Answered step by step

Verified Expert Solution

Question

1 Approved Answer

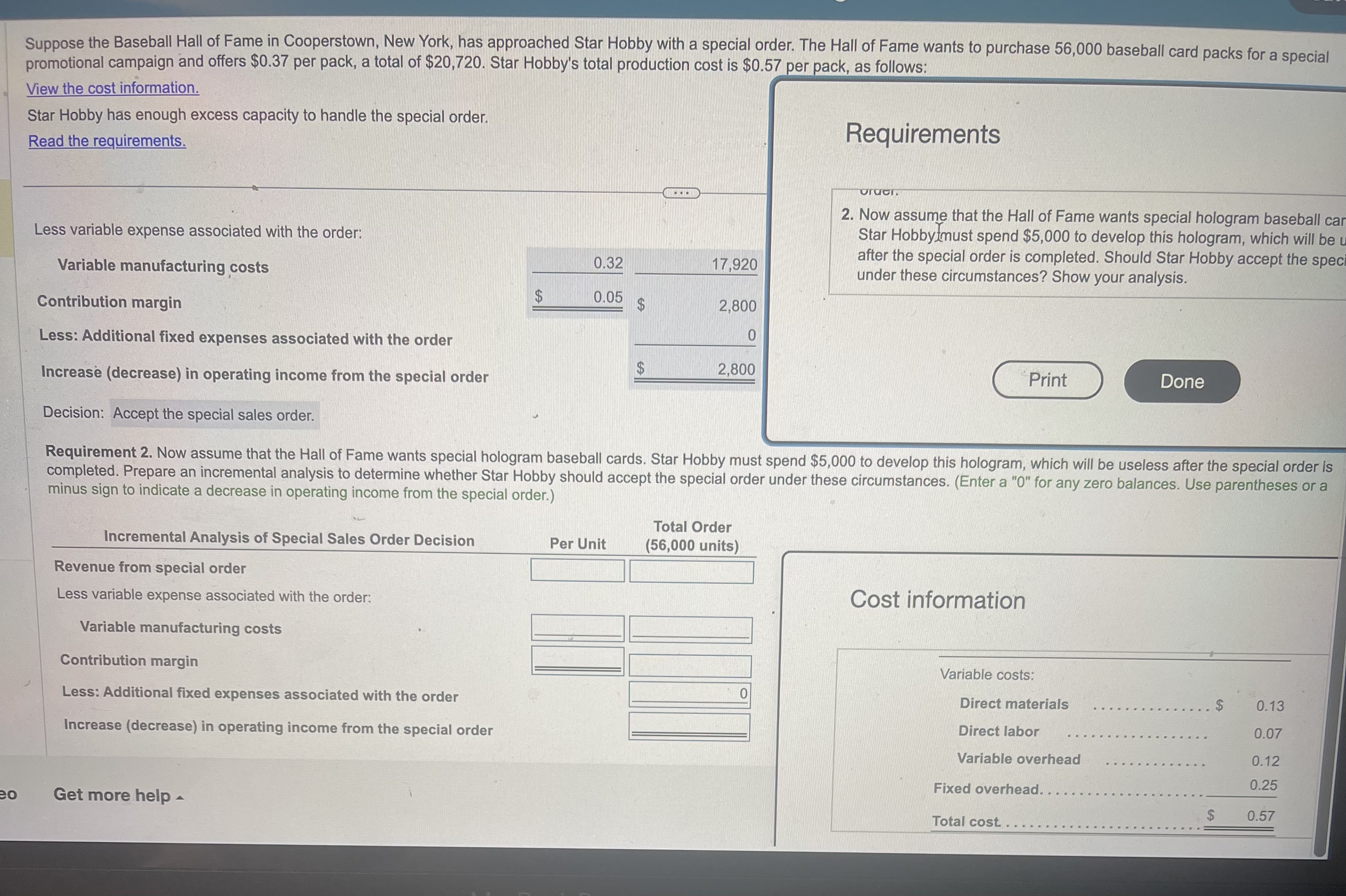

Suppose the Baseball Hall of Fame in Cooperstown, New York, has approached Star Hobby with a special order. The Hall of Fame wants to purchase

Suppose the Baseball Hall of Fame in Cooperstown, New York, has approached Star Hobby with a special order. The Hall of Fame wants to purchase baseball card packs for a special promotional campaign and offers $ per pack, a total of $ Star Hobby's total production cost is $ per pack, as follows:

View the cost information.

Star Hobby has enough excess capacity to handle the special order.

Read the requirements.

Requirements

Less variable expense associated with the order:

Variable manufacturing costs

table$$

Now assume that the Hall of Fame wants special hologram baseball car Star Hobbylmust spend $ to develop this hologram, which will be i after the special order is completed. Should Star Hobby accept the spec under these circumstances? Show your analysis.

Contribution margin

Less: Additional fixed expenses associated with the order

Increase decrease in operating income from the special order

Decision: Accept the special sales order.

Requirement Now assume that the Hall of Fame wants special hologram baseball cards. Star Hobby must spend $ to develop this hologram, which will be useless after the special order is completed. Prepare an incremental analysis to determine whether Star Hobby should accept the special order under these circumstances. Enter a for any zero balances. Use parentheses or a minus sign to indicate a decrease in operating income from the special order.

Incremental Analysis of Special Sales Order Decision

Revenue from special order

Less variable expense associated with the order:

Variable manufacturing costs

Contribution margin

Less: Additional fixed expenses associated with the order

Increase decrease in operating income from the special order

Get more help

Cost information

Variable costs:

Direct materials

Direct labor

Variable overhead

Fixed overhead.

Total cost

Per Unit units

tabletableVariable costs:Direct materials$Direct labor,,Variable overhead,,Fixed overhead. Total cost$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started