Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose today (Spot date) is Friday September 23rd, 2022 and the interest rates for different maturities are as follows: 1 Month 3 Month 6

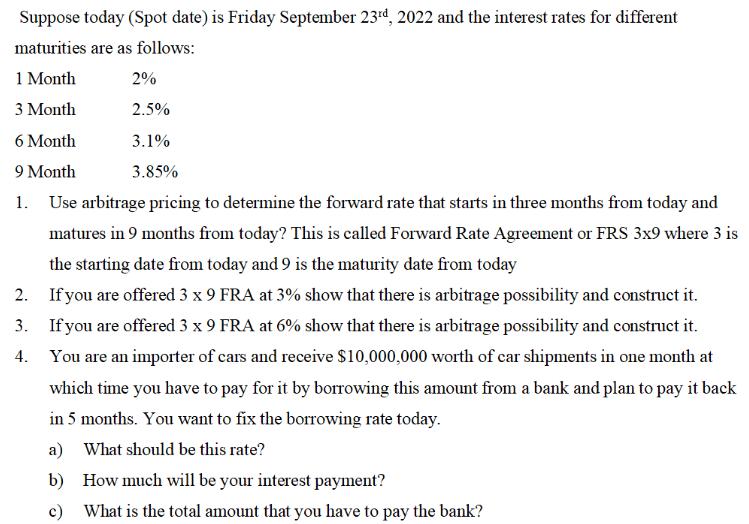

Suppose today (Spot date) is Friday September 23rd, 2022 and the interest rates for different maturities are as follows: 1 Month 3 Month 6 Month 9 Month 1. 2. 3. 4. 2% 2.5% 3.1% 3.85% Use arbitrage pricing to determine the forward rate that starts in three months from today and matures in 9 months from today? This is called Forward Rate Agreement or FRS 3x9 where 3 is the starting date from today and 9 is the maturity date from today If you are offered 3 x 9 FRA at 3% show that there is arbitrage possibility and construct it. If you are offered 3 x 9 FRA at 6% show that there is arbitrage possibility and construct it. You are an importer of cars and receive $10,000,000 worth of car shipments in one month at which time you have to pay for it by borrowing this amount from a bank and plan to pay it back in 5 months. You want to fix the borrowing rate today. a) What should be this rate? b) How much will be your interest payment? c) What is the total amount that you have to pay the bank?

Step by Step Solution

★★★★★

3.62 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

aThe 6month forward rate is calculated by taking the spot rate 2 and the 3month rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started