Question

Suppose the firm has an opportunity to do a project which cost $100 M and has payoffs of $99 M next period if a Bad

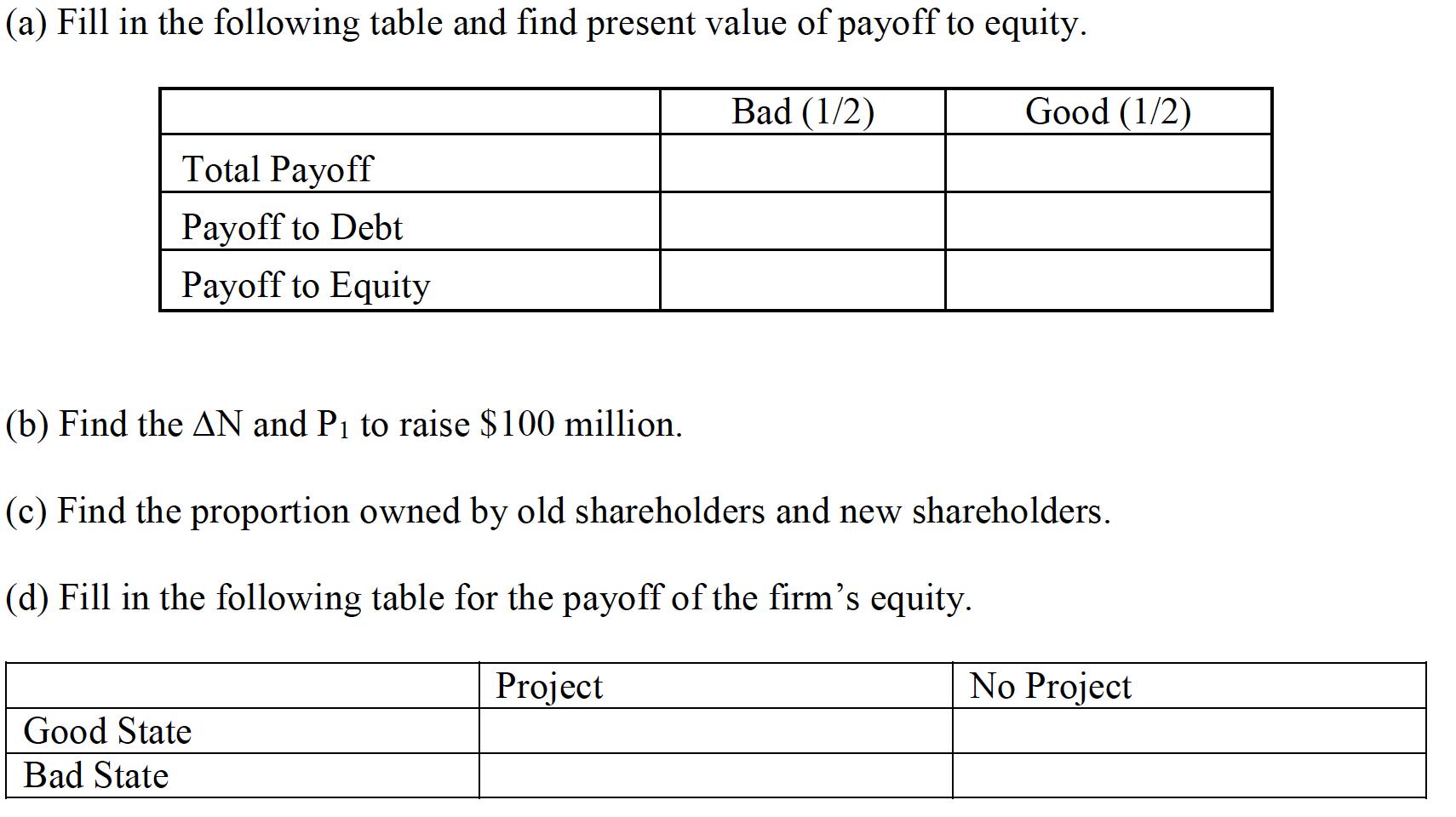

(a) Fill in the following table and find present value of payoff to equity. Bad (1/2) Good (1/2) Total Payoff Payoff to Debt Payoff to Equity (b) Find the AN and P to raise $100 million. (c) Find the proportion owned by old shareholders and new shareholders. (d) Fill in the following table for the payoff of the firm's equity. Project Good State Bad State No Project

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Bad 12 Good 12 Total Payoff 99 184 Payoff to Debt 0 0 Payoff to Equity 99 184 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Markets

Authors: Rober L. Macdonald

4th edition

321543084, 978-0321543080

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App