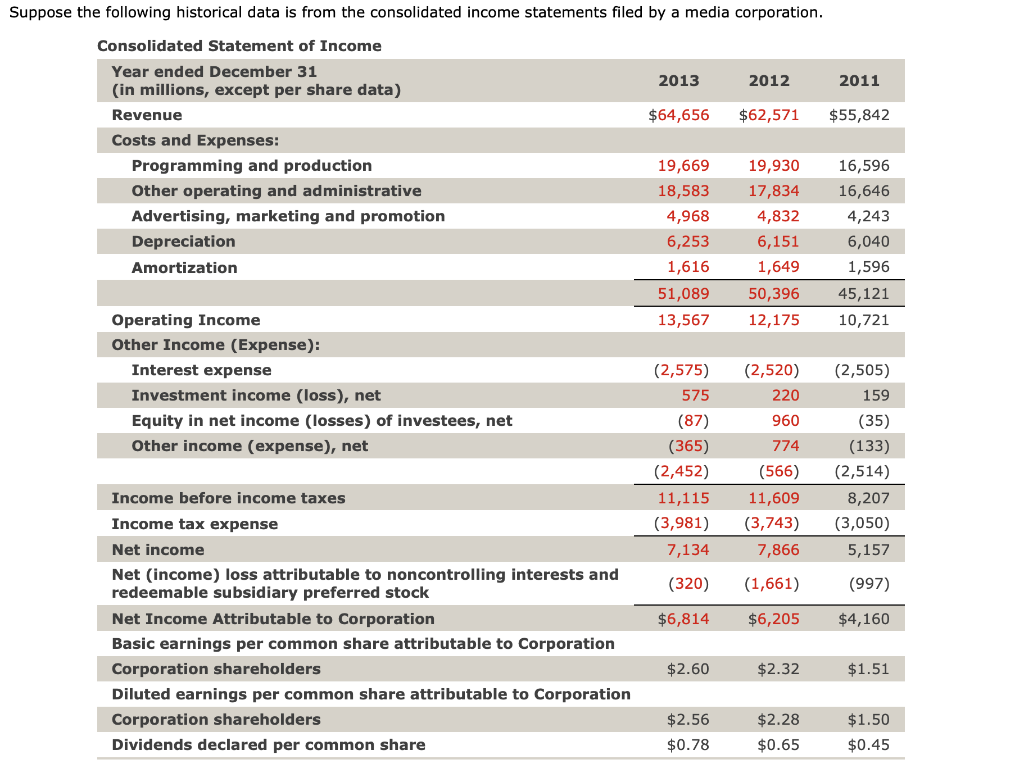

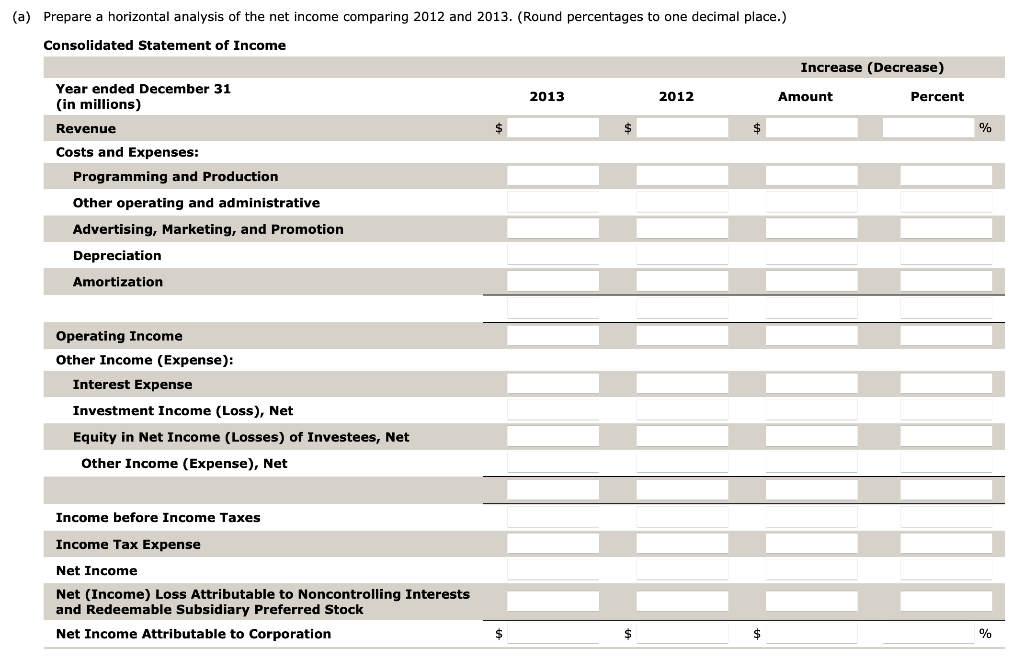

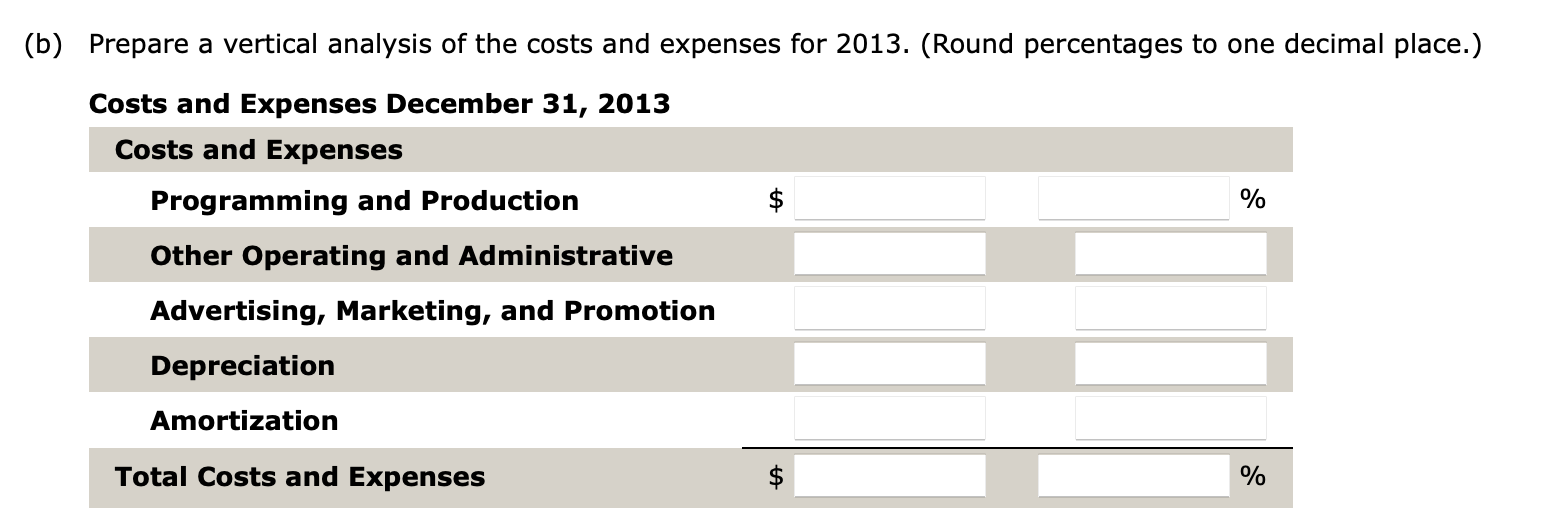

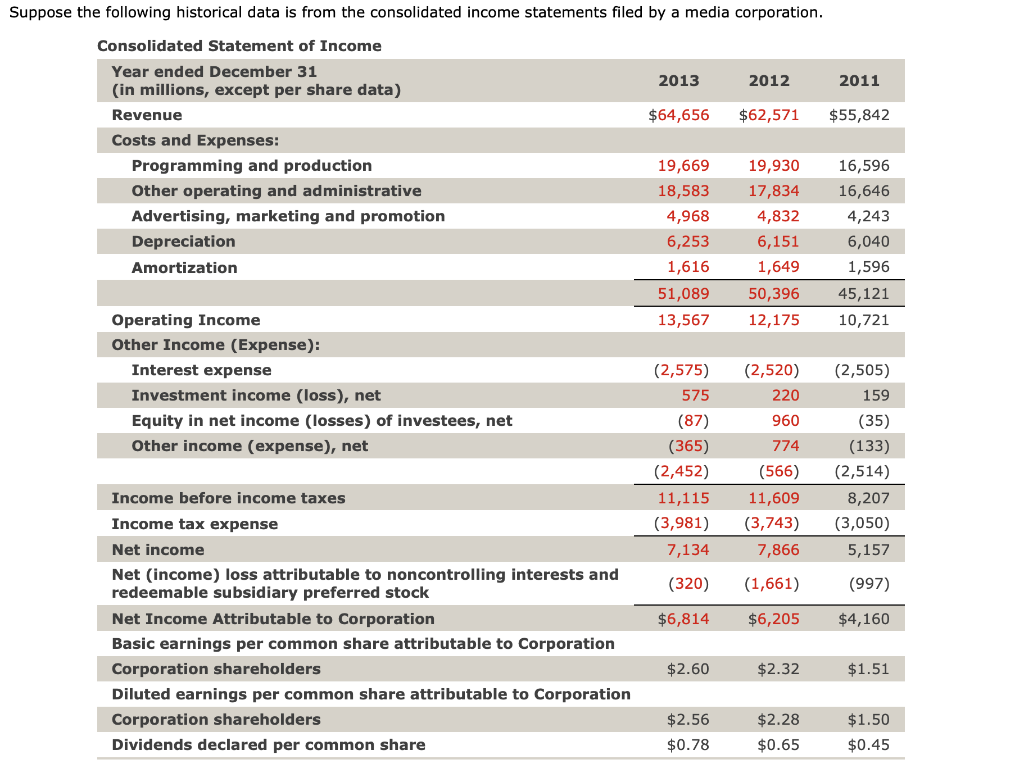

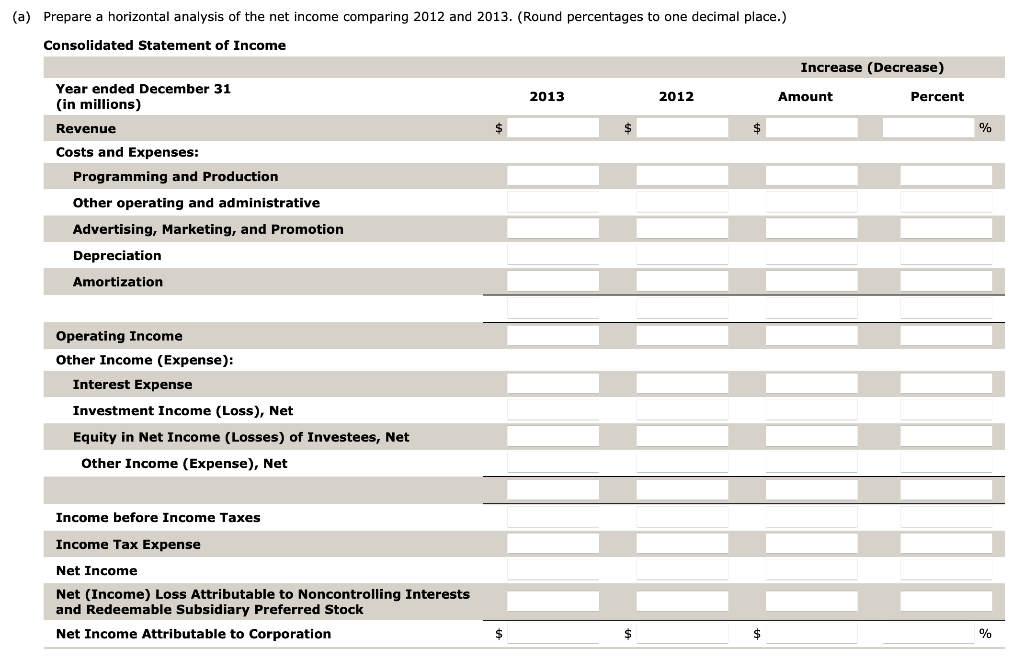

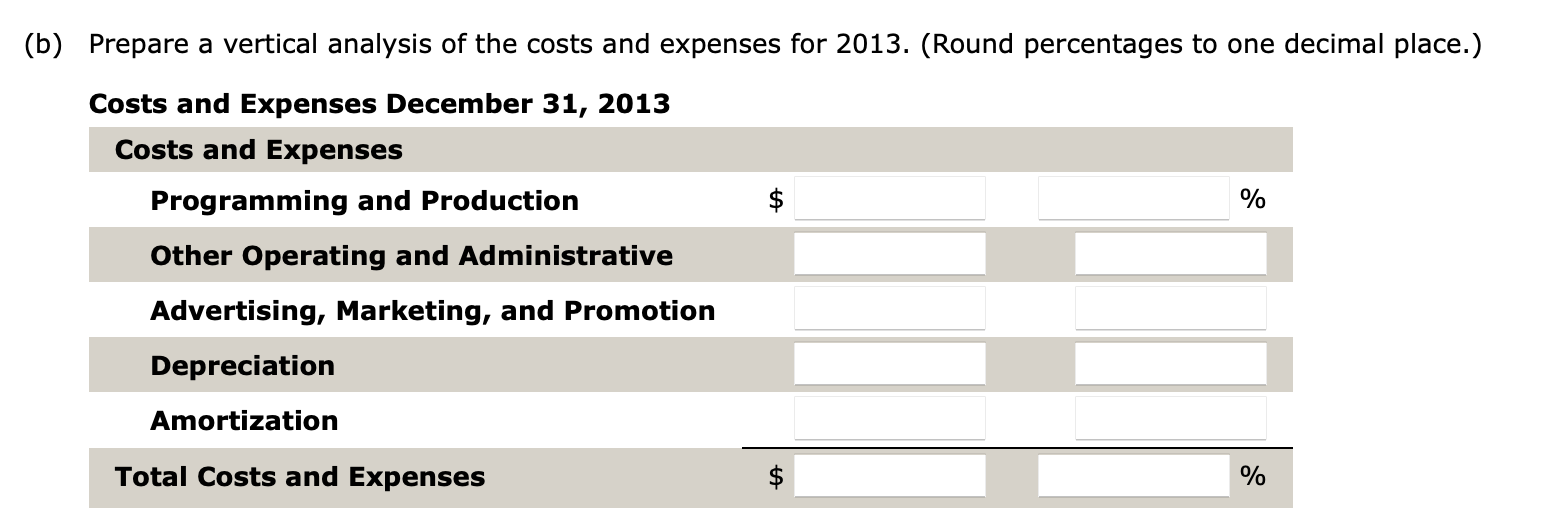

Suppose the following historical data is from the consolidated income statements filed by a media corporation. 2013 2012 2011 $64,656 $62,571 $55,842 Consolidated Statement of Income Year ended December 31 (in millions, except per share data) Revenue Costs and Expenses: Programming and production Other operating and administrative Advertising, marketing and promotion Depreciation Amortization 16,596 16,646 4,243 19,669 