Answered step by step

Verified Expert Solution

Question

1 Approved Answer

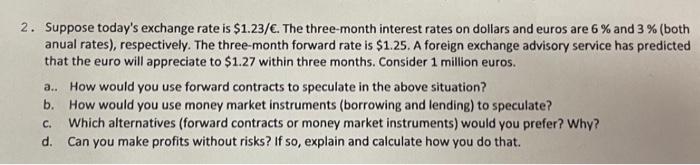

Suppose today's exchange rate is $1.23/. The three-month interest rates on dollars and euros are 6 % and 3 % (both anual rates), respectively. The

Suppose today's exchange rate is $1.23/. The three-month interest rates on dollars and euros are 6 % and 3 % (both

anual rates), respectively. The three-month forward rate is $1.25. A foreign exchange advisory service has predicted

that the euro will appreciate to $1.27 within three months. Consider 1 million euros.

a. How would you use forward contracts to speculate in the above situation?

b. How would you use money market instruments (borrowing and lending) to speculate?

c. Which alternatives (forward contracts or money market instruments) would you prefer? Why?

d. Can you make profits without risks? If so, explain and calculate how you do that.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started