Question

2. Suppose the central bank sets the reserve requirement ratio at 5%. The maximum the central bank is willing to lend is 25% of

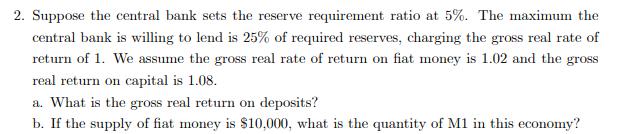

2. Suppose the central bank sets the reserve requirement ratio at 5%. The maximum the central bank is willing to lend is 25% of required reserves, charging the gross real rate of return of 1. We assume the gross real rate of return on fiat money is 1.02 and the gross real return on capital is 1.08. a. What is the gross real return on deposits? b. If the supply of fiat money is $10,000, what is the quantity of M1 in this economy?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Gross Real return on deposit will be 102 which ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modeling Monetary Economies

Authors: Bruce Champ, Scott Freeman, Joseph Haslag

4th Edition

1316508671, 1316508676, 9781316723302 , 978-1107145221

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App