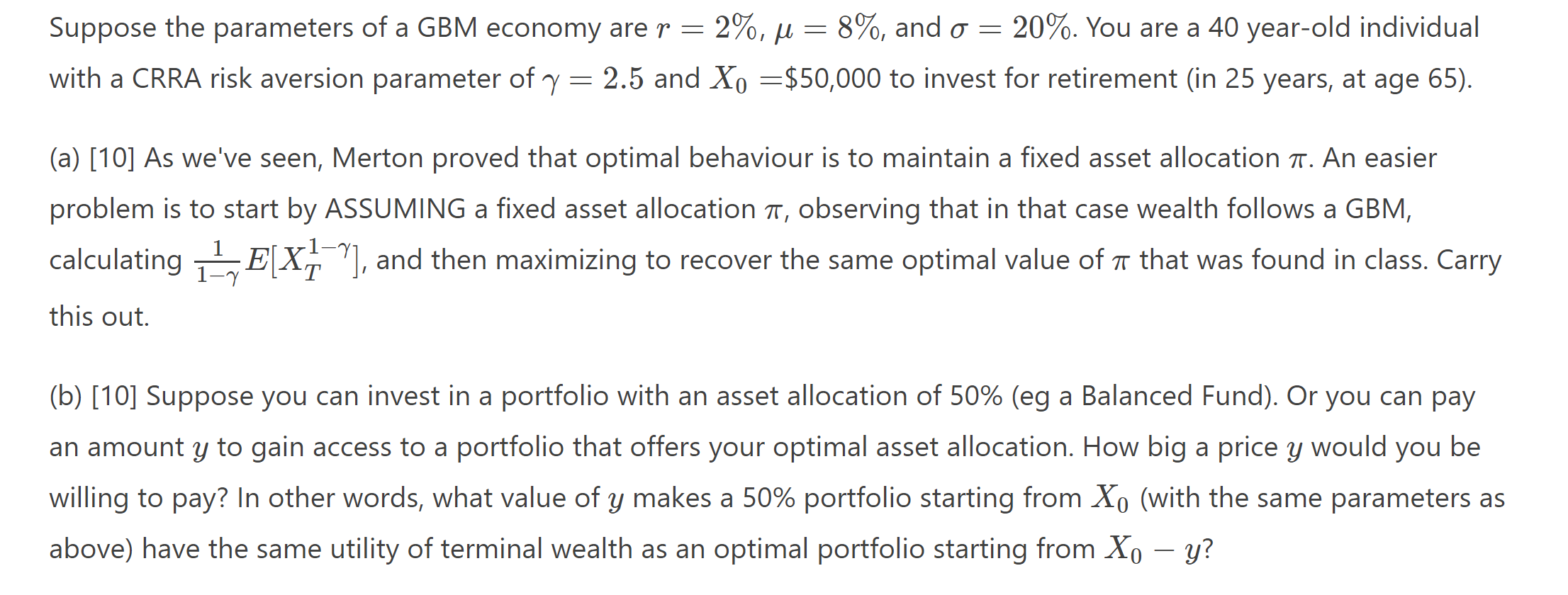

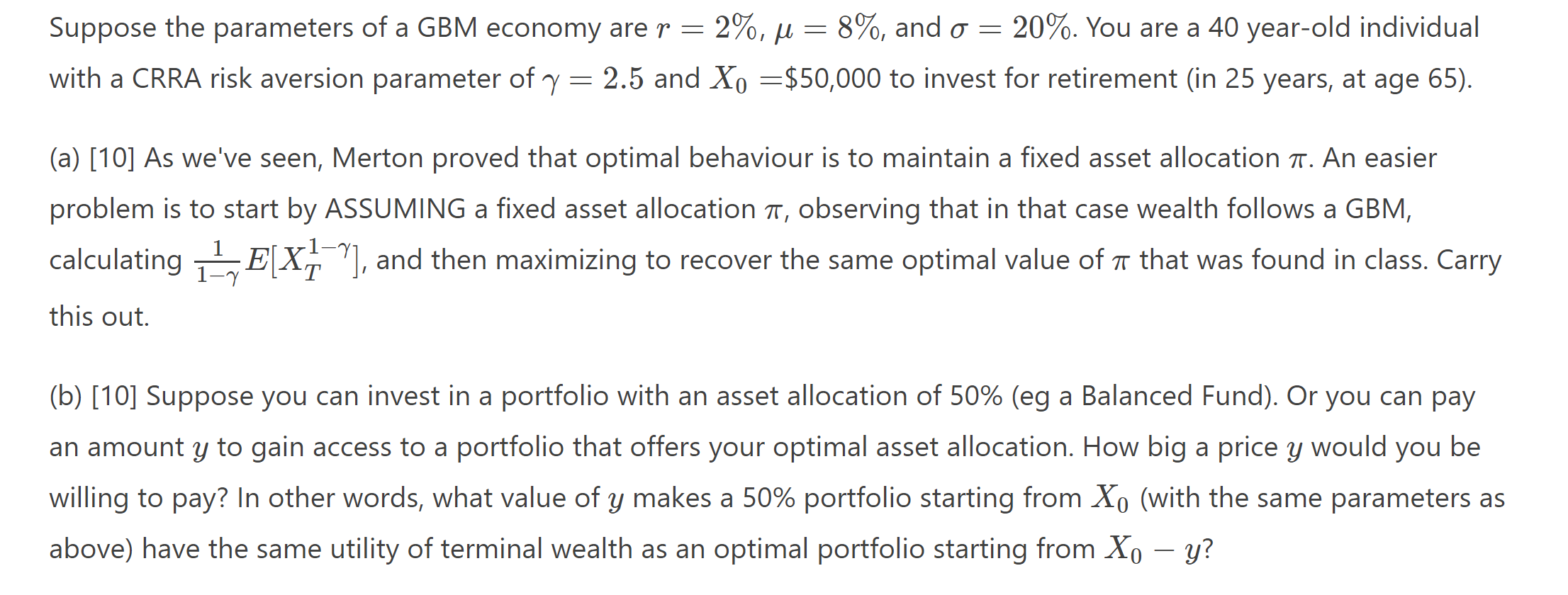

= - = Suppose the parameters of a GBM economy are r = 2%, u = 8%, and o = 20%. You are a 40 year-old individual with a CRRA risk aversion parameter of 7 = 2.5 and Xo =$50,000 to invest for retirement (in 25 years, at age 65). - (a) [10] As we've seen, Merton proved that optimal behaviour is to maintain a fixed asset allocation 1. An easier problem is to start by ASSUMING a fixed asset allocation 7, observing that in that case wealth follows a GBM, calculating 15, E[x]_^), and then maximizing to recover the same optimal value of a that was found in class. Carry X 1-7 this out. (b) [10] Suppose you can invest in a portfolio with an asset allocation of 50% (eg a Balanced Fund). Or you can pay an amount y to gain access to a portfolio that offers your optimal asset allocation. How big a price y would you be willing to pay? In other words, what value of y makes a 50% portfolio starting from Xo (with the same parameters as above) have the same utility of terminal wealth as an optimal portfolio starting from Xo y? = - = Suppose the parameters of a GBM economy are r = 2%, u = 8%, and o = 20%. You are a 40 year-old individual with a CRRA risk aversion parameter of 7 = 2.5 and Xo =$50,000 to invest for retirement (in 25 years, at age 65). - (a) [10] As we've seen, Merton proved that optimal behaviour is to maintain a fixed asset allocation 1. An easier problem is to start by ASSUMING a fixed asset allocation 7, observing that in that case wealth follows a GBM, calculating 15, E[x]_^), and then maximizing to recover the same optimal value of a that was found in class. Carry X 1-7 this out. (b) [10] Suppose you can invest in a portfolio with an asset allocation of 50% (eg a Balanced Fund). Or you can pay an amount y to gain access to a portfolio that offers your optimal asset allocation. How big a price y would you be willing to pay? In other words, what value of y makes a 50% portfolio starting from Xo (with the same parameters as above) have the same utility of terminal wealth as an optimal portfolio starting from Xo y