Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Suppose today's date is January 1, 2020. You are considering starting a firm that will run for three years and requires capital expenditures of

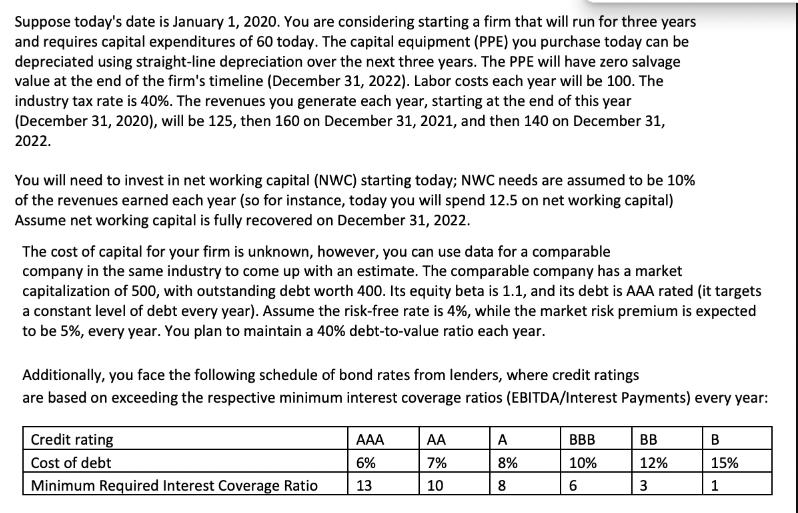

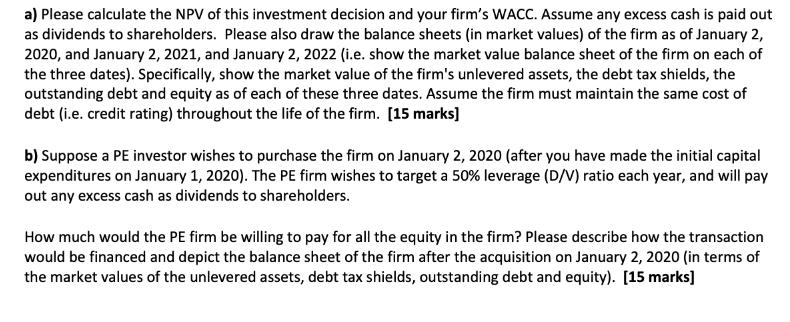

Suppose today's date is January 1, 2020. You are considering starting a firm that will run for three years and requires capital expenditures of 60 today. The capital equipment (PPE) you purchase today can be depreciated using straight-line depreciation over the next three years. The PPE will have zero salvage value at the end of the firm's timeline (December 31, 2022). Labor costs each year will be 100. The industry tax rate is 40%. The revenues you generate each year, starting at the end of this year (December 31, 2020), will be 125, then 160 on December 31, 2021, and then 140 on December 31, 2022. You will need to invest in net working capital (NWC) starting today; NWC needs are assumed to be 10% of the revenues earned each year (so for instance, today you will spend 12.5 on net working capital) Assume net working capital is fully recovered on December 31, 2022. The cost of capital for your firm is unknown, however, you can use data for a comparable company in the same industry to come up with an estimate. The comparable company has a market capitalization of 500, with outstanding debt worth 400. Its equity beta is 1.1, and its debt is AAA rated (it targets a constant level of debt every year). Assume the risk-free rate is 4%, while the market risk premium is expected to be 5%, every year. You plan to maintain a 40% debt-to-value ratio each year. Additionally, you face the following schedule of bond rates from lenders, where credit ratings are based on exceeding the respective minimum interest coverage ratios (EBITDA/Interest Payments) every year: Credit rating AAA AA A BBB BB B Cost of debt 6% 7% 8% 10% 12% 15% Minimum Required Interest Coverage Ratio 13 10 8 6 3 1 a) Please calculate the NPV of this investment decision and your firm's WACC. Assume any excess cash is paid out as dividends to shareholders. Please also draw the balance sheets (in market values) of the firm as of January 2, 2020, and January 2, 2021, and January 2, 2022 (i.e. show the market value balance sheet of the firm on each of the three dates). Specifically, show the market value of the firm's unlevered assets, the debt tax shields, the outstanding debt and equity as of each of these three dates. Assume the firm must maintain the same cost of debt (i.e. credit rating) throughout the life of the firm. [15 marks] b) Suppose a PE investor wishes to purchase the firm on January 2, 2020 (after you have made the initial capital expenditures on January 1, 2020). The PE firm wishes to target a 50% leverage (D/V) ratio each year, and will pay out any excess cash as dividends to shareholders. How much would the PE firm be willing to pay for all the equity in the firm? Please describe how the transaction would be financed and depict the balance sheet of the firm after the acquisition on January 2, 2020 (in terms of the market values of the unlevered assets, debt tax shields, outstanding debt and equity). [15 marks]

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a NPV calculation and WACC Unlevered free cash flows Year 1 Dec 31 2020 Revenue 125 COGS 100 Depreci...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started