Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the following financial data for Allied company, who have a leading role in the relevant industry. The company has paid its dividends at

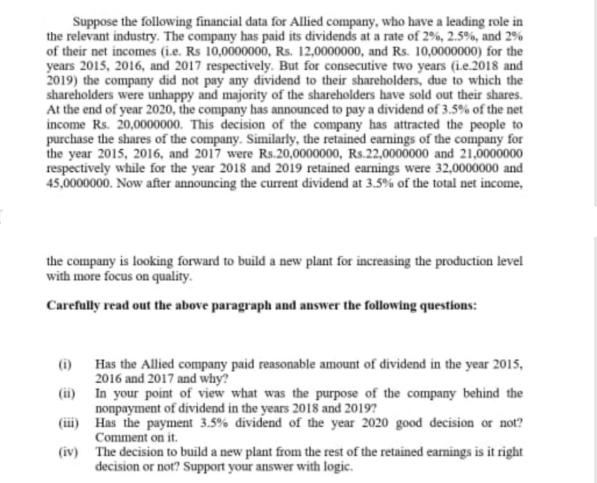

Suppose the following financial data for Allied company, who have a leading role in the relevant industry. The company has paid its dividends at a rate of 2%, 2.5%, and 2% of their net incomes (ie. Rs 10,0000000, Rs. 12,0000000, and Rs. 10,0000000) for the years 2015, 2016, and 2017 respectively. But for consecutive two years (L.e.2018 and 2019) the company did not pay any dividend to their shareholders, due to which the shareholders were unhappy and majority of the shareholders have sold out their shares. At the end of year 2020, the company has announced to pay a dividend of 3.5% of the net income Rs. 20,0000000. This decision of the company has attracted the people to purchase the shares of the company. Similarly, the retained earnings of the company for the year 2015, 2016, and 2017 were Rs.20,0000000, Rs.22,0000000 and 21,0000000 respectively while for the year 2018 and 2019 retained earnings were 32,0000000 and 45,0000000. Now after announcing the current dividend at 3.5% of the total net income, the company is looking forward to build a new plant for increasing the production level with more focus on quality. Carefully read out the above paragraph and answer the following questions: (1) (ii) (ii) (iv) Has the Allied company paid reasonable amount of dividend in the year 2015, 2016 and 2017 and why? In your point of view what was the purpose of the company behind the nonpayment of dividend in the years 2018 and 2019? Has the payment 3.5% dividend of the year 2020 good decision or not? Comment on it. The decision to build a new plant from the rest of the retained earnings is it right decision or not? Support your answer with logic.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Has the Allied company paid a reasonable amount of dividend in the years 2015 2016 and 2017 and why The payment of dividends is a decision made by the companys management based on various factors in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started