Question

Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $ 3 comma 000 on which it pays interest

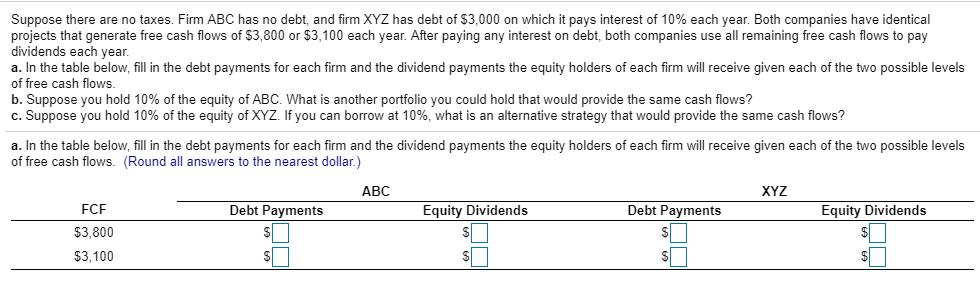

Suppose there are no taxes. Firm ABC has no debt, and firm XYZ has debt of $ 3 comma 000 on which it pays interest of 10 % each year. Both companies have identical projects that generate free cash flows of $ 3 comma 800 or $ 3 comma 100 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year. a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows. b. Suppose you hold 10 % of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows? c. Suppose you hold 10 % of the equity of XYZ. If you can borrow at 10 % , what is an alternative strategy that would provide the same cash flows? a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows. (Round all answers to the nearest dollar.)

Suppose there are no taxes. Firm ABC has no debt and firm XYZ has debt of $3,000 on which it pays interest of 10% each year. Both companies have identical projects that generate free cash flows of $3,800 or $3,100 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows? C. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows? a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows. (Round all answers to the nearest dollar.) ABC XYZ FCF $3,800 $3,100 Debt Payments Equity Dividends Debt Payments Equity Dividends Suppose there are no taxes. Firm ABC has no debt and firm XYZ has debt of $3,000 on which it pays interest of 10% each year. Both companies have identical projects that generate free cash flows of $3,800 or $3,100 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividends each year a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows b. Suppose you hold 10% of the equity of ABC. What is another portfolio you could hold that would provide the same cash flows? C. Suppose you hold 10% of the equity of XYZ. If you can borrow at 10%, what is an alternative strategy that would provide the same cash flows? a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows. (Round all answers to the nearest dollar.) ABC XYZ FCF $3,800 $3,100 Debt Payments Equity Dividends Debt Payments Equity DividendsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started