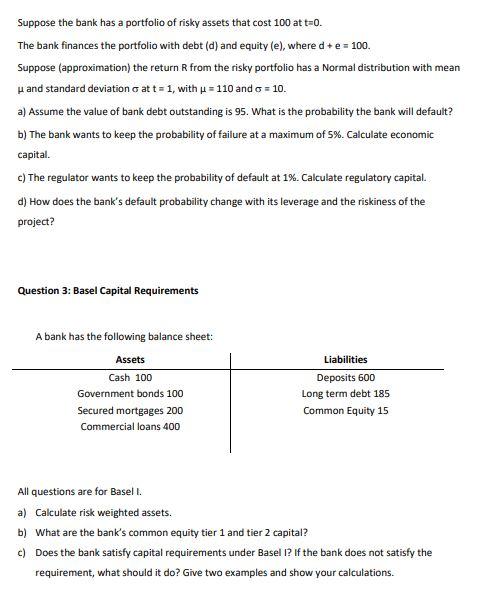

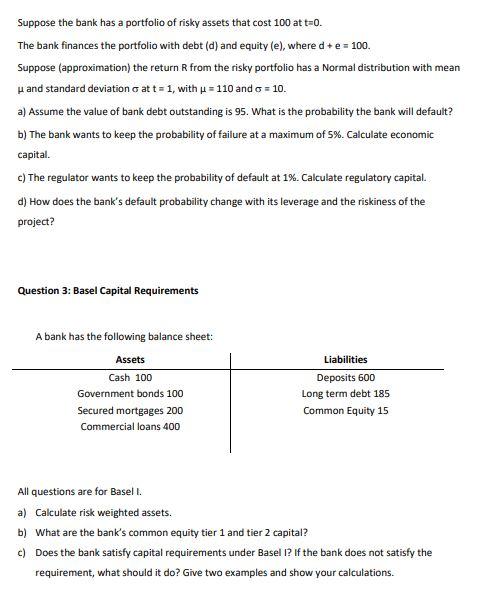

Suppose the bank has a portfolio of risky assets that cost 100 at t=0. The bank finances the portfolio with debt (d) and equity (e), where d + e = 100. Suppose (approximation) the return R from the risky portfolio has a Normal distribution with mean u and standard deviation o att = 1, with u = 110 and o = 10. a) Assume the value of bank debt outstanding is 95. What is the probability the bank will default? b) The bank wants to keep the probability of failure at a maximum of 5%. Calculate economic capital. c) The regulator wants to keep the probability of default at 1%. Calculate regulatory capital. d) How does the bank's default probability change with its leverage and the riskiness of the project? Question 3: Basel Capital Requirements A bank has the following balance sheet: Assets Cash 100 Government bonds 100 Secured mortgages 200 Commercial loans 400 Liabilities Deposits 600 Long term debt 185 Common Equity 15 All questions are for Baselt. a) Calculate risk weighted assets. b) What are the bank's common equity tier 1 and tier 2 capital? c) Does the bank satisfy capital requirements under Basel 1? If the bank does not satisfy the requirement, what should it do? Give two examples and show your calculations. Suppose the bank has a portfolio of risky assets that cost 100 at t=0. The bank finances the portfolio with debt (d) and equity (e), where d + e = 100. Suppose (approximation) the return R from the risky portfolio has a Normal distribution with mean u and standard deviation o att = 1, with u = 110 and o = 10. a) Assume the value of bank debt outstanding is 95. What is the probability the bank will default? b) The bank wants to keep the probability of failure at a maximum of 5%. Calculate economic capital. c) The regulator wants to keep the probability of default at 1%. Calculate regulatory capital. d) How does the bank's default probability change with its leverage and the riskiness of the project? Question 3: Basel Capital Requirements A bank has the following balance sheet: Assets Cash 100 Government bonds 100 Secured mortgages 200 Commercial loans 400 Liabilities Deposits 600 Long term debt 185 Common Equity 15 All questions are for Baselt. a) Calculate risk weighted assets. b) What are the bank's common equity tier 1 and tier 2 capital? c) Does the bank satisfy capital requirements under Basel 1? If the bank does not satisfy the requirement, what should it do? Give two examples and show your calculations