Answered step by step

Verified Expert Solution

Question

1 Approved Answer

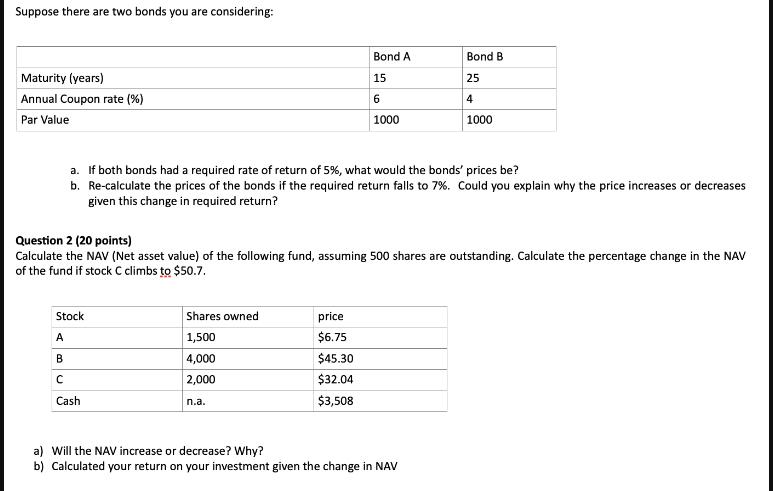

Suppose there are two bonds you are considering: Maturity (years) Annual Coupon rate (%) Par Value a. If both bonds had a required rate

Suppose there are two bonds you are considering: Maturity (years) Annual Coupon rate (%) Par Value a. If both bonds had a required rate of return of 5%, what would the bonds' prices be? b. Re-calculate the prices of the bonds if the required return falls to 7%. Could you explain why the price increases or decreases given this change in required return? Stock A B Cash Question 2 (20 points) Calculate the NAV (Net asset value) of the following fund, assuming 500 shares are outstanding. Calculate the percentage change in the NAV of the fund if stock C climbs to $50.7. Shares owned 1,500 4,000 2,000 Bond A 15 6 1000 n.a. price $6.75 $45.30 $32.04 $3,508 Bond B 25 4 1000 a) Will the NAV increase or decrease? Why? b) Calculated your return on your investment given the change in NAV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculating the prices of Bond A and Bond B at a required rate of return of 5 Bond A Maturity 15 years Annual Coupon rate 6 Par Value 1000 To calculate the price of Bond A we need to discount the fu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started