Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the principal, the shareholders, is risk neutral, caring only about the expected amount of money he or she receives, and the agent (the

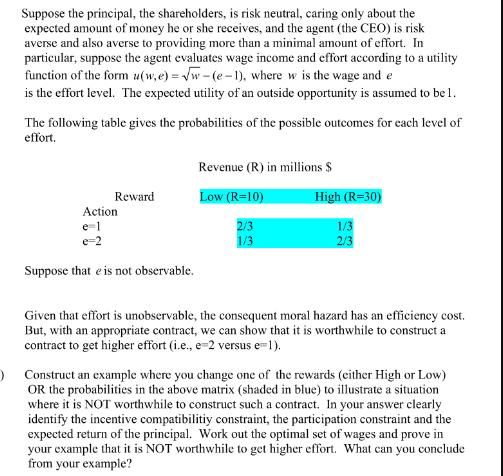

Suppose the principal, the shareholders, is risk neutral, caring only about the expected amount of money he or she receives, and the agent (the CEO) is risk averse and also averse to providing more than a minimal amount of effort. In particular, suppose the agent evaluates wage income and effort according to a utility function of the form u(w, e)=w-(e-1), where w is the wage and e is the effort level. The expected utility of an outside opportunity is assumed to be 1. The following table gives the probabilities of the possible outcomes for each level of effort. Reward Action e=1 e=2 Suppose that is not observable. Revenue (R) in millions $ Low (R=10) 2/3 1/3 High (R=30) 1/3 2/3 Given that effort is unobservable, the consequent moral hazard has an efficiency cost. But, with an appropriate contract, we can show that it is worthwhile to construct a contract to get higher effort (i.e., e-2 versus e=1). ) Construct an example where you change one of the rewards (either High or Low) OR the probabilities in the above matrix (shaded in blue) to illustrate a situation where it is NOT worthwhile to construct such a contract. In your answer clearly identify the incentive compatibilitiy constraint, the participation constraint and the expected return of the principal. Work out the optimal set of wages and prove in your example that it is NOT worthwhile to get higher effort. What can you conclude from your example?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To illustrate a situation where it is not worthwhile to construct a contract that incentivizes higher effort lets modify the table by changing the pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started