Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose the value of the firm's assets depends on the interest rate x as follows: A ( x ) = ( - 1 0 x

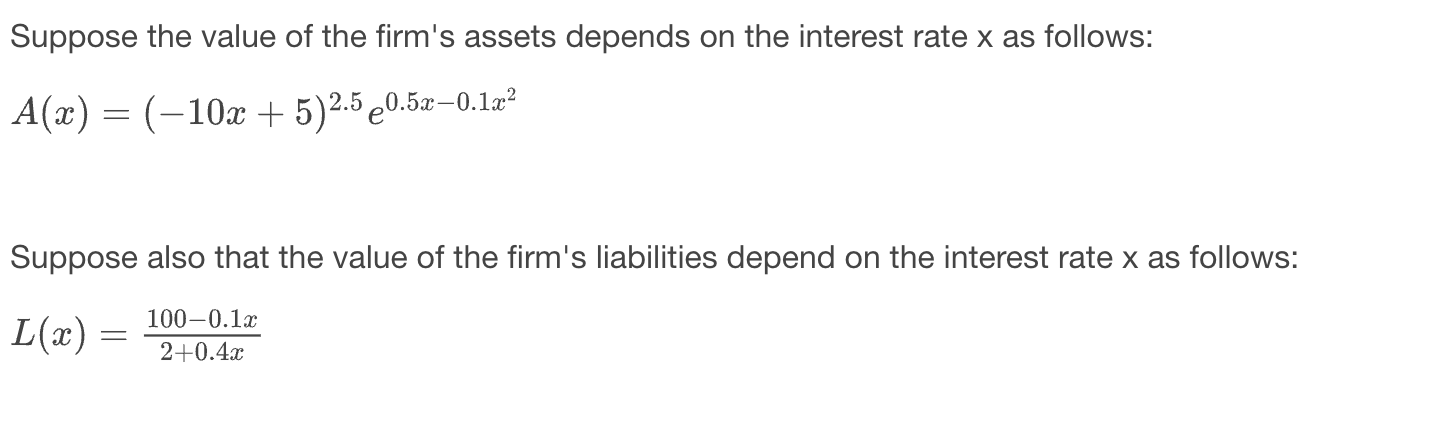

Suppose the value of the firm's assets depends on the interest rate as follows:

Suppose also that the value of the firm's liabilities depend on the interest rate as follows:

You manage the portfolio of assets and liabilities of a boutique insurance company. The assets consist entirely of bonds, and therefore the value of the firm' assets depends on the shortterm interest rate, x At the same time, the value of the firm's liabilities also depends on the shortterm interest rate, x Your job is to measure how the value of the assets and the value of the liabilities change when the interest rate x changes.

Suppose the value of the firm's assets depends on the interest rate x as follows:

Suppose also that the value of the firm's liabilities depend on the interest rate x as follows:

Finally, suppose that interest rates are currently at x

Question : By how much would the value of the assets, A change if interest rates were to increase from to Please show your work. Please use marginal analysis to answer this question.

Answer:

Choose one of the following answers:

A

B

C

D

E

Question : By how much would the value of the firm's liabilities, L change if interest rates were to increase from to Please show your work. Please use marginal analysis to answer this question.

Answer:

Choose one of the following answers:

A

B

C

D

E

Question : The value of the equity in the firm can be viewed as the difference between the value of the assets, A and the value of the liabilities, L If the value of equity falls below the firm is officially bankrupt. How much of an interest rates change from the current level of x is enough to put your firm into bankruptcy? Please show your work.

Answer:

Choose one of the following answers:

A

B

C

D

E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started