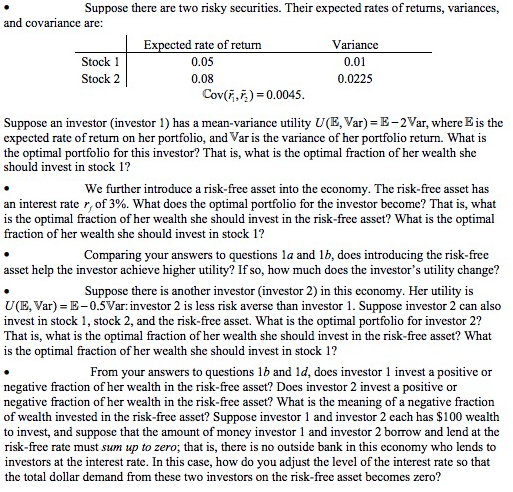

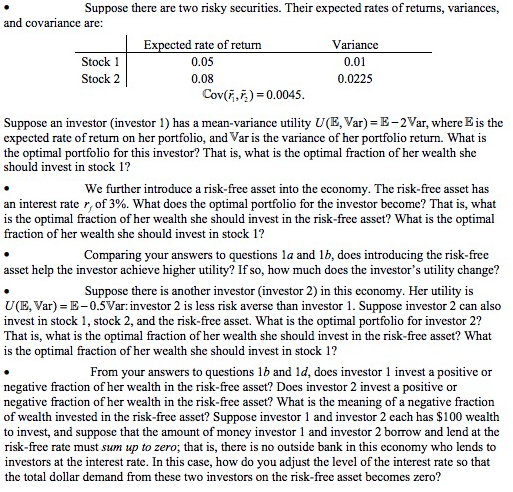

Suppose there are two risky securities. Their expected rates of returns, variances and covariance are Stock 1 Stock 2 Expected rate of return 0.05 0.08 Variance 0.01 0.0225 Cov(f,) = 0.0045 Suppose an investor investor 1) has a mean-variance utility U(E, Var) E-2Var, where Eis the expected rate of return on her portfolio, and Var is the variance of her portfolio return. What is the optimal portfolio for this investor? That is, what is the optimal fraction of her wealth she should invest in stock 1? We further introduce a risk-free asset into the economy. The risk-free asset has an interest rate r, of 3%. What does the optimal portfolio for the investor become? That is, what is the optimal fraction of her wealth she should invest in the risk-free asset? What is the optimal fraction of her wealth she should invest in stock 1? Comparing your answers to questions la and 1b, does introducing the risk-free asset help the investor achieve higher utility? If so, how much does the investor's utility change? Suppose there is another investor (investor 2) in this economy. Her utility is U(E, Var) E-0.5Var: investor 2 is less risk averse than investor 1. Suppose investor 2 can also invest in stock 1, stock 2, and the risk-free asset. What is the optimal portfolio for investor 2? That is, what is the optimal fraction of her wealth she should invest in the risk-free asset? What is the optimal fraction of her wealth she should invest in stock 1? From your answers to questions lb and ld, does investor 1 invest a positive or negative fraction of her wealth in the risk-free asset? Does investor 2 invest a positive or negative fraction of her wealth in the risk-free asset? What is the meaning of a negative fraction of wealth invested in the risk-free asset? Suppose investor 1 and investor 2 cach has $100 wealth to invest, and suppose that the amount of money investor 1 and investor 2 borrow and lend at the risk-free rate must sum up to zero; that is, there is no outside bank in this economy who lends to investors at the interest rate. In this case, how do you adjust the level of the interest rate so that the total dollar demand from these two investors on the risk-free asset becomes zero