Answered step by step

Verified Expert Solution

Question

1 Approved Answer

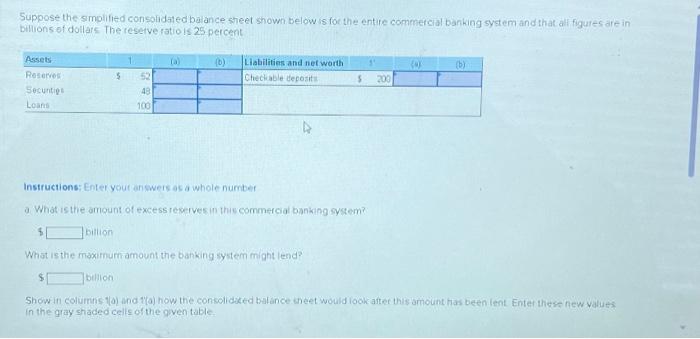

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The

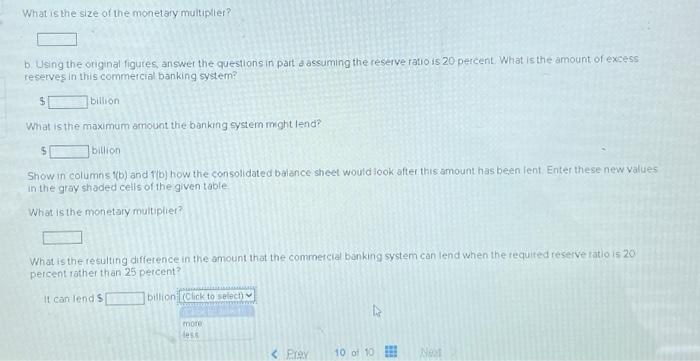

Suppose the simplified consolidated balance sheet shown below is for the entire commercial banking system and that all figures are in billions of dollars. The reserve ratio is 25 percent. Assets Reserves Securities Loans $ billion $ 1 billion 52 48 100 (a) (b) Liabilities and net worth Checkable deposits Instructions: Enter your answers as a whole number a. What is the amount of excess reserves in this commercial banking system? 4 $ 11 200 (a) (b) What is the maximum amount the banking system might lend? $ Show in columns 1(a) and 1'(a) how the consolidated balance sheet would look after this amount has been lent. Enter these new values in the gray shaded cells of the given table.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started