Question: Suppose we have two identical companies with the same level of operating leverage ( same operating structure ) , but different levels of financial leverage.

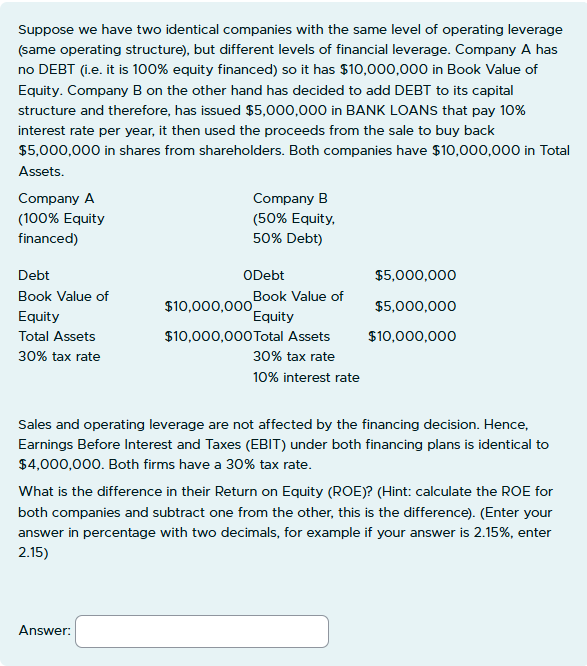

Suppose we have two identical companies with the same level of operating leverage same operating structure but different levels of financial leverage. Company A has no DEBT ie it is equity financed so it has $ in Book Value of Equity. Company B on the other hand has decided to add DEBT to its capital structure and therefore, has issued $ in BANK LOANS that pay interest rate per year, it then used the proceeds from the sale to buy back $ in shares from shareholders. Both companies have $ in Total Assets.

Company A Company B

Equity financed Equity, Debt

Debt Debt $

Book Value of Equity $ Book Value of Equity $

Total Assets $ Total Assets $

tax rate tax rate

interest rate

Sales and operating leverage are not affected by the financing decision. Hence, Earnings Before Interest and Taxes EBIT under both financing plans is identical to $ Both firms have a tax rate.

What is the difference in their Return on Equity ROEHint: calculate the ROE for both companies and subtract one from the other, this is the differenceEnter your answer in percentage with two decimals, for example if your answer is enter

Answer:Question

Suppose we have two identical companies with the same level of operating leverage same operating structure but different levels of financial leverage. Company A has no DEBT ie it is equity financed so it has $ in Book Value of Equity. Company B on the other hand has decided to add DEBT to its capital structure and therefore, has issued $ in BANK LOANS that pay interest rate per year, it then used the proceeds from the sale to buy back $ in shares from shareholders. Both companies have $ in Total Assets.

Sales and operating leverage are not affected by the financing decision. Hence, Earnings Before Interest and Taxes EBIT under both financing plans is identical to $ Both firms have a tax rate.

What is the difference in their Return on Equity ROEHint: calculate the ROE for both companies and subtract one from the other, this is the differenceEnter your answer in percentage with two decimals, for example if your answer is enter

Answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock