Answered step by step

Verified Expert Solution

Question

1 Approved Answer

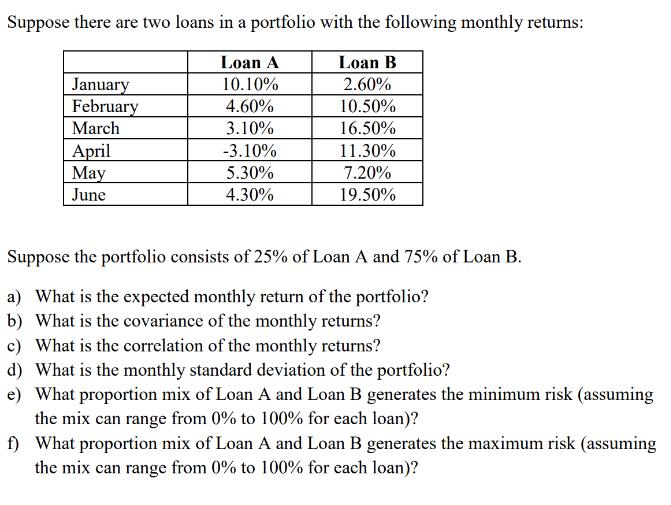

Suppose there are two loans in a portfolio with the following monthly returns: January February March April May June Loan A 10.10% 4.60% 3.10%

Suppose there are two loans in a portfolio with the following monthly returns: January February March April May June Loan A 10.10% 4.60% 3.10% -3.10% 5.30% 4.30% Loan B 2.60% 10.50% 16.50% 11.30% 7.20% 19.50% Suppose the portfolio consists of 25% of Loan A and 75% of Loan B. a) What is the expected monthly return of the portfolio? b) What is the covariance of the monthly returns? c) What is the correlation of the monthly returns? d) What is the monthly standard deviation of the portfolio? e) What proportion mix of Loan A and Loan B generates the minimum risk (assuming the mix can range from 0% to 100% for each loan)? f) What proportion mix of Loan A and Loan B generates the maximum risk (assuming the mix can range from 0% to 100% for each loan)?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a To calculate the expected monthly return of the portfolio we need to take the weighted average of the returns of Loan A and Loan B Expected monthly return of portfolio 025 Average return of L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started