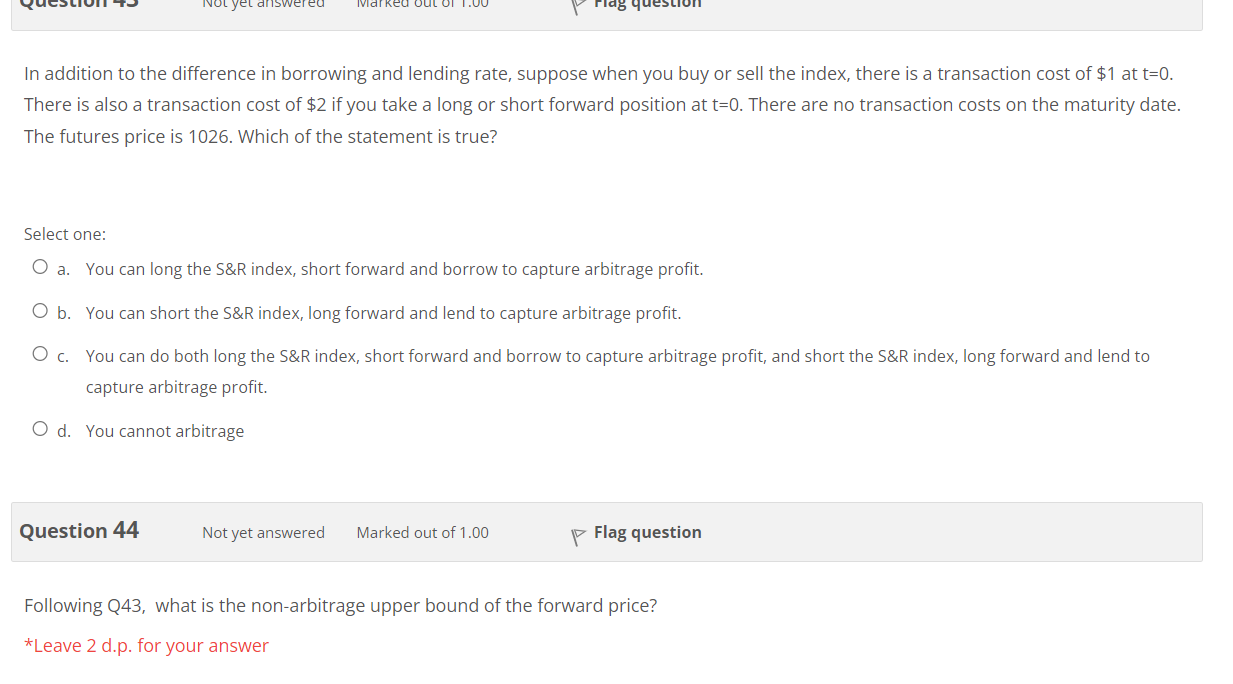

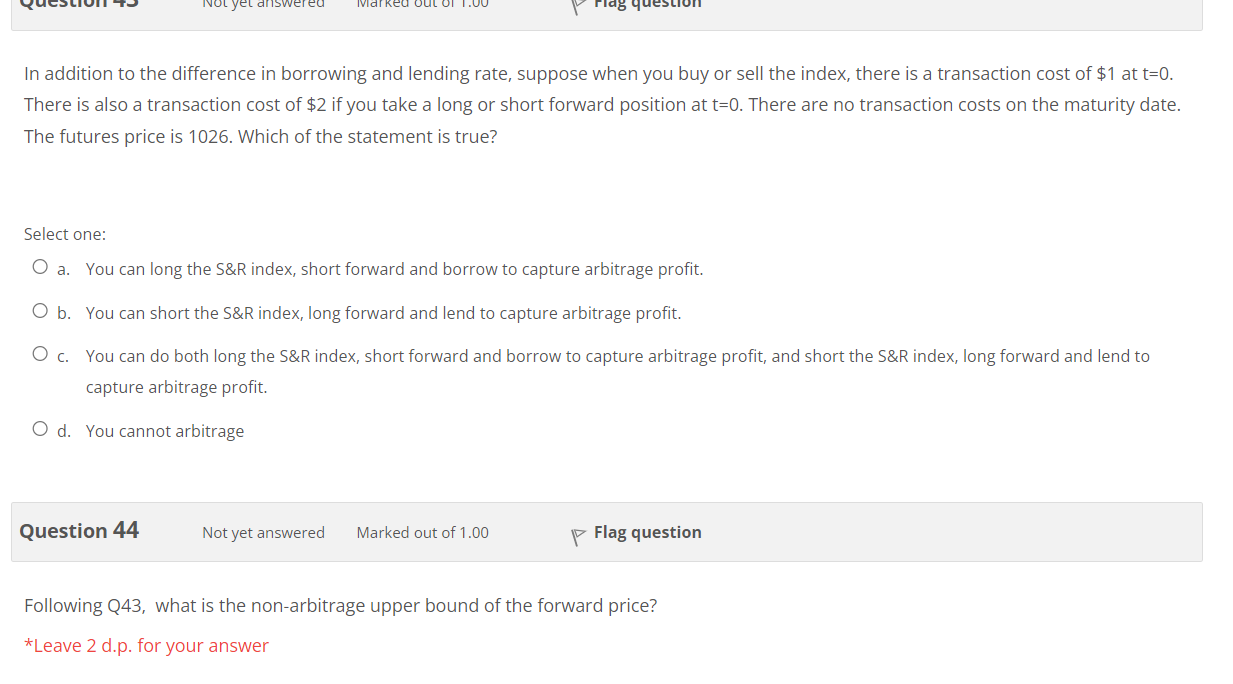

Suppose the S&R index is 1000 and the dividend yield is zero. The continuously compounded borrowing rate is 5% p.a. while the continuously compounded lending rate is 4.5% p.a.. The maturity of the forward contract is 6 months. - yet In addition to the difference in borrowing and lending rate, suppose when you buy or sell the index, there is a transaction cost of $1 at t=0. There is also a transaction cost of $2 if you take a long or short forward position at t=0. There are no transaction costs on the maturity date. The futures price is 1026. Which of the statement is true? Select one: O a. You can long the S&R index, short forward and borrow to capture arbitrage profit. Ob. You can short the S&R index, long forward and lend to capture arbitrage profit. O c. You can do both long the S&R index, short forward and borrow to capture arbitrage profit, and short the S&R index, long forward and lend to capture arbitrage profit. O d. You cannot arbitrage Question 44 Not yet answered Marked out of 1.00 P Flag question Following Q43, what is the non-arbitrage upper bound of the forward price? *Leave 2 d.p. for your answer Suppose the S&R index is 1000 and the dividend yield is zero. The continuously compounded borrowing rate is 5% p.a. while the continuously compounded lending rate is 4.5% p.a.. The maturity of the forward contract is 6 months. - yet In addition to the difference in borrowing and lending rate, suppose when you buy or sell the index, there is a transaction cost of $1 at t=0. There is also a transaction cost of $2 if you take a long or short forward position at t=0. There are no transaction costs on the maturity date. The futures price is 1026. Which of the statement is true? Select one: O a. You can long the S&R index, short forward and borrow to capture arbitrage profit. Ob. You can short the S&R index, long forward and lend to capture arbitrage profit. O c. You can do both long the S&R index, short forward and borrow to capture arbitrage profit, and short the S&R index, long forward and lend to capture arbitrage profit. O d. You cannot arbitrage Question 44 Not yet answered Marked out of 1.00 P Flag question Following Q43, what is the non-arbitrage upper bound of the forward price? *Leave 2 d.p. for your