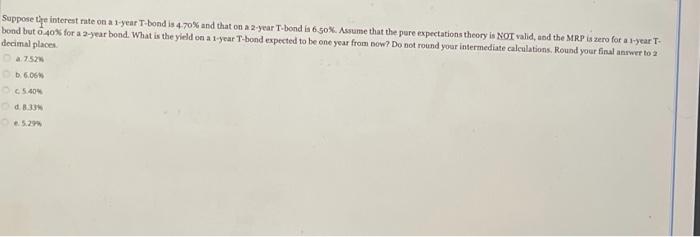

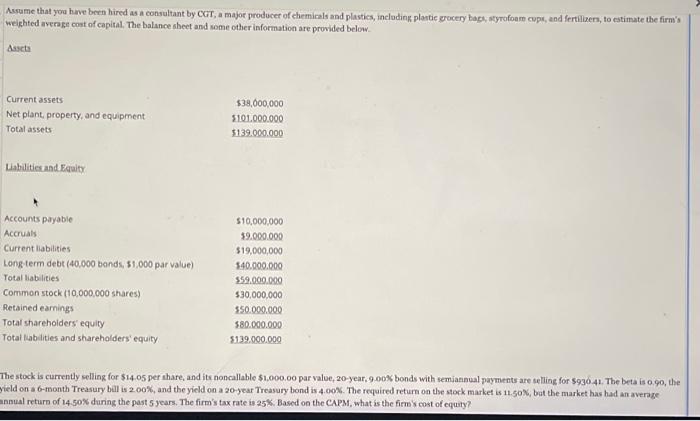

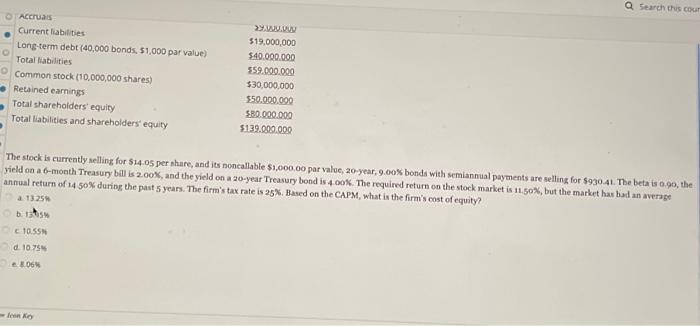

Suppose tipe interest rate on a 1-year T-bond is 4 70% and that on a 2-year T-bond in 6 50%. Assume that the pure expectations theory is NOT valid, and the MRP is zero for a 1-year T- bond but 40% for a 2-year bond. What is the yield on a 1-year T-bond expected to be one year from now? Do not round your intermediate calculations. Round your final answer to a decimal places 2752 b. 6.06% 5.404 Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plasties, including plantic grocery haps, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below Asseta Current assets Net plant property, and equipment Total assets $38,000,000 3101.000.000 5139.000.000 Liabilities and Equity Accounts payable Accruals Current liabilities Long term debt (40.000 bands, $1,000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders equity Total liabilities and shareholders' equity $10,000,000 39.000.000 $19,000,000 340.000.000 359.000.000 $30,000,000 350.000.000 $80.000.000 5139.000.000 The stock is currently selling for $14.05 per share, and its noncallable $1,000.00 par value, 20-year. 9.00% bonds with semiannual payments are selling for $936.41. The beta is o go, the yield on a 6-month Treasury bill is 2.00%, and the yield on a 20-year Treasury bond is 4.00%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past years. The firm's tax rate to ask Based on the CAPM, what is the firm's cost of equity? Q Search this con Accruals Current liabilities Long-term debt (40.000 bonds. 51.000 par value) Total liabilities Common stock (10,000,000 shares) Retained earnings Total shareholders' equity Total liabilities and shareholders equity $19,000,000 $40.000.000 559.000.000 $30.000.000 550.000.000 $80.000.000 $139.000.000 The stock is currently selling for $14.05 per share, and its noncallable $1,000.00 par value, 20-year, 9.00% bonds with semiannual payments are selling for $930.41. The beta is 0.90, the yield on a 6-month Treasury bal is 2.00%, and the yield on a 20-year Treasury bond is 4.00% The required return on the stock market is 11,50%, but the market has had an average annual return of 14 50% during the past 5 years. The firm's tax rate is 25%. Based on the CAPM, what is the firm's cost of equity? 1325 b.15 10.SSN d. 10.75 06 lenko