Question

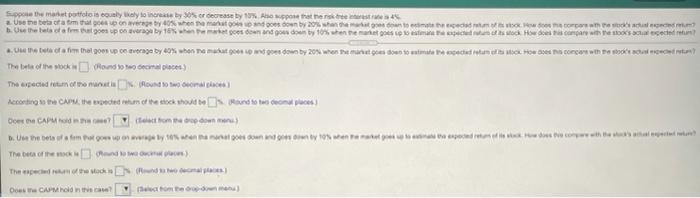

Suppose the market portfolio is equally likely to increase by 30% or decrease by 10%. Also suppose that the risk-free interest rate is 4%. a.

Suppose the market portfolio is equally likely to increase by 30% or decrease by 10%. Also suppose that the risk-free interest rate is 4%.

a. Use the beta of a firm that goes up on average by 40% when the market goes up and goes down by 20% when the market goes down to estimate the expected return of its stock. How does this compare with the stock's actual expected return?

b. Use the beta of a firm that goes up on average by 16% when the market goes down and goes down by 10% when the market goes up to estimate the expected return of its stock. How does this compare with the stock's actual expected return?

Spon the mattoo is only way to increase by or decrease by the opere rather 2. Use the beata matowy 40% when a maraton on by owner to the 1. Use the first goes up onverage by the goes on and good by 10% where goes to estimated compare the screen eta farmhal on page by cox who me by 203 when it goes to desconto The bota of the stock Mondo del place) The expected return to the con According the CAP: the pece um che stockholde rendo com puces De CAPM? om Uw bet la fon or go w by Wedning om te wees va prendre cet out where The bea of the count) Thered socks Does CroidStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started