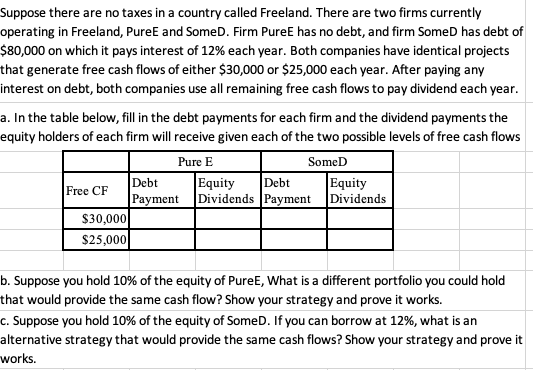

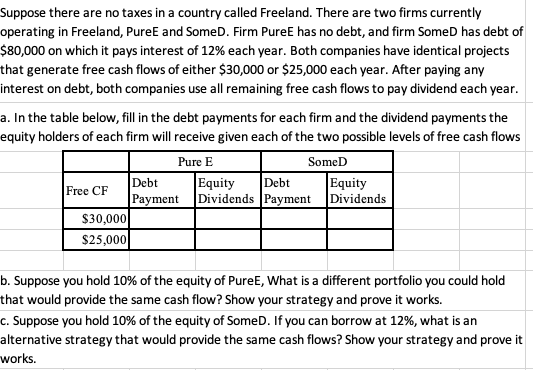

Suppose there are no taxes in a country called Freeland. There are two firms currently operating in Freeland, PureE and SomeD. Firm Pure has no debt, and firm SomeD has debt of $80,000 on which it pays interest of 12% each year. Both companies have identical projects that generate free cash flows of either $30,000 or $25,000 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividend each year. a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows Pure E SomeD Debt Equity Equity Payment Dividends Payment Dividends $30,000 $25,000 Debt Free CF b. Suppose you hold 10% of the equity of PureE, What is a different portfolio you could hold that would provide the same cash flow? Show your strategy and prove it works. c. Suppose you hold 10% of the equity of SomeD. If you can borrow at 12%, what is an alternative strategy that would provide the same cash flows? Show your strategy and prove it works. Suppose there are no taxes in a country called Freeland. There are two firms currently operating in Freeland, PureE and SomeD. Firm Pure has no debt, and firm SomeD has debt of $80,000 on which it pays interest of 12% each year. Both companies have identical projects that generate free cash flows of either $30,000 or $25,000 each year. After paying any interest on debt, both companies use all remaining free cash flows to pay dividend each year. a. In the table below, fill in the debt payments for each firm and the dividend payments the equity holders of each firm will receive given each of the two possible levels of free cash flows Pure E SomeD Debt Equity Equity Payment Dividends Payment Dividends $30,000 $25,000 Debt Free CF b. Suppose you hold 10% of the equity of PureE, What is a different portfolio you could hold that would provide the same cash flow? Show your strategy and prove it works. c. Suppose you hold 10% of the equity of SomeD. If you can borrow at 12%, what is an alternative strategy that would provide the same cash flows? Show your strategy and prove it works