Question

Suppose the owners of a rm and nanciers are risk-neutral, and that interest rates are zero. Suppose also that the owners are optimistic, while nanciers

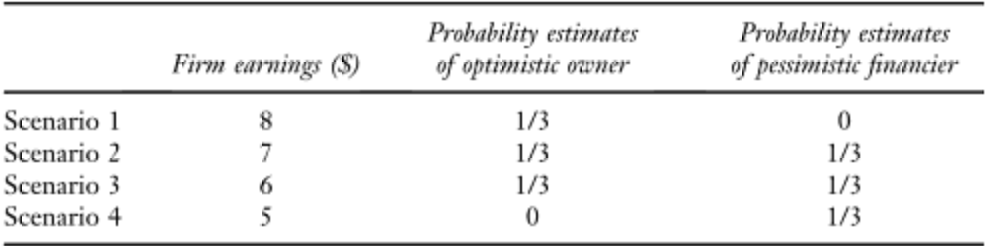

Suppose the owners of a rm and nanciers are risk-neutral, and that interest rates are zero. Suppose also that the owners are optimistic, while nanciers are pessimistic, and their views about the earnings distributions are shown in the following table. Suppose the rm needs to raise $5 .5.

a. What is the value of equity from the point view of owners?

a. What is the value of equity from the point view of owners?

b. What is the value of equity from the point view of nanciers?

c. If the rm raises the needed $5 .5 through equity, what proportion of the shares would the nanciers demand? How much are those shares worth from the point view of owners?

d. Alternatively, suppose nanciers propose a debt issue that promises to pay off $5.75 if the rm has the funds, or whatever funds are available if the rm does not generate cash ows at least equal to $5 .75. How much would the nanciers value the debt?

e. How much would the owners value the debt?

f. Combining all the above results, which form of nancing would the owners prefer to raise the needed $5.5, equity or debt? Why?

Firm earnings ($) Probability estimates of optimistic owner Probability estimates of pessimistic financier 1/3 Scenario 1 Scenario 2 Scenario 3 Scenario 4 8 7 6 1/3 1/3 0 1/3 1/3 1/3 0 Firm earnings ($) Probability estimates of optimistic owner Probability estimates of pessimistic financier 1/3 Scenario 1 Scenario 2 Scenario 3 Scenario 4 8 7 6 1/3 1/3 0 1/3 1/3 1/3 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started