Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same anrum. funds to start a project.

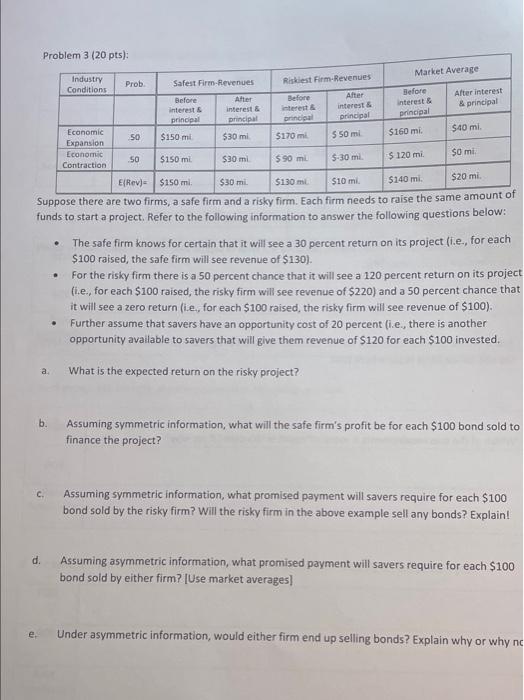

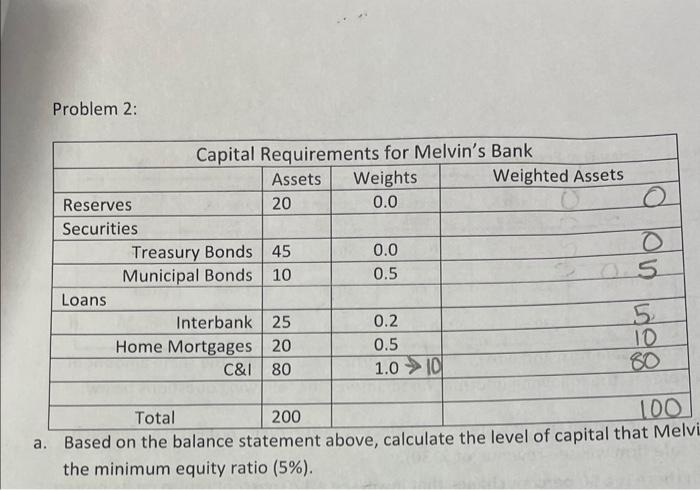

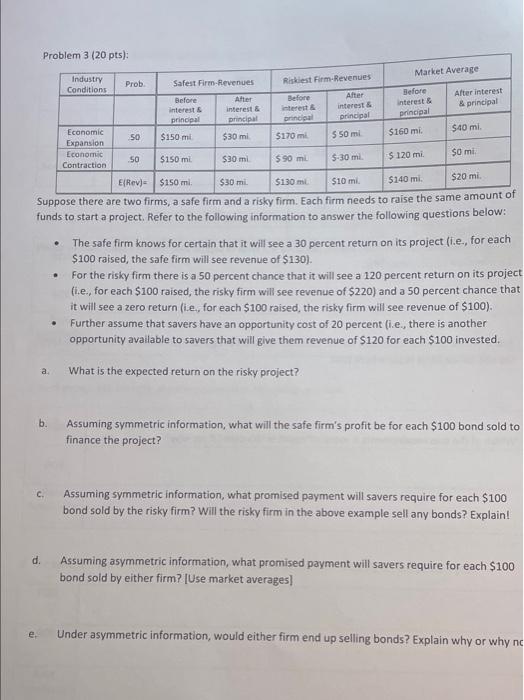

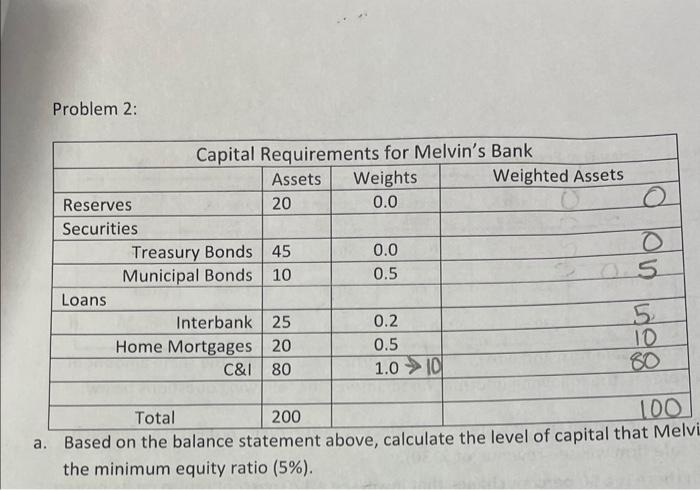

Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same anrum. funds to start a project. Refer to the following information to answer the following questions below: - The safe firm knows for certain that it will see a 30 percent return on its project (i.e., for each $100 raised, the safe firm will see revenue of \$130). - For the risky firm there is a 50 percent chance that it will see a 120 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $220 ) and a 50 percent chance that it will see a zero return (i.e, for each $100 raised, the risky firm will see revenue of $100 ). - Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. a. What is the expected return on the risky project? b. Assuming symmetric information, what will the safe firm's profit be for each $100 bond sold to finance the project? c. Assuming symmetric information, what promised payment will savers require for each $100 bond sold by the risky firm? Will the risky firm in the above example sell any bonds? Explain! d. Assuming asymmetric information, what promised payment will savers require for each $100 bond sold by either firm? [Use market averages] e. Under asymmetric information, would either firm end up selling bonds? Explain why or why no Problem 2: a. Based on the balance statement above, calculate the Ievel or capital ulawiviu. the minimum equity ratio (5%). Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same anrum. funds to start a project. Refer to the following information to answer the following questions below: - The safe firm knows for certain that it will see a 30 percent return on its project (i.e., for each $100 raised, the safe firm will see revenue of \$130). - For the risky firm there is a 50 percent chance that it will see a 120 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $220 ) and a 50 percent chance that it will see a zero return (i.e, for each $100 raised, the risky firm will see revenue of $100 ). - Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. a. What is the expected return on the risky project? b. Assuming symmetric information, what will the safe firm's profit be for each $100 bond sold to finance the project? c. Assuming symmetric information, what promised payment will savers require for each $100 bond sold by the risky firm? Will the risky firm in the above example sell any bonds? Explain! d. Assuming asymmetric information, what promised payment will savers require for each $100 bond sold by either firm? [Use market averages] e. Under asymmetric information, would either firm end up selling bonds? Explain why or why no Problem 2: a. Based on the balance statement above, calculate the Ievel or capital ulawiviu. the minimum equity ratio (5%)

Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same anrum. funds to start a project. Refer to the following information to answer the following questions below: - The safe firm knows for certain that it will see a 30 percent return on its project (i.e., for each $100 raised, the safe firm will see revenue of \$130). - For the risky firm there is a 50 percent chance that it will see a 120 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $220 ) and a 50 percent chance that it will see a zero return (i.e, for each $100 raised, the risky firm will see revenue of $100 ). - Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. a. What is the expected return on the risky project? b. Assuming symmetric information, what will the safe firm's profit be for each $100 bond sold to finance the project? c. Assuming symmetric information, what promised payment will savers require for each $100 bond sold by the risky firm? Will the risky firm in the above example sell any bonds? Explain! d. Assuming asymmetric information, what promised payment will savers require for each $100 bond sold by either firm? [Use market averages] e. Under asymmetric information, would either firm end up selling bonds? Explain why or why no Problem 2: a. Based on the balance statement above, calculate the Ievel or capital ulawiviu. the minimum equity ratio (5%). Suppose there are two firms, a safe firm and a risky firm. Each firm needs to raise the same anrum. funds to start a project. Refer to the following information to answer the following questions below: - The safe firm knows for certain that it will see a 30 percent return on its project (i.e., for each $100 raised, the safe firm will see revenue of \$130). - For the risky firm there is a 50 percent chance that it will see a 120 percent return on its project (i.e., for each $100 raised, the risky firm will see revenue of $220 ) and a 50 percent chance that it will see a zero return (i.e, for each $100 raised, the risky firm will see revenue of $100 ). - Further assume that savers have an opportunity cost of 20 percent (i.e., there is another opportunity available to savers that will give them revenue of $120 for each $100 invested. a. What is the expected return on the risky project? b. Assuming symmetric information, what will the safe firm's profit be for each $100 bond sold to finance the project? c. Assuming symmetric information, what promised payment will savers require for each $100 bond sold by the risky firm? Will the risky firm in the above example sell any bonds? Explain! d. Assuming asymmetric information, what promised payment will savers require for each $100 bond sold by either firm? [Use market averages] e. Under asymmetric information, would either firm end up selling bonds? Explain why or why no Problem 2: a. Based on the balance statement above, calculate the Ievel or capital ulawiviu. the minimum equity ratio (5%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started