Answered step by step

Verified Expert Solution

Question

1 Approved Answer

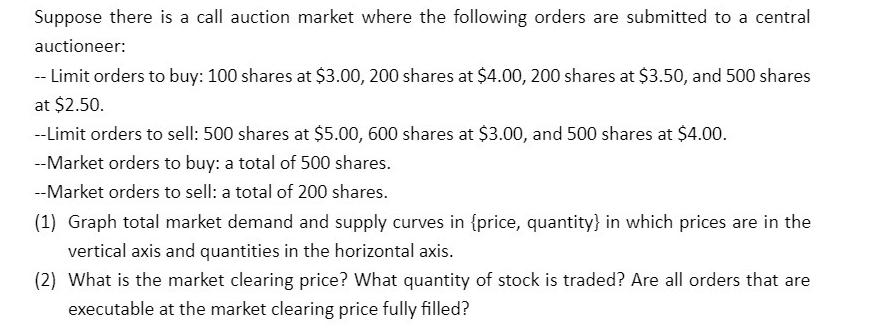

Suppose there is a call auction market where the following orders are submitted to a central auctioneer: -- Limit orders to buy: 100 shares

Suppose there is a call auction market where the following orders are submitted to a central auctioneer: -- Limit orders to buy: 100 shares at $3.00, 200 shares at $4.00, 200 shares at $3.50, and 500 shares at $2.50. --Limit orders to sell: 500 shares at $5.00, 600 shares at $3.00, and 500 shares at $4.00. --Market orders to buy: a total of 500 shares. --Market orders to sell: a total of 200 shares. (1) Graph total market demand and supply curves in {price, quantity} in which prices are in the vertical axis and quantities in the horizontal axis. (2) What is the market clearing price? What quantity of stock is traded? Are all orders that are executable at the market clearing price fully filled?

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To graph the total market demand and supply curves we need to compile the buy and sell orders and ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started