Answered step by step

Verified Expert Solution

Question

1 Approved Answer

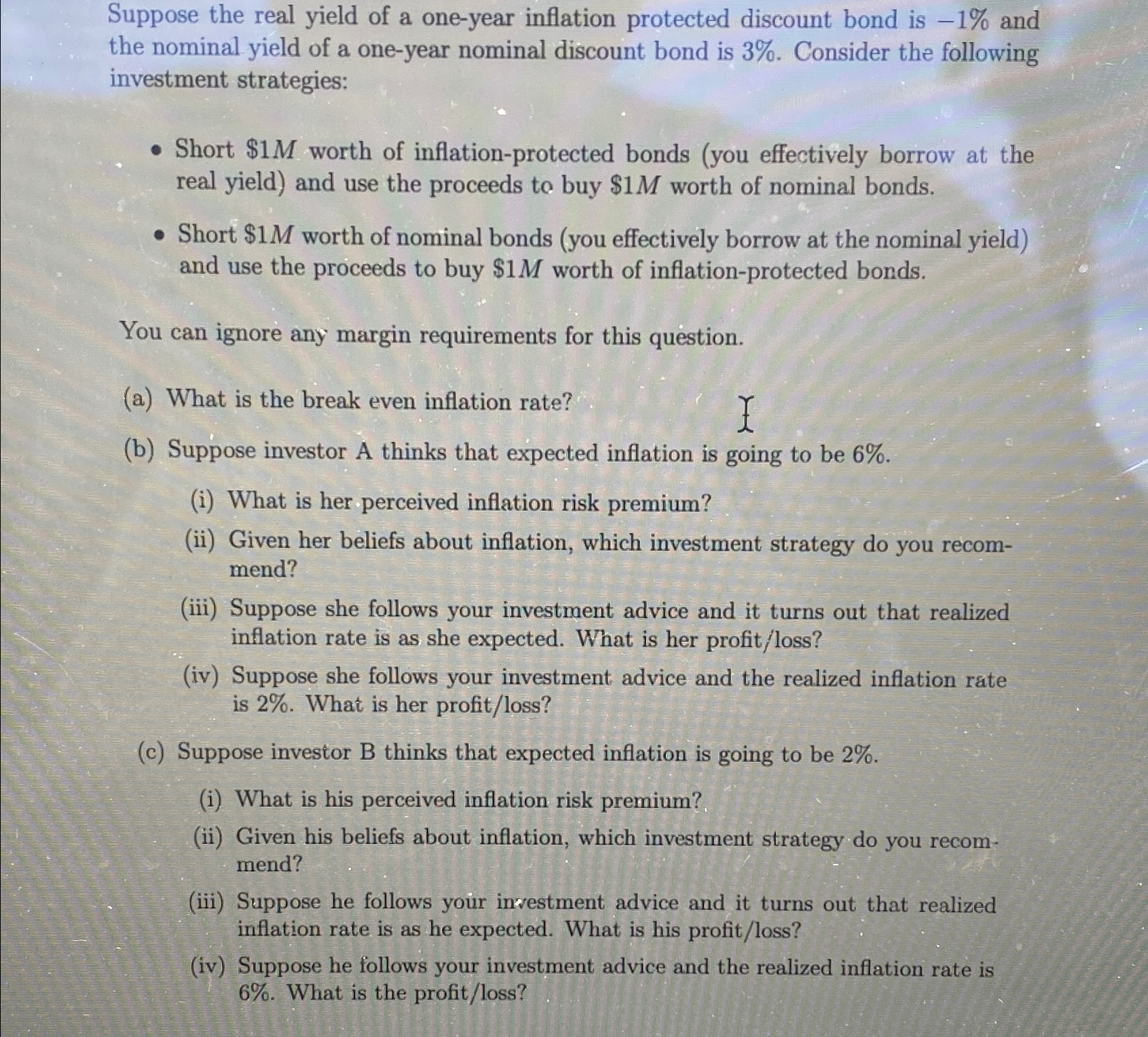

Suppose the real yield of a one - year inflation protected discount bond is - 1 % and the nominal yield of a one -

Suppose the real yield of a oneyear inflation protected discount bond is and the nominal yield of a oneyear nominal discount bond is Consider the following investment strategies:

Short $ worth of inflationprotected bonds you effectively borrow at the real yield and use the proceeds to buy $ worth of nominal bonds.

Short $ worth of nominal bonds you effectively borrow at the nominal yield and use the proceeds to buy $ worth of inflationprotected bonds.

You can ignore any margin requirements for this question.

a What is the break even inflation rate?

b Suppose investor A thinks that expected inflation is going to be

i What is her perceived inflation risk premium?

ii Given her beliefs about inflation, which investment strategy do you recommend?

iii Suppose she follows your investment advice and it turns out that realized inflation rate is as she expected. What is her profitloss

iv Suppose she follows your investment advice and the realized inflation rate is What is her profitloss

c Suppose investor B thinks that expected inflation is going to be

i What is his perceived inflation risk premium?

ii Given his beliefs about inflation, which investment strategy do you recommend?

iii Suppose he follows your investment advice and it turns out that realized inflation rate is as he expected. What is his profitloss

iv Suppose he follows your investment advice and the realized inflation rate is What is the profitloss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started