Answered step by step

Verified Expert Solution

Question

1 Approved Answer

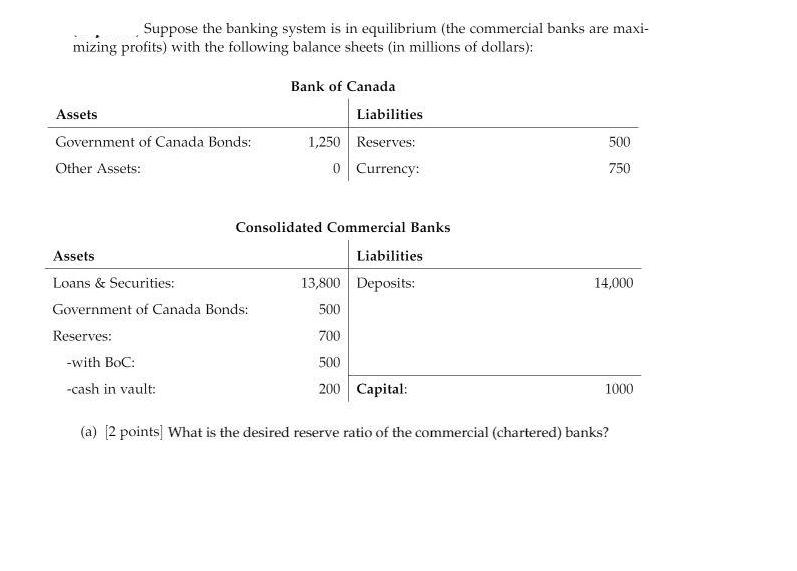

Suppose the banking system is in equilibrium (the commercial banks are maxi- mizing profits) with the following balance sheets (in millions of dollars): Assets

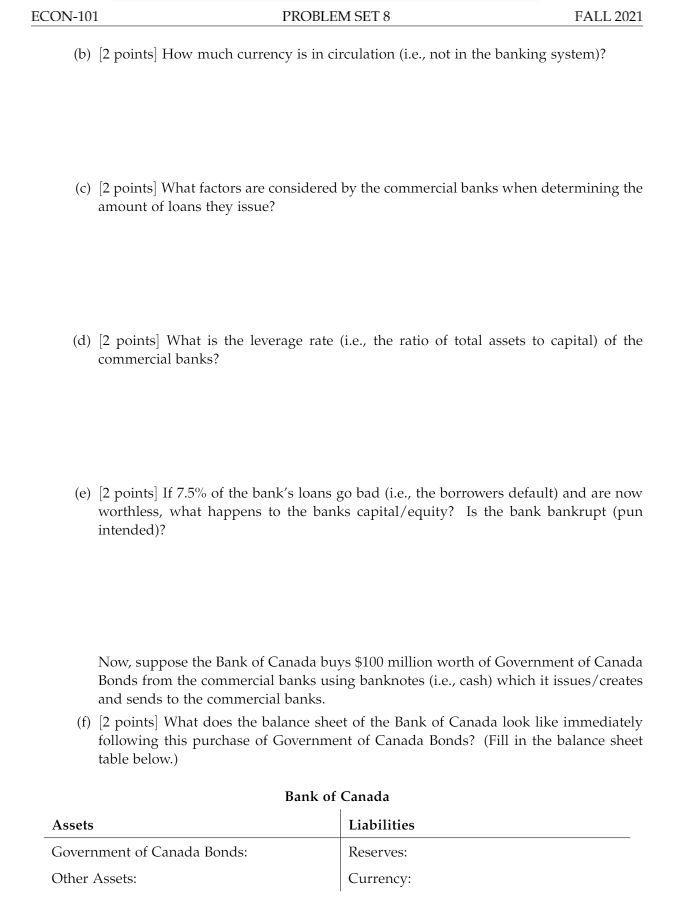

Suppose the banking system is in equilibrium (the commercial banks are maxi- mizing profits) with the following balance sheets (in millions of dollars): Assets Government of Canada Bonds: Other Assets: Bank of Canada Assets Loans & Securities: Government of Canada Bonds: Reserves: -with BoC: -cash in vault: Liabilities Reserves: 0 Currency: 1,250 Consolidated Commercial Banks Liabilities 13,800 Deposits: 500 700 500 200 Capital: (a) [2 points] What is the desired reserve ratio of the commercial (chartered) banks? 500 750 14,000 1000 ECON-101 PROBLEM SET 8 (b) [2 points] How much currency is in circulation (i.e., not in the banking system)? (c) [2 points] What factors are considered by the commercial banks when determining the amount of loans they issue? (d) [2 points] What is the leverage rate (i.e., the ratio of total assets to capital) of the commercial banks? FALL 2021 now (e) [2 points] If 7.5% of the bank's loans go bad (i.e., the borrowers default) and are no worthless, what happens to the banks capital/equity? Is the bank bankrupt (pun intended)? Now, suppose the Bank of Canada buys $100 million worth of Government of Canada Bonds from the commercial banks using banknotes (i.e., cash) which it issues/creates and sends to the commercial banks. Assets Government of Canada Bonds: (f) [2 points] What does the balance sheet of the Bank of Canada look like immediately following this purchase of Government of Canada Bonds? (Fill in the balance sheet table below.) Other Assets: Bank of Canada Liabilities Reserves: Currency:

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The desired reserve ratio of the commercial banks is 10 Total assets Total liabilitie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started