Question

Suppose today is January 1, 2024 and you are given two options: a. an annuity that pays you 1000 dollars at the end of

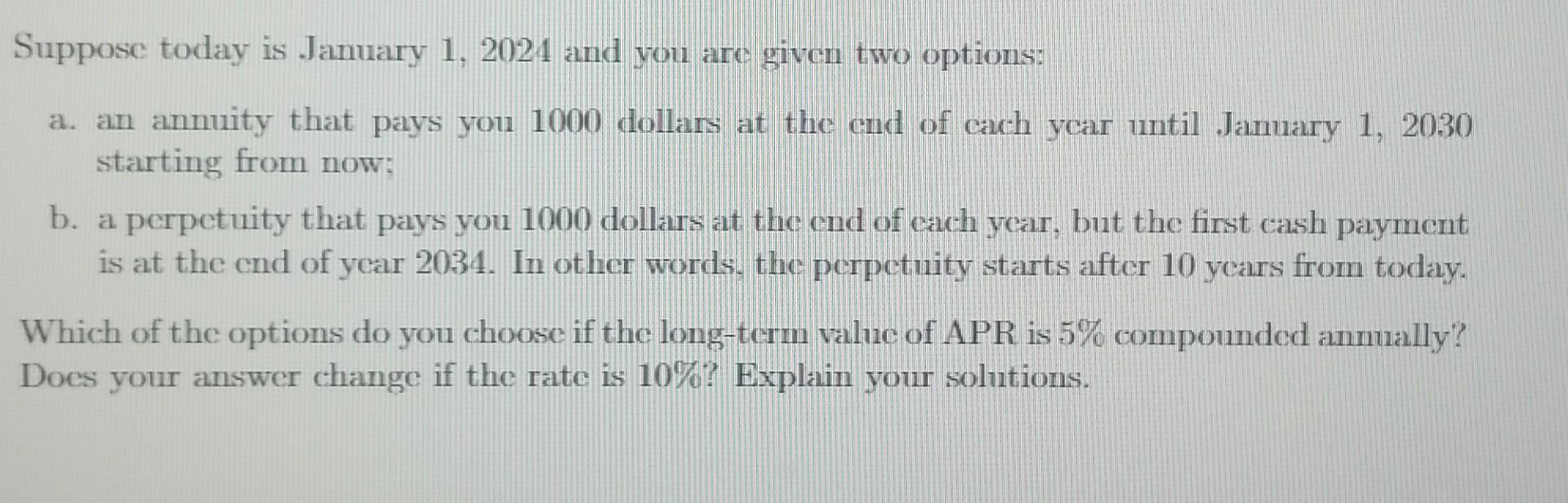

Suppose today is January 1, 2024 and you are given two options: a. an annuity that pays you 1000 dollars at the end of each year until January 1, 2030 starting from now; b. a perpetuity that pays you 1000 dollars at the end of each year, but the first cash payment is at the end of year 2034. In other words, the perpetuity starts after 10 years from today. Which of the options do you choose if the long-term value of APR is 5% compounded annually? Does your answer change if the rate is 10%? Explain your solutions.

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine which option is better we need to calculate the present value of each option using the given annual percentage rate APR and comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Corporate Finance

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

5th Edition

0135811600, 978-0135811603

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App