Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) In this problem, you'll draw some time series graphs in an example that is more or less the opposite of the one done

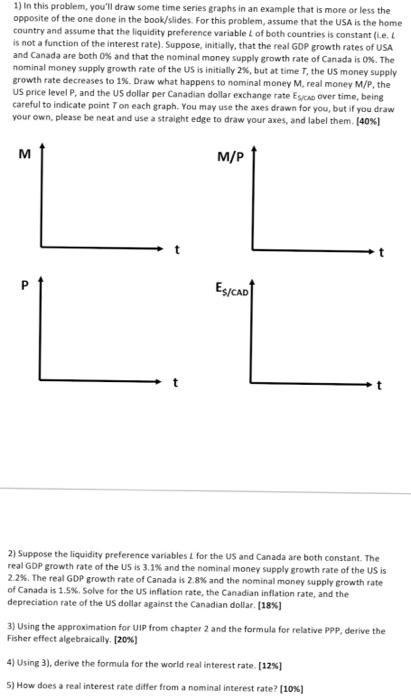

1) In this problem, you'll draw some time series graphs in an example that is more or less the opposite of the one done in the book/slides. For this problem, assume that the USA is the home country and assume that the liquidity preference variable L of both countries is constant (1.e. L is not a function of the interest rate). Suppose, initially, that the real GDP growth rates of USA and Canada are both 0% and that the nominal money supply growth rate of Canada is 0%. The nominal money supply growth rate of the US is initially 25%, but at time T, the US money supply growth rate decreases to 1%. Draw what happens to nominal money M, real money M/P, the US price level P, and the US dollar per Canadian dollar exchange rate Es/CAD over time, being careful to indicate point T on each graph. You may use the axes drawn for you, but if you draw your own, please be neat and use a straight edge to draw your axes, and label them. [40% ] M/P M P ES/CAD t 2) Suppose the liquidity preference variables L for the US and Canada are both constant. The real GDP growth rate of the US is 3.1% and the nominal money supply growth rate of the US is 2.2%. The real GDP growth rate of Canada is 2.8% and the nominal money supply growth rate of Canada is 1.5%. Solve for the US inflation rate, the Canadian inflation rate, and the depreciation rate of the US dollar against the Canadian dollar. [18%) 3) Using the approximation for UIP from chapter 2 and the formula for relative PPP, derive the Fisher effect algebraically. [20% ] 4) Using 3), derive the formula for the world real interest rate. [12%] 5) How does a real interest rate differ from a nominal interest rate? [10% ]

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

M Initially the nominal money supply growth rate of the US is 2 so the nominal money supply M increases at a steady rate At time T the growth rate decreases to 1 so the slope of the graph becomes less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started