Answered step by step

Verified Expert Solution

Question

1 Approved Answer

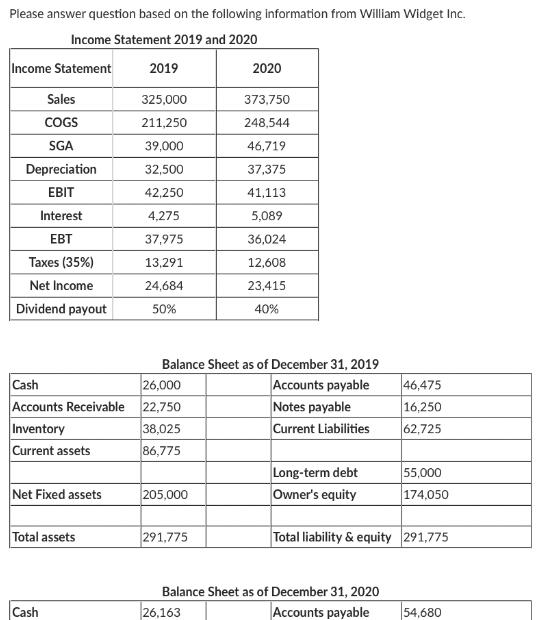

Please answer question based on the following information from William Widget Inc. Income Statement 2019 and 2020 Income Statement Sales COGS SGA Depreciation EBIT

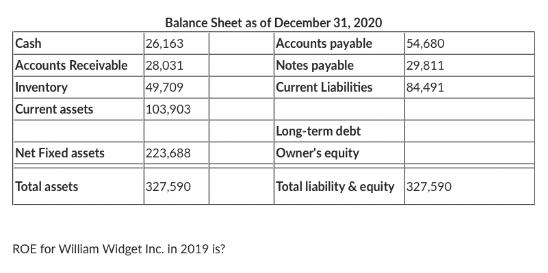

Please answer question based on the following information from William Widget Inc. Income Statement 2019 and 2020 Income Statement Sales COGS SGA Depreciation EBIT Interest EBT Taxes (35%) Net Income Dividend payout Cash Accounts Receivable Inventory Current assets Net Fixed assets Total assets Cash 2019 325,000 211,250 39,000 32,500 42,250 4,275 37,975 13,291 24,684 50% 26,000 22,750 38,025 86,775 Balance Sheet as of December 31, 2019 Accounts payable 205,000 2020 291,775 373,750 248,544 46,719 37,375 41,113 5,089 36,024 12,608 23,415 40% Notes payable Current Liabilities Long-term debt Owner's equity 46,475 16,250 62,725 Balance Sheet as of December 31, 2020 26,163 Accounts payable 55,000 174,050 Total liability & equity 291,775 54,680 Cash Accounts Receivable Inventory Current assets Net Fixed assets Total assets Balance Sheet as of December 31, 2020 Accounts payable Notes payable Current Liabilities 26,163 28,031 49,709 103,903 223,688 327,590 ROE for William Widget Inc. in 2019 is? Long-term debt Owner's equity 54,680 29,811 84,491 Total liability & equity 327,590

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Return on Equity ROE we need to use the formul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started