18,583 4,968 6,253 1,616 51,089 13,567 19,930 17,834 4,832 6,151 1,649 50,396 12,175 6,040 1,596 45,121 10,721 Operating Income Other Income (Expense): Interest expense Investment income (loss), net Equity in net income (losses) of investees, net Other income (expense), net (2,520) 220 960 (2,575) 575 (87) (365) (2,452) 11,115 (3,981) 7,134 774 (566) 11,609 (3,743) 7,866 (2,505) 159 (35) (133) (2,514) 8,207 (3,050) 5,157 (320) (1,661) (997) Income before income taxes Income tax expense Net income Net (income) loss attributable to noncontrolling interests and redeemable subsidiary preferred stock Net Income Attributable to Corporation Basic earnings per common share attributable to Corporation Corporation shareholders Diluted earnings per common share attributable to Corporation Corporation shareholders Dividends declared per common share $6,814 $6,205 $4,160 $2.60 $2.32 $1.51 $1.50 $2.56 $0.78 $2.28 $0.65 $0.45 (a) Prepare a horizontal analysis of the net income comparing 2012 and 2013. (Round percentages to one decimal place.) Consolidated Statement of Income Increase (Decrease) 2013 2012 Amount Percent $ $ % Year ended December 31 (in millions) Revenue Costs and Expenses: Programming and Production Other operating and administrative Advertising, Marketing, and Promotion Depreciation Amortization Operating Income Other Income (Expense): Interest Expense Investment Income (Loss), Net Equity in Net Income (Losses) of Investees, Net Other Income (Expense), Net DINOO Income before Income Taxes Income Tax Expense Net Income Net (Income) Loss Attributable to Noncontrolling Interests and Redeemable Subsidiary Preferred Stock Net Income Attributable to Corporation $ $ $ % (b) Prepare a vertical analysis of the costs and expenses for 2013. (Round percentages to one decimal place.) % Costs and Expenses December 31, 2013 Costs and Expenses Programming and Production Other Operating and Administrative Advertising, Marketing, and Promotion Depreciation Amortization Total Costs and Expenses A %