Answered step by step

Verified Expert Solution

Question

1 Approved Answer

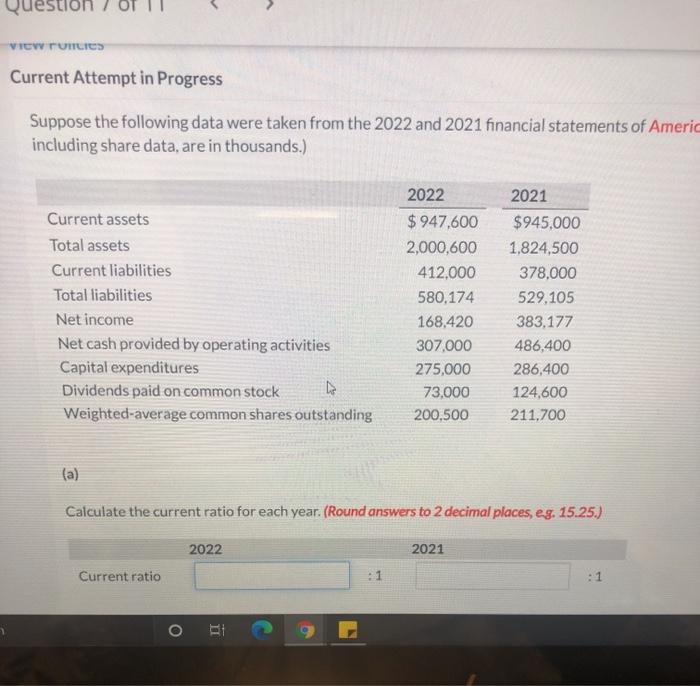

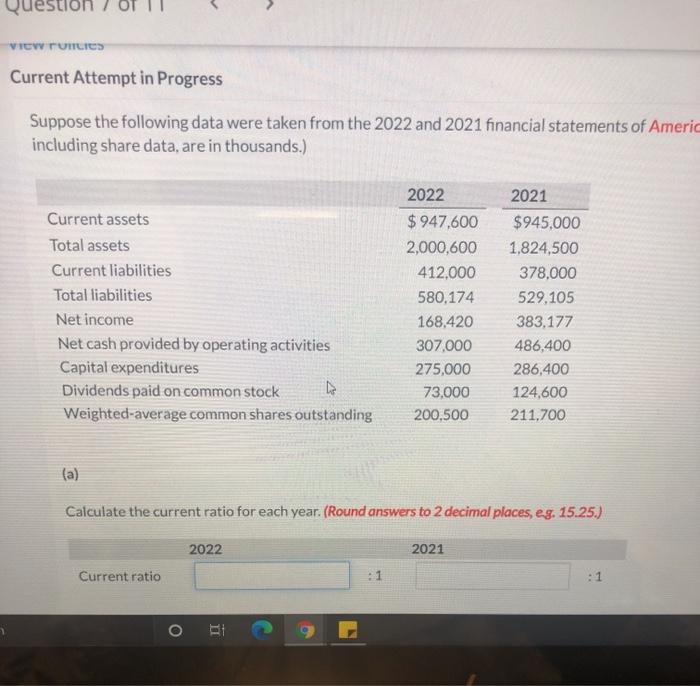

Suppose the following data were taken from the 2022 and 2021 financial statements of American Eagle Outfitters uestion / OT VIEW TOILIES Current Attempt in

Suppose the following data were taken from the 2022 and 2021 financial statements of American Eagle Outfitters

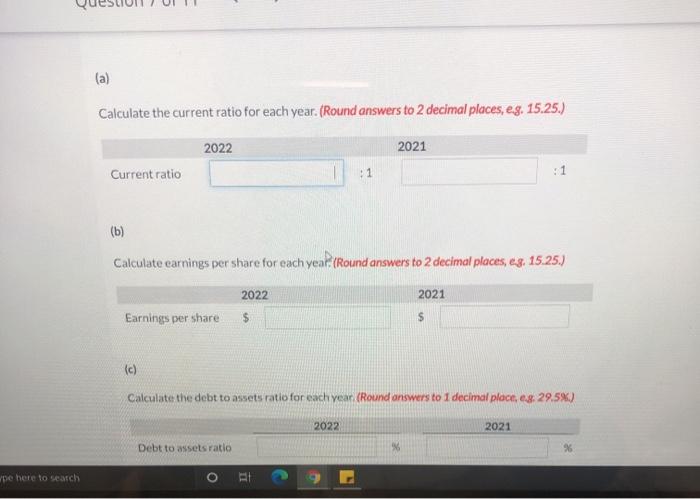

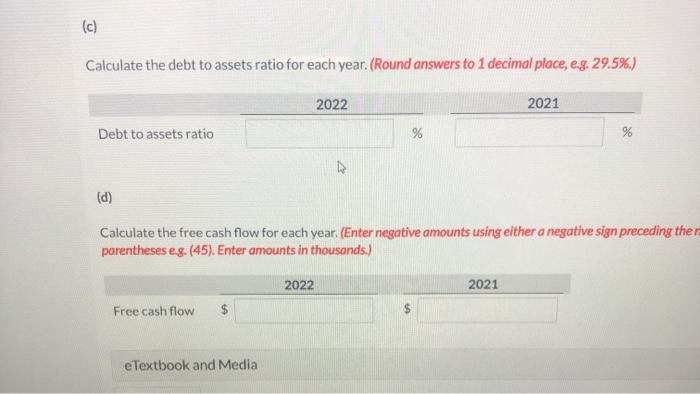

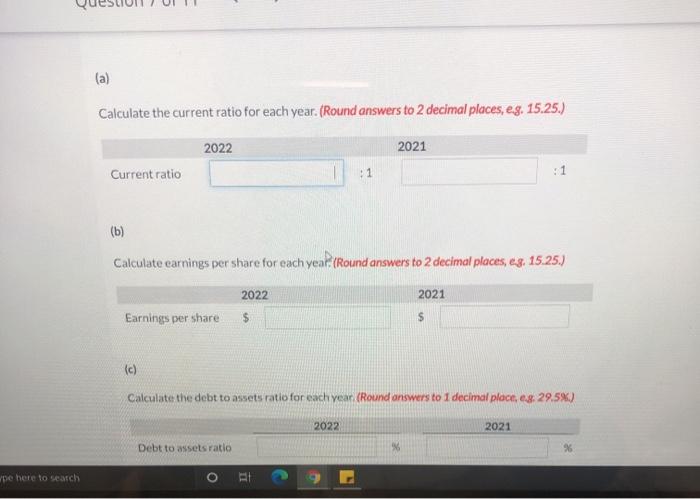

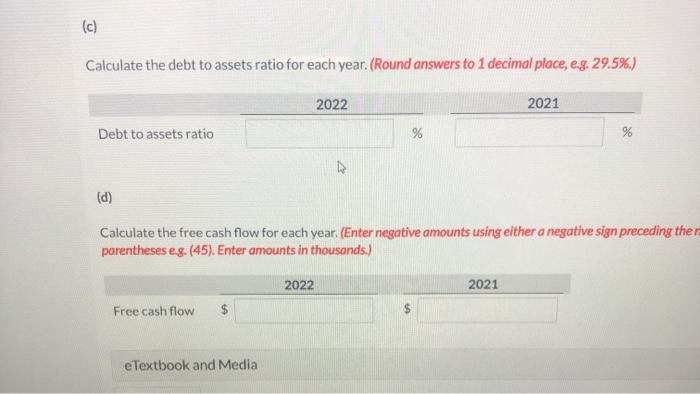

uestion / OT VIEW TOILIES Current Attempt in Progress Suppose the following data were taken from the 2022 and 2021 financial statements of Americ including share data are in thousands.) 2022 Current assets Total assets Current liabilities Total liabilities Net income Net cash provided by operating activities Capital expenditures Dividends paid on common stock De Weighted-average common shares outstanding $ 947,600 2,000,600 412,000 580.174 168,420 307,000 275,000 73.000 200.500 2021 $945,000 1,824,500 378.000 529,105 383,177 486,400 286,400 124,600 211.700 (a) Calculate the current ratio for each year. (Round answers to 2 decimal places, eg. 15.25.) 2022 2021 Current ratio : 1 :1 O BI (a) Calculate the current ratio for each year. (Round answers to 2 decimal places, eg, 15.25.) 2022 2021 Current ratio 11 (b) Calculate earnings per share for each year (Round answers to 2 decimal places, eg, 15.25.) 2022 2021 Earnings per share $ (c) Calculate the debt to assets ratio for each year (Round answers to 1 decimal place, 0.8. 29.5%) 2022 2021 Debt to assets ratio be here to search (c) Calculate the debt to assets ratio for each year. (Round answers to 1 decimal place, e.g. 29.5%) 2022 2021 Debt to assets ratio % % (d) Calculate the free cash flow for each year. (Enter negative amounts using either a negative sign preceding then parentheses eg. (45). Enter amounts in thousands.) 2022 2021 Free cash flow e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started