Answered step by step

Verified Expert Solution

Question

1 Approved Answer

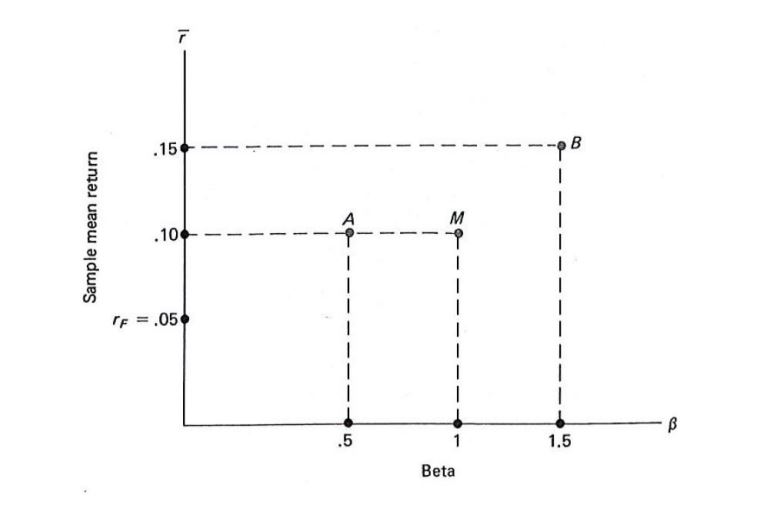

Suppose the returns and corresponding beta values for two assets (A and B) and the market (M) are as indicated in the accompanying figure as

Suppose the returns and corresponding beta values for two assets (A and B) and the market (M) are as indicated in the accompanying figure as per below:

(i) Compute the Treynor Index for A and B. Interpret the results.

(ii) Compute the Jensen index for A and B. Interpret the results.

(iii) Suppose one manager had selected a portfolio represented by A and another manager had selected a portfolio represented by B. Would you feel confident in evaluating the managers relative performance with the Treynor or Jensen results? Explain.

Sample mean return .15 .10 TF = .05 A I .5 M 1 Beta 1 1.5 B Sample mean return .15 .10 TF = .05 A I .5 M 1 Beta 1 1.5 BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started