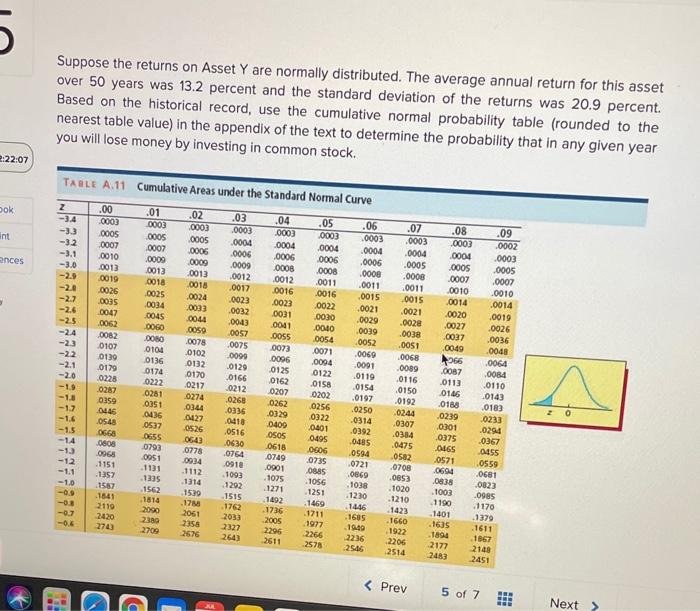

Suppose the returns on Asset Y are normally distributed. The average annual return for this asset over 50 years was 13.2 percent and the standard deviation of the returns was 20.9 percent. Based on the historical record, use the cumulative normal probability table (rounded to the nearest table value) in the appendix of the text to determine the probability that in any given year you will lose money by investing in common stock. 2:22:07 z ent 9000 ances 6000 .0013 0008 0026 0035 0023 0059 0041 0055 TABLE A.11 Cumulative Areas under the Standard Normal Curve .00 .01 .02 .03 ,04 .05 .06 -3.4 0003 0003 0003 0003 .0003 0003 -3.3 0005 .0003 0005 0005 .0004 .0004 0004 .0004 -32 0007 0007 0006 0006 .0006 .0006 -3.1 0010 .0000 0009 0008 -3.0 .0013 .0000 0013 .0012 .0012 .0011 .0011 -2.9 .0019 0018 0018 .0017 0016 0016 .0015 -24 0025 0024 .0023 0022 0021 -2.7 0034 0033 .0032 .0031 0030 -2.6 0047 .0029 0045 0044 0043 .0040 -25 0062 0060 .0039 .0057 .0054 -24 0082 .0052 0078 .0075 0073 .0071 -23 0107 .0069 0102 0099 0096 -22 0139 0094 .0091 0132 0129 -2.1 0179 .0119 0174 0170 0166 0162 -20 0228 0158 .0154 0222 0212 0212 0207 0202 -19 0287 0281 .0197 0274 0268 0262 -1.8 0359 0256 0351 0250 0344 -1.7 0329 .0314 0427 -1.6 0548 0409 0526 .0392 0516 0505 -1.5 0668 0655 0485 0643 0630 0618 0608 O606 0793 .0594 0778 .0764 -1.3 0068 0749 0735 0051 0934 0721 -12 .1151 .1131 0885 1112 0869 1093 1025 .1357 1056 1305 1314 .1038 1292 1271 -1.0 1587 1251 1562 1530 1230 1515 1492 .1469 1841 .17 1446 1762 -03 1736 2119 2000 1211 2061 .1685 -0.7 2005 2420 2389 1977 1940 2327 -0.6 2743 2296 2709 2266 2676 2236 264) 2578 2546 0900 TOLO 9E10 .07 .0003 .0004 .0005 .0008 .0011 .0015 .0021 .0028 .0038 0051 .0068 0089 0116 0150 .0192 0244 0307 0384 0475 0582 0708 0853 1020 0125 0122 .08 .0003 .0004 .0005 .0007 0010 0014 .0020 0027 0037 .0049 366 0087 0113 0105 0188 .0239 0301 0375 0465 0571 .0604 0838 1003 1190 1401 .1635 1894 2177 2483 .09 .0002 .0003 .0005 .0007 0010 .0014 .0019 .0026 .0036 .0048 0064 0084 0110 0143 .0183 0233 .0294 .0367 0455 0559 0681 0823 0985 1170 1379 .1611 1867 2148 2451 0446 0336 0410 0436 0537 20 1000 SOTO -14 0918 0901 1614 .1210 2033 2356 1423 .1660 1922 2206 2514